Chevron 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

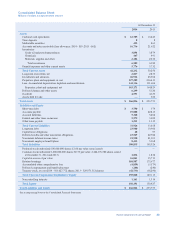

Millions of dollars, except per-share amounts

Costs also are capitalized for exploratory wells that have found crude oil and natural gas reserves even if the reserves cannot

be classified as proved when the drilling is completed, provided the exploratory well has found a sufficient quantity of

reserves to justify its completion as a producing well and the company is making sufficient progress assessing the reserves

and the economic and operating viability of the project. All other exploratory wells and costs are expensed. Refer to Note 20,

beginning on page 57, for additional discussion of accounting for suspended exploratory well costs.

Long-lived assets to be held and used, including proved crude oil and natural gas properties, are assessed for possible

impairment by comparing their carrying values with their associated undiscounted, future net before-tax cash flows. Events

that can trigger assessments for possible impairments include write-downs of proved reserves based on field performance,

significant decreases in the market value of an asset (including changes to the commodity price forecast), significant change

in the extent or manner of use of or a physical change in an asset, and a more-likely-than-not expectation that a long-lived

asset or asset group will be sold or otherwise disposed of significantly sooner than the end of its previously estimated useful

life. Impaired assets are written down to their estimated fair values, generally their discounted, future net before-tax cash

flows. For proved crude oil and natural gas properties in the United States, the company generally performs an impairment

review on an individual field basis. Outside the United States, reviews are performed on a country, concession, development

area or field basis, as appropriate. In Downstream, impairment reviews are performed on the basis of a refinery, a plant, a

marketing/lubricants area or distribution area, as appropriate. Impairment amounts are recorded as incremental

“Depreciation, depletion and amortization” expense.

Long-lived assets that are held for sale are evaluated for possible impairment by comparing the carrying value of the asset

with its fair value less the cost to sell. If the net book value exceeds the fair value less cost to sell, the asset is considered

impaired and adjusted to the lower value. Refer to Note 9, beginning on page 42, relating to fair value measurements.

The fair value of a liability for an ARO is recorded as an asset and a liability when there is a legal obligation associated with

the retirement of a long-lived asset and the amount can be reasonably estimated. Refer also to Note 24, on page 67, relating

to AROs.

Depreciation and depletion of all capitalized costs of proved crude oil and natural gas producing properties, except mineral

interests, are expensed using the unit-of-production method, generally by individual field, as the proved developed reserves

are produced. Depletion expenses for capitalized costs of proved mineral interests are recognized using the unit-of-

production method by individual field as the related proved reserves are produced. Periodic valuation provisions for

impairment of capitalized costs of unproved mineral interests are expensed.

The capitalized costs of all other plant and equipment are depreciated or amortized over their estimated useful lives. In

general, the declining-balance method is used to depreciate plant and equipment in the United States; the straight-line method

is generally used to depreciate international plant and equipment and to amortize all capitalized leased assets.

Gains or losses are not recognized for normal retirements of properties, plant and equipment subject to composite group

amortization or depreciation. Gains or losses from abnormal retirements are recorded as expenses, and from sales as “Other

income.”

Expenditures for maintenance (including those for planned major maintenance projects), repairs and minor renewals to

maintain facilities in operating condition are generally expensed as incurred. Major replacements and renewals are

capitalized.

Goodwill Goodwill resulting from a business combination is not subject to amortization. The company tests such goodwill at

the reporting unit level for impairment on an annual basis and between annual tests if an event occurs or circumstances

change that would more likely than not reduce the fair value of the reporting unit below its carrying amount.

Environmental Expenditures Environmental expenditures that relate to ongoing operations or to conditions caused by past

operations are expensed. Expenditures that create future benefits or contribute to future revenue generation are capitalized.

Liabilities related to future remediation costs are recorded when environmental assessments or cleanups or both are probable

and the costs can be reasonably estimated. For the company’s U.S. and Canadian marketing facilities, the accrual is based in

part on the probability that a future remediation commitment will be required. For crude oil, natural gas and mineral-

producing properties, a liability for an ARO is made in accordance with accounting standards for asset retirement and

environmental obligations. Refer to Note 24, on page 67, for a discussion of the company’s AROs.

Chevron Corporation 2014 Annual Report 37