Chevron 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

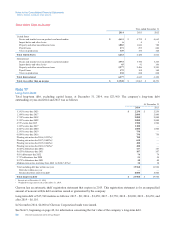

approximate amounts of required payments under these various commitments are: 2015 – $3,600; 2016 – $3,000; 2017 –

$2,300; 2018 – $2,100; 2019 – $1,600; 2020 and after – $4,500. A portion of these commitments may ultimately be shared

with project partners. Total payments under the agreements were approximately $3,700 in 2014, $3,600 in 2013 and $3,600

in 2012.

Environmental The company is subject to loss contingencies pursuant to laws, regulations, private claims and legal

proceedings related to environmental matters that are subject to legal settlements or that in the future may require the

company to take action to correct or ameliorate the effects on the environment of prior release of chemicals or petroleum

substances, including MTBE, by the company or other parties. Such contingencies may exist for various sites, including, but

not limited to, federal Superfund sites and analogous sites under state laws, refineries, crude oil fields, service stations,

terminals, land development areas, and mining operations, whether operating, closed or divested. These future costs are not

fully determinable due to such factors as the unknown magnitude of possible contamination, the unknown timing and extent

of the corrective actions that may be required, the determination of the company’s liability in proportion to other responsible

parties, and the extent to which such costs are recoverable from third parties.

Although the company has provided for known environmental obligations that are probable and reasonably estimable, the

amount of additional future costs may be material to results of operations in the period in which they are recognized. The

company does not expect these costs will have a material effect on its consolidated financial position or liquidity. Also, the

company does not believe its obligations to make such expenditures have had, or will have, any significant impact on the

company’s competitive position relative to other U.S. or international petroleum or chemical companies.

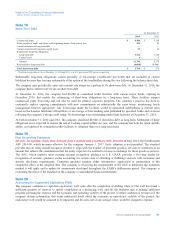

Chevron’s environmental reserve as of December 31, 2014, was $1,683. Included in this balance were remediation activities

at approximately 164 sites for which the company had been identified as a potentially responsible party or otherwise

involved in the remediation by the U.S. Environmental Protection Agency (EPA) or other regulatory agencies under the

provisions of the federal Superfund law or analogous state laws. The company’s remediation reserve for these sites at year-

end 2014 was $456. The federal Superfund law and analogous state laws provide for joint and several liability for all

responsible parties. Any future actions by the EPA or other regulatory agencies to require Chevron to assume other

potentially responsible parties’ costs at designated hazardous waste sites are not expected to have a material effect on the

company’s results of operations, consolidated financial position or liquidity.

Of the remaining year-end 2014 environmental reserves balance of $1,227, $868 related to the company’s U.S. downstream

operations, including refineries and other plants, marketing locations (i.e., service stations and terminals), chemical facilities,

and pipelines. The remaining $359 was associated with various sites in international downstream $79, upstream $275 and

other businesses $5. Liabilities at all sites, whether operating, closed or divested, were primarily associated with the

company’s plans and activities to remediate soil or groundwater contamination or both. These and other activities include

one or more of the following: site assessment; soil excavation; offsite disposal of contaminants; onsite containment,

remediation and/or extraction of petroleum hydrocarbon liquid and vapor from soil; groundwater extraction and treatment;

and monitoring of the natural attenuation of the contaminants.

The company manages environmental liabilities under specific sets of regulatory requirements, which in the United States

include the Resource Conservation and Recovery Act and various state and local regulations. No single remediation site at

year-end 2014 had a recorded liability that was material to the company’s results of operations, consolidated financial

position or liquidity.

It is likely that the company will continue to incur additional liabilities, beyond those recorded, for environmental

remediation relating to past operations. These future costs are not fully determinable due to such factors as the unknown

magnitude of possible contamination, the unknown timing and extent of the corrective actions that may be required, the

determination of the company’s liability in proportion to other responsible parties, and the extent to which such costs are

recoverable from third parties.

Refer to Note 24 for a discussion of the company’s asset retirement obligations.

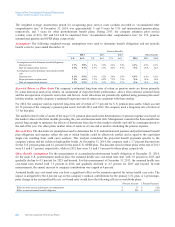

Other Contingencies On April 26, 2010, a California appeals court issued a ruling related to the adequacy of an

Environmental Impact Report (EIR) supporting the issuance of certain permits by the city of Richmond, California, to

replace and upgrade certain facilities at Chevron’s refinery in Richmond. Settlement discussions with plaintiffs in the case

ended late fourth quarter 2010, and on March 3, 2011, the trial court entered a final judgment and peremptory writ ordering

the City to set aside the project EIR and conditional use permits and enjoining Chevron from any further work. On May 23,

2011, the company filed an application with the City Planning Department for a conditional use permit for a revised project

to complete construction of the hydrogen plant, certain sulfur removal facilities and related infrastructure.

66 Chevron Corporation 2014 Annual Report