Chevron 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

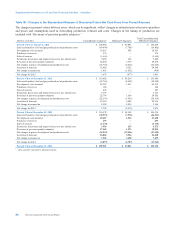

Supplemental Information on Oil and Gas Producing Activities - Unaudited

Table VII - Changes in the Standardized Measure of Discounted Future Net Cash Flows From Proved Reserves

The changes in present values between years, which can be significant, reflect changes in estimated proved-reserve quantities

and prices and assumptions used in forecasting production volumes and costs. Changes in the timing of production are

included with “Revisions of previous quantity estimates.”

Millions of dollars Consolidated Companies1Affiliated Companies

Total Consolidated and

Affiliated Companies

Present Value at January 1, 2012 $ 106,948 $ 45,891 $ 152,839

Sales and transfers of oil and gas produced net of production costs (49,094) (7,708) (56,802)

Development costs incurred 18,013 942 18,955

Purchases of reserves 376 — 376

Sales of reserves (1,665) — (1,665)

Extensions, discoveries and improved recovery less related costs 9,296 106 9,402

Revisions of previous quantity estimates 26,060 3,759 29,819

Net changes in prices, development and production costs (18,752) (2,266) (21,018)

Accretion of discount 18,026 6,322 24,348

Net change in income tax 1,418 (1,832) (414)

Net change for 2012 3,678 (677) 3,001

Present Value at December 31, 2012 $ 110,626 $ 45,214 $ 155,840

Sales and transfers of oil and gas produced net of production costs (43,760) (8,692) (52,452)

Development costs incurred 22,907 1,411 24,318

Purchases of reserves 184 — 184

Sales of reserves 243 — 243

Extensions, discoveries and improved recovery less related costs 3,135 — 3,135

Revisions of previous quantity estimates 22,796 1,306 24,102

Net changes in prices, development and production costs (22,591) (5,925) (28,516)

Accretion of discount 18,510 6,406 24,916

Net change in income tax 2,328 2,818 5,146

Net change for 2013 3,752 (2,676) 1,076

Present Value at December 31, 2013 $ 114,378 $ 42,538 $ 156,916

Sales and transfers of oil and gas produced net of production costs (38,935) (7,578) (46,513)

Development costs incurred 25,687 1,963 27,650

Purchases of reserves 255 — 255

Sales of reserves (1,178) — (1,178)

Extensions, discoveries and improved recovery less related costs 3,956 215 4,171

Revisions of previous quantity estimates 17,462 1,573 19,035

Net changes in prices, development and production costs (34,953) (12,496) (47,449)

Accretion of discount 18,884 5,926 24,810

Net change in income tax 3,965 3,690 7,655

Net change for 2014 (4,857) (6,707) (11,564)

Present Value at December 31, 2014 $ 109,521 $ 35,831 $ 145,352

12012 and 2013 conformed to 2014 presentation.

80 Chevron Corporation 2014 Annual Report