Chevron 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

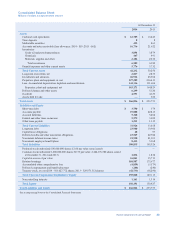

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

The Consolidated Statement of Cash Flows excludes changes to the Consolidated Balance Sheet that did not affect cash. The

2012 period excludes the effects of $800 of proceeds to be received in future periods for the sale of an equity interest in the

Wheatstone Project, of which $164 has been received as of December 31, 2014. “Capital expenditures” in the 2012 period

excludes a $1,850 increase in “Properties, plant and equipment” related to an upstream asset exchange in Australia. Refer

also to Note 24, on page 67, for a discussion of revisions to the company’s AROs that also did not involve cash receipts or

payments for the three years ending December 31, 2014.

The major components of “Capital expenditures” and the reconciliation of this amount to the reported capital and exploratory

expenditures, including equity affiliates, are presented in the following table:

Year ended December 31

2014 2013 2012

Additions to properties, plant and equipment *$ 34,393 $ 36,550 $ 29,526

Additions to investments 526 934 1,042

Current-year dry hole expenditures 504 594 475

Payments for other liabilities and assets, net (16) (93) (105)

Capital expenditures 35,407 37,985 30,938

Expensed exploration expenditures 1,110 1,178 1,173

Assets acquired through capital lease obligations and other financing obligations 332 16 1

Capital and exploratory expenditures, excluding equity affiliates 36,849 39,179 32,112

Company’s share of expenditures by equity affiliates 3,467 2,698 2,117

Capital and exploratory expenditures, including equity affiliates $ 40,316 $ 41,877 $ 34,229

*Excludes noncash additions of $2,310 in 2014, $1,661 in 2013 and $4,569 in 2012.

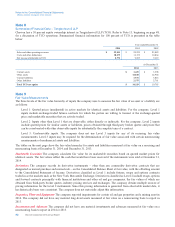

Note 5

Equity

Retained earnings at December 31, 2014 and 2013, included approximately $14,512 and $11,395, respectively, for the

company’s share of undistributed earnings of equity affiliates.

At December 31, 2014, about 133 million shares of Chevron’s common stock remained available for issuance from the

260 million shares that were reserved for issuance under the Chevron LTIP. In addition, approximately 174,510 shares

remain available for issuance from the 800,000 shares of the company’s common stock that were reserved for awards under

the Chevron Corporation Non-Employee Directors’ Equity Compensation and Deferral Plan.

Note 6

Lease Commitments

Certain noncancelable leases are classified as capital leases, and the leased assets are included as part of “Properties, plant

and equipment, at cost” on the Consolidated Balance Sheet. Such leasing arrangements involve crude oil production and

processing equipment, service stations, bareboat charters, office buildings, and other facilities. Other leases are classified as

operating leases and are not capitalized. The payments on operating leases are recorded as expense. Details of the capitalized

leased assets are as follows:

At December 31

2014 2013

Upstream $ 765 $ 445

Downstream 97 316

All Other ——

Total 862 761

Less: Accumulated amortization 381 523

Net capitalized leased assets $ 481 $ 238

40 Chevron Corporation 2014 Annual Report