Chevron 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

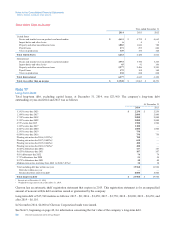

Note 18

Short-Term Debt

At December 31

2014 2013

Commercial paper*$ 8,506 $ 5,130

Notes payable to banks and others with originating terms of one year or less 104 49

Current maturities of long-term debt ——

Current maturities of long-term capital leases 22 34

Redeemable long-term obligations

Long-term debt 3,152 3,152

Capital leases 69

Subtotal 11,790 8,374

Reclassified to long-term debt (8,000) (8,000)

Total short-term debt $ 3,790 $ 374

*Weighted-average interest rates at December 31, 2014 and 2013, were 0.12 percent and 0.09 percent, respectively.

Redeemable long-term obligations consist primarily of tax-exempt variable-rate put bonds that are included as current

liabilities because they become redeemable at the option of the bondholders during the year following the balance sheet date.

The company may periodically enter into interest rate swaps on a portion of its short-term debt. At December 31, 2014, the

company had no interest rate swaps on short-term debt.

At December 31, 2014, the company had $8,000 in committed credit facilities with various major banks, expiring in

December 2016, that enable the refinancing of short-term obligations on a long-term basis. These facilities support

commercial paper borrowing and can also be used for general corporate purposes. The company’s practice has been to

continually replace expiring commitments with new commitments on substantially the same terms, maintaining levels

management believes appropriate. Any borrowings under the facilities would be unsecured indebtedness at interest rates

based on the London Interbank Offered Rate or an average of base lending rates published by specified banks and on terms

reflecting the company’s strong credit rating. No borrowings were outstanding under these facilities at December 31, 2014.

At both December 31, 2014 and 2013, the company classified $8,000 of short-term debt as long-term. Settlement of these

obligations is not expected to require the use of working capital within one year, and the company has both the intent and the

ability, as evidenced by committed credit facilities, to refinance them on a long-term basis.

Note 19

New Accounting Standards

Revenue Recognition (Topic 606), Revenue from Contracts with Customers (ASU 2014-09) In May 2014, the FASB issued

ASU 2014-09, which becomes effective for the company January 1, 2017. Early adoption is not permitted. The standard

provides that an entity should recognize revenue to align with the transfer of promised goods or services to customers in an

amount that reflects the consideration that the entity expects to be entitled to receive in exchange for those goods or services.

The ASU, which replaces most existing revenue recognition guidance in U.S. GAAP, provides a five-step model for

recognition of revenue, guidance on the accounting for certain costs of obtaining or fulfilling contracts with customers and

specific disclosure requirements. Transition guidance permits either retrospective application or presentation of the

cumulative effect at the adoption date. The company is reviewing the requirements of the ASU to determine the transition

method it will apply and to update its assessments developed throughout the FASB’s deliberation period. The company is

evaluating the effect of the standard on the company’s consolidated financial statements.

Note 20

Accounting for Suspended Exploratory Wells

The company continues to capitalize exploratory well costs after the completion of drilling when (a) the well has found a

sufficient quantity of reserves to justify completion as a producing well, and (b) the business unit is making sufficient

progress assessing the reserves and the economic and operating viability of the project. If either condition is not met or if the

company obtains information that raises substantial doubt about the economic or operational viability of the project, the

exploratory well would be assumed to be impaired, and its costs, net of any salvage value, would be charged to expense.

Chevron Corporation 2014 Annual Report 57