Chevron 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

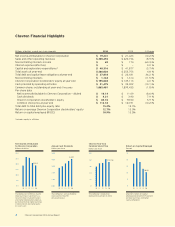

Millions of dollars, except per-share amounts 2014 201 3 % Change

Net income attributable to Chevron Corporation $ 19,241 $ 21,423 (10.2) %

Sales and other operating revenues $ 200,494 $ 220,156 (8.9) %

Noncontrolling interests income $ 69 $ 174 (60.3) %

Interest expense (after tax) $ — $ — 0.0 %

Capital and exploratory expenditures* $ 40,316 $ 41,877 (3.7) %

Total assets at year-end $ 266,026 $ 253,753 4.8 %

Total debt and capital lease obligations at year-end $ 27,818 $ 20,431 36.2 %

Noncontrolling interests $ 1,163 $ 1,314 (11.5) %

Chevron Corporation stockholders’ equity at year-end $ 155,028 $ 149,113 4.0 %

Cash provided by operating activities $ 31,475 $ 35,002 (10.1) %

Common shares outstanding at year-end (Thousands) 1,865,481 1,899,435 (1.8) %

Per-share data

Net income attributable to Chevron Corporation — diluted $ 10.14 $ 11.09 (8.6) %

Cash dividends $ 4.21 $ 3.90 7.9 %

Chevron Corporation stockholders’ equity $ 83.10 $ 78.50 5.9 %

Common stock price at year-end $ 112.18 $ 124.91 (10.2) %

Total debt to total debt-plus-equity ratio 15.2% 12.1%

Return on average Chevron Corporation stockholders’ equity 12.7% 15.0%

Return on capital employed (ROCE) 10.9% 13.5%

Chevron Financial Highlights

*Includes equity in affiliates

0.0

30.0

20.0

15.0

5.0

10.0

25.0

Net Income Attributable

to Chevron Corporation

Billions of dollars

The decrease in 2014 was due to

lower earnings in upstream as a

result of lower crude oil margins

and higher depreciation expense,

partially offset by higher earnings

in downstream and higher gains

on asset sales.

10 12 13 14

$19.2

11

0.00

5.00

4.00

3.00

1.00

2.00

Annual Cash Dividends

Dollars per share

The company’s annual dividend

increased for the 27th

consecutive year.

11

10 12 13 14

$4.21

0

150

120

90

60

30

Chevron Year-End

Common Stock Price

Dollars per share

The company’s stock price

declined 10.2 percent in 2014.

1110 12 13 14

$112.18

0

25

20

15

10

5

Return on Capital Employed

Percent

Chevron’s return on capital

employed declined to 10.9 percent

on lower earnings and higher

capital employed.

1110 12 13 14

10.9%

4 Chevron Corporation 2014 Annual Report