Chevron 2014 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Supplemental Information on Oil and Gas Producing Activities - Unaudited

Proved reserves are estimated by company asset teams composed of earth scientists and engineers. As part of the internal

control process related to reserves estimation, the company maintains a Reserves Advisory Committee (RAC) that is chaired

by the Manager of Corporate Reserves, a corporate department that reports directly to the Vice Chairman responsible for the

company’s worldwide exploration and production activities. The Manager of Corporate Reserves has more than 30 years’

experience working in the oil and gas industry and a Master of Science in Petroleum Engineering degree from Stanford

University. His experience includes more than 15 years of managing oil and gas reserves processes. He was chairman of the

Society of Petroleum Engineers Oil and Gas Reserves Committee, served on the United Nations Expert Group on Resources

Classification, and is a past member of the Joint Committee on Reserves Evaluator Training and the California Conservation

Committee. He is an active member of the Society of Petroleum Evaluation Engineers and serves on the Society of

Petroleum Engineers Oil and Gas Reserves Committee.

All RAC members are degreed professionals, each with more than 10 years of experience in various aspects of reserves

estimation relating to reservoir engineering, petroleum engineering, earth science or finance. The members are

knowledgeable in SEC guidelines for proved reserves classification and receive annual training on the preparation of reserves

estimates. The reserves activities are managed by two operating company-level reserves managers. These two reserves

managers are not members of the RAC so as to preserve corporate-level independence.

The RAC has the following primary responsibilities: establish the policies and processes used within the operating units to

estimate reserves; provide independent reviews and oversight of the business units’ recommended reserves estimates and

changes; confirm that proved reserves are recognized in accordance with SEC guidelines; determine that reserve volumes are

calculated using consistent and appropriate standards, procedures and technology; and maintain the Corporate Reserves

Manual, which provides standardized procedures used corporatewide for classifying and reporting hydrocarbon reserves.

During the year, the RAC is represented in meetings with each of the company’s upstream business units to review and

discuss reserve changes recommended by the various asset teams. Major changes are also reviewed with the company’s

Strategy and Planning Committee, whose members include the Chief Executive Officer and the Chief Financial Officer. The

company’s annual reserve activity is also reviewed with the Board of Directors. If major changes to reserves were to occur

between the annual reviews, those matters would also be discussed with the Board.

RAC subteams also conduct in-depth reviews during the year of many of the fields that have large proved reserves quantities.

These reviews include an examination of the proved-reserve records and documentation of their compliance with the

Corporate Reserves Manual.

Technologies Used in Establishing Proved Reserves Additions In 2014, additions to Chevron’s proved reserves were based

on a wide range of geologic and engineering technologies. Information generated from wells, such as well logs, wire line

sampling, production and pressure testing, fluid analysis, and core analysis, was integrated with seismic data, regional

geologic studies, and information from analogous reservoirs to provide “reasonably certain” proved reserves estimates. Both

proprietary and commercially available analytic tools, including reservoir simulation, geologic modeling and seismic

processing, have been used in the interpretation of the subsurface data. These technologies have been utilized extensively by

the company in the past, and the company believes that they provide a high degree of confidence in establishing reliable and

consistent reserves estimates.

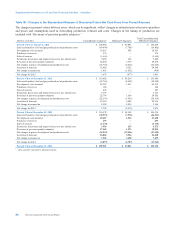

Proved Undeveloped Reserves At the end of 2014, proved undeveloped reserves totaled 5.0 billion barrels of oil-equivalent

(BOE), a decrease of 174 million BOE from year-end 2013. The decrease was due to the transfer of 646 million BOE to

proved developed and 2 million BOE in sales, partially offset by increases of 277 million BOE in extensions and discoveries,

169 million BOE in revisions, and 28 million BOE in improved recovery.

During 2014, investments totaling approximately $15.4 billion in oil and gas producing activities and about $2.9 billion in

non-oil and gas producing activities were expended to advance the development of proved undeveloped reserves. Australia

accounted for about $7.1 billion of the total, mainly for development and construction activities at the Gorgon and

Wheatstone LNG projects. Expenditures of about $3.4 billion in the United States related primarily to various development

activities in the Gulf of Mexico and the midcontinent region. In Asia, expenditures during the year totaled approximately

$3.3 billion, primarily related to development projects of the TCO affiliate in Kazakhstan, and in Thailand. In Africa, about

$2.8 billion was expended on various offshore development and natural gas projects in Nigeria and Angola. Development

activities in Canada and Brazil were primarily responsible for about $1.6 billion of expenditures in Other Americas.

Chevron Corporation 2014 Annual Report 75