Dollar General 2009 Annual Report Download - page 47

Download and view the complete annual report

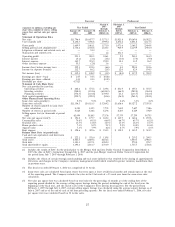

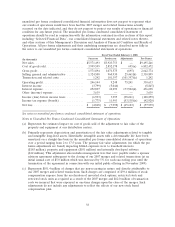

Please find page 47 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$42.0 million in 2008 compared to pro forma 2007 due to improved overall financial performance and

an increase in professional fees in 2008 of $10.4 million compared to pro forma 2007 primarily

reflecting legal expenses related to shareholder litigation.

Litigation Settlement and Related Costs, Net. The $32.0 million in 2008 represents the settlement

of a class action lawsuit filed in response to our 2007 merger, and includes the $40.0 million settlement

plus related expenses of $2.0 million, net of $10.0 million of insurance proceeds received in the fourth

quarter of 2008.

Transaction and Related Costs. The $1.2 million and $101.4 million of expenses recorded in the

2007 Successor and Predecessor periods reflect $1.2 million and $62.0 million, respectively, of expenses

related to our 2007 merger, such as investment banking and legal fees as well as $39.4 million of

compensation expense in the Predecessor period related to stock options, restricted stock and restricted

stock units which fully vested immediately prior to and as a result of our 2007 merger.

Interest Income. Interest income consists primarily of interest on investments. The decrease in

interest income in 2009 compared to 2008 was the result of reduced investments in interest-bearing

instruments and lower interest rates. The decrease in interest income in 2008 compared to the 2007

periods was a result of lower interest rates, partially offset by higher investments.

Interest Expense. The decrease in interest expense in 2009 compared to 2008 was primarily the

result of lower average outstanding long-term obligations and lower interest rates on our term loan.

The significant increase in interest expense in 2008 and the 2007 Successor period is due to

interest on long-term obligations incurred to finance our 2007 merger. We had outstanding variable-rate

debt of $560 million and $623 million as of January 29, 2010 and January 30, 2009, respectively, after

taking into consideration the impact of interest rate swaps. The remainder of our outstanding

indebtedness at January 29, 2010 and January 30, 2009 was fixed rate debt.

Interest expense in 2008 was less than 2007 pro forma interest expense due to lower borrowing

amounts, specifically on our revolving credit agreement and senior subordinated notes, along with lower

interest rates.

See the detailed discussion under ‘‘Liquidity and Capital Resources’’ regarding indebtedness

incurred to finance our 2007 merger along with subsequent repurchases of various long-term obligations

and the related effect on interest expense in the periods presented.

Other (Income) Expense. In 2009, we recorded charges totaling $55.5 million, which primarily

represents losses on debt retirement totaling $55.3 million, and also includes expense of $0.6 million

related to hedge ineffectiveness on certain of our interest rate swaps.

In 2008, we recorded a gain of $3.8 million resulting from the repurchase of $44.1 million of our

senior subordinated notes, offset by expense of $1.0 million related to hedge ineffectiveness on certain

of our interest rate swaps.

During the 2007 Successor period, we recorded an unrealized loss of $4.1 million related to the

change in the fair value of interest swaps prior to the designation of such swaps as cash flow hedges in

October 2007, offset by earnings of $1.7 million under the contractual provisions of the swap

agreements. Also during the 2007 Successor period, we recorded $6.2 million of expenses related to

consent fees and other costs associated with a tender offer for certain notes payable maturing in June

2010 (‘‘2010 Notes’’). Approximately 99% of the 2010 Notes were retired as a result of the tender

offer. The costs related to the tender of the 2010 Notes were partially offset by a $4.9 million gain in

the 2007 Successor period resulting from the repurchase of $25.0 million of our senior subordinated

notes.

36