Dollar General 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

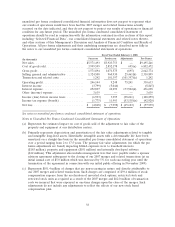

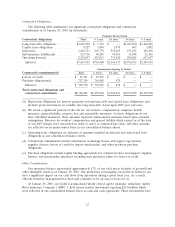

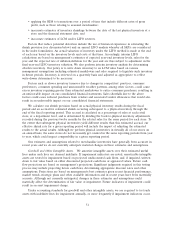

Contractual Obligations

The following table summarizes our significant contractual obligations and commercial

commitments as of January 29, 2010 (in thousands):

Payments Due by Period

Contractual obligations Total < 1 year 1-3 years 3-5 years > 5 years

Long-term debt obligations .......... $3,409,748 $ 1,723 $ — $1,963,500 $1,444,525

Capital lease obligations ............ 8,327 1,849 1,979 607 3,892

Interest(a) ...................... 1,456,713 267,778 535,265 471,232 182,438

Self-insurance liabilities(b) .......... 213,710 68,245 93,051 31,048 21,366

Operating leases(c) ............... 2,325,037 423,813 733,842 509,685 657,697

Subtotal ...................... $7,413,535 $763,408 $1,364,137 $2,976,072 $2,309,918

Commitments Expiring by Period

Commercial commitments(d) Total < 1 year 1-3 years 3-5 years > 5 years

Letters of credit ................ $ 15,351 $ 15,351 $ — $ — $ —

Purchase obligations(e) ........... 717,359 716,885 474 — —

Subtotal ..................... $ 732,710 $ 732,236 $ 474 $ — $ —

Total contractual obligations and

commercial commitments ........ $8,146,245 $1,495,644 $1,364,611 $2,976,072 $2,309,918

(a) Represents obligations for interest payments on long-term debt and capital lease obligations, and

includes projected interest on variable rate long-term debt, based upon 2009 year end rates.

(b) We retain a significant portion of the risk for our workers’ compensation, employee health

insurance, general liability, property loss and automobile insurance. As these obligations do not

have scheduled maturities, these amounts represent undiscounted estimates based upon actuarial

assumptions. Reserves for workers’ compensation and general liability which existed as of the date

of our 2007 merger were discounted in order to arrive at estimated fair value. All other amounts

are reflected on an undiscounted basis in our consolidated balance sheets.

(c) Operating lease obligations are inclusive of amounts included in deferred rent and closed store

obligations in our consolidated balance sheets.

(d) Commercial commitments include information technology license and support agreements,

supplies, fixtures, letters of credit for import merchandise, and other inventory purchase

obligations.

(e) Purchase obligations include legally binding agreements for software licenses and support, supplies,

fixtures, and merchandise purchases excluding such purchases subject to letters of credit.

Other Considerations

Our inventory balance represented approximately 47% of our total assets exclusive of goodwill and

other intangible assets as of January 29, 2010. Our proficiency in managing our inventory balances can

have a significant impact on our cash flows from operations during a given fiscal year. As a result,

efficient inventory management has been and continues to be an area of focus for us.

At January 29, 2010, our South Carolina-based wholly owned captive insurance subsidiary, Ashley

River Insurance Company (‘‘ARIC’’), held money market investments equaling $20.0 million which

were reflected in our consolidated balance sheet as cash and cash equivalents. These investments were

47