Chevron 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

Note 15

Litigation

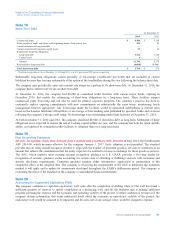

MTBE Chevron and many other companies in the petroleum industry have used methyl tertiary butyl ether (MTBE) as a

gasoline additive. Chevron is a party to seven pending lawsuits and claims, the majority of which involve numerous other

petroleum marketers and refiners. Resolution of these lawsuits and claims may ultimately require the company to correct or

ameliorate the alleged effects on the environment of prior release of MTBE by the company or other parties. Additional

lawsuits and claims related to the use of MTBE, including personal-injury claims, may be filed in the future. The company’s

ultimate exposure related to pending lawsuits and claims is not determinable. The company no longer uses MTBE in the

manufacture of gasoline in the United States.

Ecuador Chevron is a defendant in a civil lawsuit initiated in the Superior Court of Nueva Loja in Lago Agrio, Ecuador, in

May 2003 by plaintiffs who claim to be representatives of certain residents of an area where an oil production consortium

formerly had operations. The lawsuit alleges damage to the environment from the oil exploration and production operations

and seeks unspecified damages to fund environmental remediation and restoration of the alleged environmental harm, plus a

health monitoring program. Until 1992, Texaco Petroleum Company (Texpet), a subsidiary of Texaco Inc., was a minority

member of this consortium with Petroecuador, the Ecuadorian state-owned oil company, as the majority partner; since 1990,

the operations have been conducted solely by Petroecuador. At the conclusion of the consortium and following an

independent third-party environmental audit of the concession area, Texpet entered into a formal agreement with the

Republic of Ecuador and Petroecuador for Texpet to remediate specific sites assigned by the government in proportion to

Texpet’s ownership share of the consortium. Pursuant to that agreement, Texpet conducted a three-year remediation program

at a cost of $40. After certifying that the sites were properly remediated, the government granted Texpet and all related

corporate entities a full release from any and all environmental liability arising from the consortium operations.

Based on the history described above, Chevron believes that this lawsuit lacks legal or factual merit. As to matters of law, the

company believes first, that the court lacks jurisdiction over Chevron; second, that the law under which plaintiffs bring the

action, enacted in 1999, cannot be applied retroactively; third, that the claims are barred by the statute of limitations in

Ecuador; and, fourth, that the lawsuit is also barred by the releases from liability previously given to Texpet by the Republic

of Ecuador and Petroecuador and by the pertinent provincial and municipal governments. With regard to the facts, the

company believes that the evidence confirms that Texpet’s remediation was properly conducted and that the remaining

environmental damage reflects Petroecuador’s failure to timely fulfill its legal obligations and Petroecuador’s further conduct

since assuming full control over the operations.

In 2008, a mining engineer appointed by the court to identify and determine the cause of environmental damage, and to

specify steps needed to remediate it, issued a report recommending that the court assess $18,900, which would, according to

the engineer, provide financial compensation for purported damages, including wrongful death claims, and pay for, among

other items, environmental remediation, health care systems and additional infrastructure for Petroecuador. The engineer’s

report also asserted that an additional $8,400 could be assessed against Chevron for unjust enrichment. In 2009, following the

disclosure by Chevron of evidence that the judge participated in meetings in which businesspeople and individuals holding

themselves out as government officials discussed the case and its likely outcome, the judge presiding over the case was

recused. In 2010, Chevron moved to strike the mining engineer’s report and to dismiss the case based on evidence obtained

through discovery in the United States indicating that the report was prepared by consultants for the plaintiffs before being

presented as the mining engineer’s independent and impartial work and showing further evidence of misconduct. In

August 2010, the judge issued an order stating that he was not bound by the mining engineer’s report and requiring the

parties to provide their positions on damages within 45 days. Chevron subsequently petitioned for recusal of the judge,

claiming that he had disregarded evidence of fraud and misconduct and that he had failed to rule on a number of motions

within the statutory time requirement.

In September 2010, Chevron submitted its position on damages, asserting that no amount should be assessed against it. The

plaintiffs’ submission, which relied in part on the mining engineer’s report, took the position that damages are between

approximately $16,000 and $76,000 and that unjust enrichment should be assessed in an amount between approximately

$5,000 and $38,000. The next day, the judge issued an order closing the evidentiary phase of the case and notifying the

parties that he had requested the case file so that he could prepare a judgment. Chevron petitioned to have that order declared

a nullity in light of Chevron’s prior recusal petition, and because procedural and evidentiary matters remained unresolved. In

October 2010, Chevron’s motion to recuse the judge was granted. A new judge took charge of the case and revoked the prior

judge’s order closing the evidentiary phase of the case. On December 17, 2010, the judge issued an order closing the

evidentiary phase of the case and notifying the parties that he had requested the case file so that he could prepare a judgment.

50 Chevron Corporation 2014 Annual Report