Dollar General 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

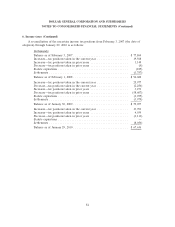

9. Commitments and contingencies (Continued)

outlined above. The court on November 6, 2008 certified a class of all persons who held stock in the

Company on the date of the Merger. The defendants filed for summary judgment.

On November 24, 2008, all defendants, including the Company, reached an agreement in principle

to settle this lawsuit, subject to final documentation and court approval. The Company determined that

the agreement would be in the best interest of the Company to avoid costly and time consuming

litigation. Based on the agreement in principle, the Company recorded a charge of approximately

$32.0 million in the third and fourth quarters of 2008 in connection with the proposed settlement,

which was net of insurance proceeds of $10.0 million which was collected in the fourth quarter of 2008.

On February 2, 2009, the Company funded the $40.0 million settlement, and on February 11, 2009, the

court approved the terms of the settlement.

From time to time, the Company is a party to various other legal actions involving claims

incidental to the conduct of its business, including actions by employees, consumers, suppliers,

government agencies, or others through private actions, class actions, administrative proceedings,

regulatory actions or other litigation, including under federal and state employment laws and wage and

hour laws. The Company believes, based upon information currently available, that such other litigation

and claims, both individually and in the aggregate, will be resolved without a material adverse effect on

the Company’s financial statements as a whole. However, litigation involves an element of uncertainty.

Future developments could cause these actions or claims to have a material adverse effect on the

Company’s results of operations, cash flows, or financial position. In addition, certain of these lawsuits,

if decided adversely to the Company or settled by the Company, may result in liability material to the

Company’s financial position or may negatively affect operating results if changes to the Company’s

business operation are required.

Other

In August 2008, the Consumer Product Safety Improvement Act of 2008 was signed into law. This

law addresses, among other things, the permissible levels of lead and listed phthalates in certain

products. The first tier of new standards for permissible levels of lead and phthalates became effective

in February 2009; the second tier became effective in August 2009. To ensure compliance, the Company

undertook a process to identify, mark down and cease the sale of any remaining inventory that would

be impacted by the new law. The impact of this process was not material to the Company’s

consolidated financial statements.

10. Benefit plans

The Dollar General Corporation 401(k) Savings and Retirement Plan, which became effective on

January 1, 1998, is a safe harbor defined contribution plan and is subject to the Employee Retirement

and Income Security Act (‘‘ERISA’’).

Participants are permitted to contribute between 1% and 25% of their pre-tax annual eligible

compensation as defined in the 401(k) plan document, subject to certain limitations under the Internal

Revenue Code. Employees who are over age 50 are permitted to contribute additional amounts on a

pre-tax basis under the catch-up provision of the 401(k) plan subject to Internal Revenue Code

limitations. The Company currently matches employee contributions, including catch-up contributions,

at a rate of 100% of employee contributions up to 5% of annual eligible salary, after an employee has

been employed for one year and has completed a minimum of 1,000 hours of service.

94