Dollar General 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

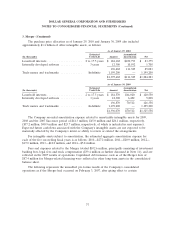

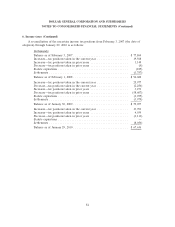

3. Merger (Continued)

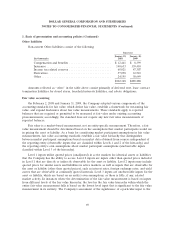

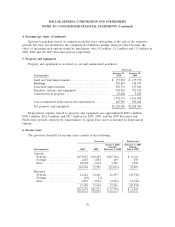

The purchase price allocation as of January 29, 2010 and January 30, 2009 also included

approximately $1.4 billion of other intangible assets, as follows:

As of January 29, 2010

Estimated Accumulated

(In thousands) Useful Life Amount Amortization Net

Leasehold interests ..................... 2 to 17.5 years $ 184,168 $100,793 $ 83,375

Internally developed software ............. 3 years 12,300 10,592 1,708

196,468 111,385 85,083

Trade names and trademarks ............. Indefinite 1,199,200 — 1,199,200

$1,395,668 $111,385 $1,284,283

As of January 30, 2009

Estimated Accumulated

(In thousands) Useful Life Amount Amortization Net

Leasehold interests ..................... 2 to 17.5 years $ 184,570 $64,020 $ 120,550

Internally developed software ............. 3 years 12,300 6,492 5,808

196,870 70,512 126,358

Trade names and trademarks ............. Indefinite 1,199,200 — 1,199,200

$1,396,070 $70,512 $1,325,558

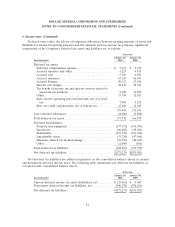

The Company recorded amortization expense related to amortizable intangible assets for 2009,

2008 and the 2007 Successor period of $41.3 million, $45.0 million and $26.1 million, respectively,

($37.2 million, $40.9 million and $23.7 million, respectively, of which is included in rent expense).

Expected future cash flows associated with the Company’s intangible assets are not expected to be

materially affected by the Company’s intent or ability to renew or extend the arrangements.

For intangible assets subject to amortization, the estimated aggregate amortization expense for

each of the five succeeding fiscal years is as follows: 2010—$27.2 million, 2011—$20.9 million, 2012—

$17.0 million, 2013—$12.0 million, and 2014—$5.8 million.

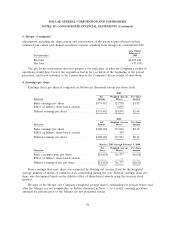

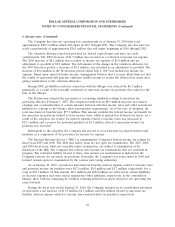

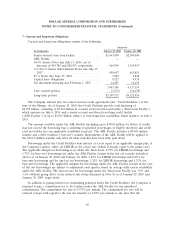

Fees and expenses related to the Merger totaled $102.6 million, principally consisting of investment

banking fees, legal fees and stock compensation ($39.4 million as further discussed in Note 11), and are

reflected in the 2007 results of operations. Capitalized debt issuance costs as of the Merger date of

$87.4 million for Merger-related financing were reflected in other long-term assets in the consolidated

balance sheet.

The following represents the unaudited pro forma results of the Company’s consolidated

operations as if the Merger had occurred on February 3, 2007, after giving effect to certain

77