Chevron 2014 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Liquidity and Capital Resources

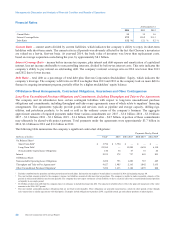

Cash, Cash Equivalents, Time Deposits and Marketable Securities Total balances were $13.2 billion and $16.5 billion at

December 31, 2014 and 2013, respectively. Cash provided by operating activities in 2014 was $31.5 billion, compared with

$35.0 billion in 2013 and $38.8 billion in 2012. Cash provided by operating activities was net of contributions to employee

pension plans of approximately $0.4 billion, $1.2 billion and $1.2 billion in 2014, 2013 and 2012, respectively. Cash

provided by investing activities included proceeds and deposits related to asset sales of $5.7 billion in 2014, $1.1 billion in

2013, and $2.8 billion in 2012.

Restricted cash of $1.5 billion and $1.2 billion at December 31, 2014 and 2013, respectively, was held in cash and short-term

marketable securities and recorded as “Deferred charges and other assets” on the Consolidated Balance Sheet. These amounts

are generally associated with tax payments, upstream abandonment activities, funds held in escrow for asset acquisitions and

capital investment projects.

Dividends Dividends paid to common stockholders were $7.9 billion in 2014, $7.5 billion in 2013 and $6.8 billion in 2012.

In April 2014, the company increased its quarterly dividend by 7 percent to $1.07 per common share.

Debt and Capital Lease Obligations Total debt and capital lease obligations were $27.8 billion at December 31, 2014, up

from $20.4 billion at year-end 2013.

The $7.4 billion increase in total debt and capital lease obligations during 2014 was primarily due to funding the company’s

capital investment program, which included several large projects in the construction phase. The company completed a $4

billion bond issuance in November 2014, timed in part to take advantage of historically low interest rates. The company’s

debt and capital lease obligations due within one year, consisting primarily of commercial paper, redeemable long-term

obligations and the current portion of long-term debt, totaled $11.8 billion at December 31, 2014, compared with $8.4 billion

at year-end 2013. Of these amounts, $8.0 billion was reclassified to long-term at the end of both periods. At year-end 2014,

settlement of these obligations was not expected to require the use of working capital in 2015, as the company had the intent

and the ability, as evidenced by committed credit facilities, to refinance them on a long-term basis.

Chevron has an automatic shelf registration statement that expires in November 2015 for an unspecified amount of

nonconvertible debt securities issued or guaranteed by the company.

0.0

45.0

18.0

27.0

9.0

36.0

Cash Provided by

Operating Activities

Billions of dollars

1110 12 13 14

$31.5

0.0

30.0

24.0

6.0

12.0

18.0

Total Debt at Year-End

Billions of dollars

$27.8

1110 12 13 14

0.0

16.0

12.0

4.0

8.0

Ratio of Total Debt to Total

Debt-Plus-Chevron Corporation

Stockholders’ Equity

Percent

1110 12 13 14

15.2%

0.0

44.0

22.0

33.0

11.0

Total Capital & Exploratory

Expenditures*

Billions of dollars

All Other

Downstream

Upstream

*Includes equity in affiliates.

Excludes the acquisition of Atlas

Energy, Inc. in 2011.

1110 12 13 14

$40.3

The major debt rating agencies routinely evaluate the company’s debt, and the company’s cost of borrowing can increase or

decrease depending on these debt ratings. The company has outstanding public bonds issued by Chevron Corporation and

Texaco Capital Inc. All of these securities are the obligations of, or guaranteed by, Chevron Corporation and are rated AA by

Standard & Poor’s Corporation and Aa1 by Moody’s Investors Service. The company’s U.S. commercial paper is rated A-1+

by Standard & Poor’s and P-l by Moody’s. All of these ratings denote high-quality, investment-grade securities.

20 Chevron Corporation 2014 Annual Report