Chevron 2014 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

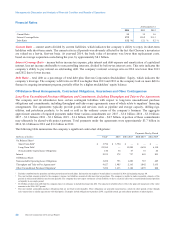

Financial Ratios

At December 31

2014 2013 2012

Current Ratio 1.3 1.5 1.6

Interest Coverage Ratio 87.2 126.2 191.3

Debt Ratio 15.2 % 12.1 % 8.2 %

Current Ratio – current assets divided by current liabilities, which indicates the company’s ability to repay its short-term

liabilities with short-term assets. The current ratio in all periods was adversely affected by the fact that Chevron’s inventories

are valued on a last-in, first-out basis. At year-end 2014, the book value of inventory was lower than replacement costs,

based on average acquisition costs during the year, by approximately $8.1 billion.

Interest Coverage Ratio – income before income tax expense, plus interest and debt expense and amortization of capitalized

interest, less net income attributable to noncontrolling interests, divided by before-tax interest costs. This ratio indicates the

company’s ability to pay interest on outstanding debt. The company’s interest coverage ratio in 2014 was lower than 2013

and 2012 due to lower income.

Debt Ratio – total debt as a percentage of total debt plus Chevron Corporation Stockholders’ Equity, which indicates the

company’s leverage. The company’s debt ratio in 2014 was higher than 2013 and 2012 as the company took on more debt to

finance its ongoing investment program, partially offset by a higher stockholders’ equity balance.

Off-Balance-Sheet Arrangements, Contractual Obligations, Guarantees and Other Contingencies

Long-Term Unconditional Purchase Obligations and Commitments, Including Throughput and Take-or-Pay Agreements

The company and its subsidiaries have certain contingent liabilities with respect to long-term unconditional purchase

obligations and commitments, including throughput and take-or-pay agreements, some of which relate to suppliers’ financing

arrangements. The agreements typically provide goods and services, such as pipeline and storage capacity, drilling rigs,

utilities, and petroleum products, to be used or sold in the ordinary course of the company’s business. The aggregate

approximate amounts of required payments under these various commitments are: 2015 – $3.6 billion; 2016 – $3.0 billion;

2017 – $2.3 billion; 2018 – $2.1 billion; 2019 – $1.6 billion; 2020 and after – $4.5 billion. A portion of these commitments

may ultimately be shared with project partners. Total payments under the agreements were approximately $3.7 billion in

2014, $3.6 billion in 2013 and $3.6 billion in 2012.

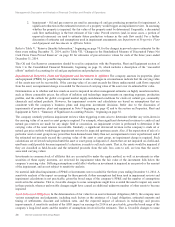

The following table summarizes the company’s significant contractual obligations:

Payments Due by Period

Millions of dollars Total12015 2016-2017 2018-2019 After 2019

On Balance Sheet:2

Short-Term Debt3$ 3,790 $ 3,790 $ — $ — $ —

Long-Term Debt323,960 — 13,200 4,650 6,110

Noncancelable Capital Lease Obligations 140 34 47 35 24

Interest 2,393 378 737 445 833

Off Balance Sheet:

Noncancelable Operating Lease Obligations 3,498 793 1,229 787 689

Throughput and Take-or-Pay Agreements49,627 1,985 2,165 1,842 3,635

Other Unconditional Purchase Obligations47,490 1,633 3,120 1,895 842

1Excludes contributions for pensions and other postretirement benefit plans. Information on employee benefit plans is contained in Note 22 beginning on page 60.

2Does not include amounts related to the company’s income tax liabilities associated with uncertain tax positions. The company is unable to make reasonable estimates of the

periods in which such liabilities may become payable. The company does not expect settlement of such liabilities to have a material effect on its consolidated financial position

or liquidity in any single period.

3$8.0 billion of short-term debt that the company expects to refinance is included in long-term debt. The repayment schedule above reflects the projected repayment of the entire

amounts in the 2016–2017 period.

4Does not include commodity purchase obligations that are not fixed or determinable. These obligations are generally monetized in a relatively short period of time through

sales transactions or similar agreements with third parties. Examples include obligations to purchase LNG, regasified natural gas and refinery products at indexed prices.

22 Chevron Corporation 2014 Annual Report