Chevron 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

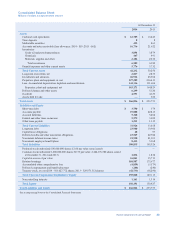

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

Note 3

Noncontrolling Interests

Ownership interests in the company’s subsidiaries held by parties other than the parent are presented separately from the

parent’s equity on the Consolidated Balance Sheet. The amount of consolidated net income attributable to the parent and the

noncontrolling interests are both presented on the face of the Consolidated Statement of Income. The term “earnings” is

defined as “Net Income Attributable to Chevron Corporation.”

Activity for the equity attributable to noncontrolling interests for 2014, 2013 and 2012 is as follows:

2014 2013 2012

Balance at January 1 $ 1,314 $ 1,308 $ 799

Net income 69 174 157

Distributions to noncontrolling interests (47) (99) (41)

Other changes, net (173) (69) 393

Balance at December 31 $ 1,163 $ 1,314 $ 1,308

Note 4

Information Relating to the Consolidated Statement of Cash Flows

Year ended December 31

2014 2013 2012

Net (increase) decrease in operating working capital was composed of the following:

Decrease (increase) in accounts and notes receivable $ 4,491 $ (1,101) $ 1,153

Increase in inventories (146) (237) (233)

(Increase) decrease in prepaid expenses and other current assets (407) 834 (471)

(Decrease) increase in accounts payable and accrued liabilities (3,737) 160 544

Decrease in income and other taxes payable (741) (987) (630)

Net (increase) decrease in operating working capital $ (540) $ (1,331) $ 363

Net cash provided by operating activities includes the following cash payments for income taxes:

Income taxes $ 10,562 $ 12,898 $ 17,334

Net (purchases) sales of marketable securities consisted of the following gross amounts:

Marketable securities purchased $ (162) $ (7) $ (35)

Marketable securities sold 14 10 32

Net (purchases) sales of marketable securities $ (148) $ 3 $ (3)

Net sales of time deposits consisted of the following gross amounts:

Time deposits purchased $ (317) $ (2,317) $ (717)

Time deposits matured 317 3,017 3,967

Net sales of time deposits $ — $ 700 $ 3,250

The “Net (increase) decrease in operating working capital” includes reductions of $58, $79 and $98 for excess income tax

benefits associated with stock options exercised during 2014, 2013 and 2012, respectively. These amounts are offset by an

equal amount in “Net purchases of treasury shares.” “Other” includes changes in postretirement benefits obligations and

other long-term liabilities.

The “Net purchases of treasury shares” represents the cost of common shares acquired less the cost of shares issued for

share-based compensation plans. Purchases totaled $5,006, $5,004 and $5,004 in 2014, 2013 and 2012, respectively. In 2014,

2013 and 2012, the company purchased 41.5 million, 41.6 million and 46.6 million common shares for $5,000, $5,000 and

$5,000 under its ongoing share repurchase program, respectively.

In 2014, 2013 and 2012, “Net (purchases) sales of other short-term investments” generally consisted of restricted cash

associated with upstream abandonment activities, funds held in escrow for tax-deferred exchanges and asset acquisitions, and

tax payments that was invested in cash and short-term securities and reclassified from “Cash and cash equivalents” to

“Deferred charges and other assets” on the Consolidated Balance Sheet.

Chevron Corporation 2014 Annual Report 39