Dollar General 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

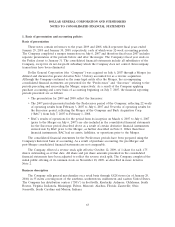

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

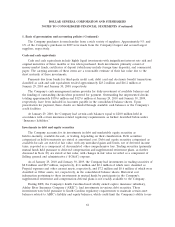

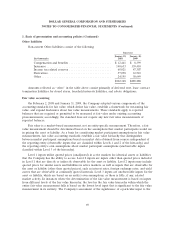

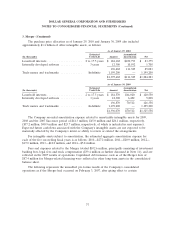

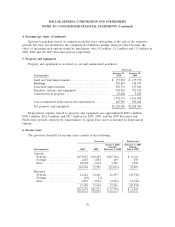

The following table presents the Company’s assets and liabilities measured at fair value on a

recurring basis as of January 29, 2010, aggregated by the level in the fair value hierarchy within which

those measurements fall.

Quoted Prices

in Active

Markets Significant

for Identical Other Significant

Assets and Observable Unobservable Balance at

Liabilities Inputs Inputs January 29,

(In thousands) (Level 1) (Level 2) (Level 3) 2010

Assets:

Trading securities(a) ..................... $ 8,822 $ — $ — $ 8,822

Liabilities:

Long-term obligations(b) .................. 3,519,171 24,644 — 3,543,815

Derivative financial instruments(c) ........... — 57,058 — 57,058

(a) Reflected at fair value in the consolidated balance sheet as Prepaid expenses and other current

assets of $1,617 and Other assets, net of $7,205.

(b) Reflected at book value in the consolidated balance sheet as Current portion of long-term

obligations of $3,671 and Long-term obligations of $3,399,715.

(c) Reflected at fair value in the consolidated balance sheet as noncurrent Other liabilities.

The carrying amounts reflected in the consolidated balance sheets for cash, cash equivalents,

short-term investments, receivables and payables approximate their respective fair values. The Company

does not have any fair value measurements using significant unobservable inputs (Level 3) as of

January 29, 2010.

Derivative financial instruments

The Company accounts for derivative financial instruments in accordance with accounting

standards for derivative instruments and hedging activities. All financial instrument positions taken by

the Company are intended to be used to reduce risk by hedging an underlying economic exposure.

The Company records all derivatives on the balance sheet at fair value. The accounting for

changes in the fair value of derivatives depends on the intended use of the derivative, whether the

Company has elected to designate a derivative in a hedging relationship and apply hedge accounting

and whether the hedging relationship has satisfied the criteria necessary to apply hedge accounting.

Derivatives designated and qualifying as a hedge of the exposure to changes in the fair value of an

asset, liability, or firm commitment attributable to a particular risk, such as interest rate risk, are

considered fair value hedges. Derivatives designated and qualifying as a hedge of the exposure to

variability in expected future cash flows, or other types of forecasted transactions, are considered cash

flow hedges. Derivatives may also be designated as hedges of the foreign currency exposure of a net

investment in a foreign operation. Hedge accounting generally provides for the matching of the timing

of gain or loss recognition on the hedging instrument with the recognition of the changes in the fair

value of the hedged asset or liability that are attributable to the hedged risk in a fair value hedge or

the earnings effect of the hedged forecasted transactions in a cash flow hedge. The Company may enter

71