Chevron 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

assumptions would have reduced estimated future obligations, thereby lowering accretion expense and amortization costs,

whereas unfavorable changes would have the opposite effect. Refer to Note 24 on page 67 for additional discussions on asset

retirement obligations.

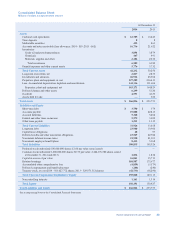

Pension and Other Postretirement Benefit Plans Note 22, beginning on page 60, includes information on the funded status

of the company’s pension and other postretirement benefit (OPEB) plans reflected on the Consolidated Balance Sheet; the

components of pension and OPEB expense reflected on the Consolidated Statement of Income; and the related underlying

assumptions.

The determination of pension plan expense and obligations is based on a number of actuarial assumptions. Two critical

assumptions are the expected long-term rate of return on plan assets and the discount rate applied to pension plan obligations.

Critical assumptions in determining expense and obligations for OPEB plans, which provide for certain health care and life

insurance benefits for qualifying retired employees and which are not funded, are the discount rate and the assumed health

care cost-trend rates. Information related to the Company’s processes to develop these assumptions is included on page 62 in

Note 22 under the relevant headings. Actual rates may vary significantly from estimates because of unanticipated changes in

the world’s financial markets.

For 2014, the company used an expected long-term rate of return of 7.5 percent and a discount rate of 4.3 percent for U.S.

pension plans. For the 10 years ending December 31, 2014, actual asset returns averaged 6.0 percent for the plan. The actual

return for 2014 was more than 7.5 percent. Additionally, with the exception of two years within this 10-year period, actual

asset returns for this plan equaled or exceeded 7.5 percent during each year.

Total pension expense for 2014 was $1.2 billion. An increase in the expected long-term return on plan assets or the discount

rate would reduce pension plan expense, and vice versa. As an indication of the sensitivity of pension expense to the long-

term rate of return assumption, a 1 percent increase in this assumption for the company’s primary U.S. pension plan, which

accounted for about 39 percent of companywide pension expense, would have reduced total pension plan expense for 2014

by approximately $98 million. A 1 percent increase in the discount rate for this same plan would have reduced pension

expense for 2014 by approximately $229 million.

The aggregate funded status recognized at December 31, 2014, was a net liability of approximately $4.7 billion. An increase

in the discount rate would decrease the pension obligation, thus changing the funded status of a plan. At December 31, 2014,

the company used a discount rate of 3.7 percent to measure the obligations for the U.S. pension plans. As an indication of the

sensitivity of pension liabilities to the discount rate assumption, a 0.25 percent increase in the discount rate applied to the

company’s primary U.S. pension plan, which accounted for about 63 percent of the companywide pension obligation, would

have reduced the plan obligation by approximately $403 million, which would have decreased the plan’s underfunded status

from approximately $1.6 billion to $1.2 billion.

For the company’s OPEB plans, expense for 2014 was $219 million, and the total liability, which reflected the unfunded

status of the plans at the end of 2014, was $3.7 billion. For the main U.S. OPEB plan, the company used a 4.7 percent

discount rate to measure expense in 2014, and a 4.1 percent discount rate to measure the benefit obligations at December 31,

2014. Discount rate changes, similar to those used in the pension sensitivity analysis, resulted in an immaterial impact on

2014 OPEB expense and OPEB liabilities at the end of 2014. For information on the sensitivity of the health care cost-trend

rate, refer to 62 in Note 22 under the heading “Other Benefit Assumptions.”

Differences between the various assumptions used to determine expense and the funded status of each plan and actual

experience are included in actuarial gain/loss. Refer to page 61 in Note 22 for a description of the method used to amortize

the $7.2 billion of before-tax actuarial losses recorded by the company as of December 31, 2014, and an estimate of the costs

to be recognized in expense during 2015. In addition, information related to company contributions is included on page 64 in

Note 22 under the heading “Cash Contributions and Benefit Payments.”

Contingent Losses Management also makes judgments and estimates in recording liabilities for claims, litigation, tax matters

and environmental remediation. Actual costs can frequently vary from estimates for a variety of reasons. For example, the

costs for settlement of claims and litigation can vary from estimates based on differing interpretations of laws, opinions on

culpability and assessments on the amount of damages. Similarly, liabilities for environmental remediation are subject to

change because of changes in laws, regulations and their interpretation, the determination of additional information on the

extent and nature of site contamination, and improvements in technology.

Under the accounting rules, a liability is generally recorded for these types of contingencies if management determines the

loss to be both probable and estimable. The company generally reports these losses as “Operating expenses” or “Selling,

Chevron Corporation 2014 Annual Report 27