Chevron 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

Cash received in payment for option exercises under all share-based payment arrangements for 2014, 2013 and 2012 was

$527, $553 and $753, respectively. Actual tax benefits realized for the tax deductions from option exercises were $54, $73

and $101 for 2014, 2013 and 2012, respectively.

Cash paid to settle performance units and stock appreciation rights was $204, $186 and $123 for 2014, 2013 and 2012,

respectively.

Chevron Long-Term Incentive Plan (LTIP) Awards under the LTIP may take the form of, but are not limited to, stock

options, restricted stock, restricted stock units, stock appreciation rights, performance units and nonstock grants. From

April 2004 through May 2023, no more than 260 million shares may be issued under the LTIP. For awards issued on or after

May 29, 2013, no more than 50 million of those shares may be in a form other than a stock option, stock appreciation right or

award requiring full payment for shares by the award recipient. For the major types of awards outstanding as of

December 31, 2014, the contractual terms vary between three years for the performance units and 10 years for the stock

options and stock appreciation rights.

Unocal Share-Based Plans (Unocal Plans) When Chevron acquired Unocal in August 2005, outstanding stock options and

stock appreciation rights granted under various Unocal Plans were exchanged for fully vested Chevron options and

appreciation rights. These awards retained the same provisions as the original Unocal Plans. Unexercised awards began

expiring in early 2010 and will continue to expire through early 2015.

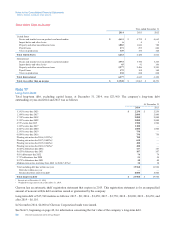

The fair market values of stock options and stock appreciation rights granted in 2014, 2013 and 2012 were measured on the

date of grant using the Black-Scholes option-pricing model, with the following weighted-average assumptions:

Year ended December 31

2014 2013 2012

Expected term in years16.0 6.0 6.0

Volatility230.3 % 31.3 % 31.7 %

Risk-free interest rate based on zero coupon U.S. treasury note 1.9 % 1.2 % 1.1 %

Dividend yield 3.3 % 3.3 % 3.2 %

Weighted-average fair value per option granted $ 25.86 $ 24.48 $ 23.35

1Expected term is based on historical exercise and postvesting cancellation data.

2Volatility rate is based on historical stock prices over an appropriate period, generally equal to the expected term.

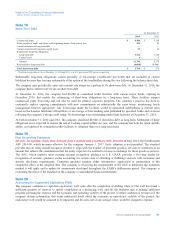

A summary of option activity during 2014 is presented below:

Shares (Thousands)

Weighted-Average

Exercise Price

Averaged Remaining

Contractual Term (Years) Aggregate Intrinsic Value

Outstanding at January 1, 2014 75,626 $ 88.44

Granted 11,380 $ 116.00

Exercised (7,464) $ 72.71

Forfeited (1,201) $ 111.73

Outstanding at December 31, 2014 78,341 $ 93.59 5.84 $ 1,548

Exercisable at December 31, 2014 56,943 $ 85.60 4.87 $ 1,533

The total intrinsic value (i.e., the difference between the exercise price and the market price) of options exercised during

2014, 2013 and 2012 was $398, $445 and $580, respectively. During this period, the company continued its practice of

issuing treasury shares upon exercise of these awards.

As of December 31, 2014, there was $226 of total unrecognized before-tax compensation cost related to nonvested share-

based compensation arrangements granted under the plans. That cost is expected to be recognized over a weighted-average

period of 1.7 years.

At January 1, 2014, the number of LTIP performance units outstanding was equivalent to 2,531,270 shares. During 2014,

772,800 units were granted, 967,234 units vested with cash proceeds distributed to recipients and 70,884 units were forfeited.

At December 31, 2014, units outstanding were 2,265,952. The fair value of the liability recorded for these instruments was

$212, and was measured using the Monte Carlo simulation method. In addition, outstanding stock appreciation rights and

other awards that were granted under various LTIP and former Unocal programs totaled approximately 3.3 million equivalent

shares as of December 31, 2014. A liability of $78 was recorded for these awards.

Chevron Corporation 2014 Annual Report 59