Dollar General 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

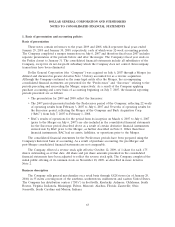

1. Basis of presentation and accounting policies (Continued)

fair value measurement in its entirety requires judgment and considers factors specific to the asset or

liability.

The valuation of the Company’s derivative financial instruments is determined using widely

accepted valuation techniques, including discounted cash flow analysis on the expected cash flows of

each derivative. This analysis reflects the contractual terms of the derivatives, including the period to

maturity, and uses observable market-based inputs, including interest rate curves. The fair values of

interest rate swaps are determined using the market standard methodology of netting the discounted

future fixed cash payments (or receipts) and the discounted expected variable cash receipts (or

payments). The variable cash receipts (or payments) are based on an expectation of future interest

rates (forward curves) derived from observable market interest rate curves.

The Company incorporates credit valuation adjustments (CVAs) to appropriately reflect both its

own nonperformance risk and the respective counterparty’s nonperformance risk in the fair value

measurements. In adjusting the fair value of its derivative contracts for the effect of nonperformance

risk, the Company has considered the impact of netting and any applicable credit enhancements, such

as collateral postings, thresholds, mutual puts, and guarantees.

The Company has determined that the majority of the inputs used to value its derivatives fall

within Level 2 of the fair value hierarchy. However, the CVAs associated with its derivatives utilize

Level 3 inputs, such as estimates of current credit spreads to evaluate the likelihood of default by itself

and its counterparties. As of January 29, 2010, the Company has assessed the significance of the impact

of the CVAs on the overall valuation of its derivative positions and has determined that the CVAs are

not significant to the overall valuation of its derivatives. Based on the Company’s review of the CVAs

by counterparty portfolio, the Company has determined that the CVAs are not significant to the overall

portfolio valuations, as the CVAs are deemed to be immaterial in terms of basis points and are a very

small percentage of the aggregate notional value. Although some of the CVAs as a percentage of

termination value appear to be more significant, primary emphasis was placed on a review of the CVA

in basis points and the percentage of the notional value. As a result, the Company has determined that

its derivative valuations in their entirety are classified in Level 2 of the fair value hierarchy.

70