Chevron 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 Annual Report

Table of contents

-

Page 1

2014 Annual Report -

Page 2

... Financial Highlights Chevron Operating Highlights Chevron at a Glance 8 9 68 69 Glossary of Energy and Financial Terms Financial Review Five-Year Financial Summary Five-Year Operating Summary 81 82 83 84 Chevron History Board of Directors Corporate Ofï¬cers Stockholder and Investor Information -

Page 3

... program in our recent corporate history. During 2014 Chevron Shipping Company took delivery of seven new ships including the ï¬rst two of six new liqueï¬ed natural gas (LNG) carriers to support our growing LNG operations. Here, Chevron Shipping employees Chris Kasey (left), site Health... -

Page 4

... barrels of oil-equivalent per day in 2017, a 20 percent increase from 2014, which is a larger growth rate than that projected for our large competitors. In early December Jack/St. Malo, one of our deepwater U.S. Gulf of Mexico projects, delivered ï¬rst oil on time and within budget. In 2015 we'll -

Page 5

... to invest in projects and local goods and services, create jobs, and generate revenues for the communities in which we work. Beyond our direct business investments and John S S. Watson Chairman of the Board and Chief Executive Ofï¬cer February 20, 2015 Chevron Corporation 2014 Annual Report 3 -

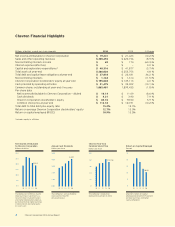

Page 6

... on asset sales. The company's annual dividend increased for the 27th consecutive year. The company's stock price declined 10.2 percent in 2014. Chevron's return on capital employed declined to 10.9 percent on lower earnings and higher capital employed. 4 Chevron Corporation 2014 Annual Report -

Page 7

... for stock splits. The interim measurement points show the value of $100 invested on December 31, 2009, as of the end of each year between 2010 and 2014. 250 Five-Year Cumulative Total Returns (Calendar years ended December 31) 200 Dollars 150 100 50 2009 2010 2011 2012 2013 2014 Chevron... -

Page 8

...distribute trans sportation fuels and lubricant ts; manufa acture an nd sell petrochemicals and additives; gen nerate power and produc ce geo othermal energy; and develop and deplo oy te echnolo ogies th hat im mprove th he energy efï¬ciency of our operations s worldwide. 6C Chevron Ch Che h he ev... -

Page 9

.... This includes commercializing our equity gas resource base and maximizing the value of the company's equity natural gas, crude oil, natural gas liquids and reï¬ned products. It has global operations with major centers in Houston; London; Singapore; and San Ramon, California. Technology Strategy... -

Page 10

... of oil-equivalent and oil-equivalent gas. The company discloses only net proved reserves in its filings with the U.S. Securities and Exchange Commission. Investors should refer to proved reserves disclosures in Chevron's Annual Report on Form 10-K for the year ended December 31, 2014. Resources... -

Page 11

... REFORM ACT OF 1995 This Annual Report of Chevron Corporation contains forward-looking statements relating to Chevron's operations that are based on management's current expectations, estimates and projections about the petroleum, chemicals and other energy-related industries. Words such as... -

Page 12

... referred to as "earnings" in the discussions that follow. Refer to the "Results of Operations" section beginning on page 15 for a discussion of financial results by major operating area for the three years ended December 31, 2014. Business Environment and Outlook Chevron is a global energy company... -

Page 13

... changes in prices for crude oil and natural gas. Management takes these developments into account in the conduct of ongoing operations and for business planning. Comments related to earnings trends for the company's major business areas are as follows: Upstream Earnings for the upstream segment are... -

Page 14

... The company's worldwide net oil-equivalent production in 2014 averaged 2.571 million million barrels per day. About onefifth of the company's net oil-equivalent production in 2014 occurred in the OPEC-member countries of Angola, Nigeria, Venezuela and the Partitioned Zone between Saudi Arabia... -

Page 15

... downstream operations. All Other consists of mining activities, power and energy services, worldwide cash management and debt financing activities, corporate administrative functions, insurance operations, real estate activities, and technology companies. Chevron Corporation 2014 Annual Report 13 -

Page 16

... of Chevron's equity LNG offtake from the project is committed under binding sales agreements to customers in Asia. Azerbaijan Achieved first production from the Chirag Oil Project in the Caspian Sea. Bangladesh Announced first gas from the Bibiyana Expansion Project. Canada Completed the sale of... -

Page 17

... gas production averaged about 1.3 billion cubic feet per day in 2014, largely unchanged from 2013 and up 4 percent from 2012. Refer to the "Selected Operating Data" table on page 19 for a three-year comparative of production volumes in the United States. Chevron Corporation 2014 Annual Report 15 -

Page 18

...up 1 percent from 2012. Refer to the "Selected Operating Data" table, on page 19, for a three-year comparative of international production volumes. U.S. Downstream Millions of dollars Earnings $ 2014 2,637 $ 2013 787 $ 2012 2,048 U.S. downstream operations earned $2.6 billion in 2014, compared with... -

Page 19

... in Kazakhstan and Petropiar in Venezuela, and higher earnings from CPChem, partially offset by 2013 impairments of power-related affiliates. Refer to Note 13, beginning on page 48, for a discussion of Chevron's investments in affiliated companies. Chevron Corporation 2014 Annual Report 17 -

Page 20

...19,996 Effective income tax rates were 38 percent in 2014, 40 percent in 2013 and 43 percent in 2012. The decrease in the effective tax rate between 2014 and 2013 primarily resulted from the impact of changes in jurisdictional mix and equity earnings, and 18 Chevron Corporation 2014 Annual Report -

Page 21

...ongoing tax charges. The rate decreased between 2013 and 2012 primarily due to a lower effective tax rate in international upstream operations. The lower international upstream effective tax rate was driven by a greater portion of equity income in 2013 than in 2012 (equity income is included as part... -

Page 22

... and are rated AA by Standard & Poor's Corporation and Aa1 by Moody's Investors Service. The company's U.S. commercial paper is rated A-1+ by Standard & Poor's and P-l by Moody's. All of these ratings denote high-quality, investment-grade securities. 20 Chevron Corporation 2014 Annual Report -

Page 23

...to the Consolidated Financial Statements, Short-Term Debt, on page 57. Common Stock Repurchase Program In July 2010, the Board of Directors approved an ongoing share repurchase program with no set term or monetary limits. During 2014, the company purchased 41.5 million common shares for $5.0 billion... -

Page 24

...-tax interest costs. This ratio indicates the company's ability to pay interest on outstanding debt. The company's interest coverage ratio in 2014 was lower than 2013 and 2012 due to lower income. Debt Ratio - total debt as a percentage of total debt plus Chevron Corporation Stockholders' Equity... -

Page 25

... 2014, the company had no interest rate swaps. Transactions With Related Parties Chevron enters into a number of business arrangements with related parties, principally its equity affiliates. These arrangements include long-term supply or offtake agreements and long-term purchase agreements. Refer... -

Page 26

... Financial Statements under the heading "Ecuador," beginning on page 50. Environmental The following table displays the annual changes to the company's before-tax environmental remediation reserves, including those for federal Superfund sites and analogous sites under state laws. Millions of dollars... -

Page 27

... oil and gas reserves on Chevron's Consolidated Financial Statements, using the successful efforts method of accounting, include the following: 1. Amortization - Capitalized exploratory drilling and development costs are depreciated on a unit-of-production (UOP) basis using proved developed reserves... -

Page 28

... Financial Statements, beginning on page 36, which includes a description of the "successful efforts" method of accounting for oil and gas exploration and production activities. Impairment of Properties, Plant and Equipment and Investments in Affiliates The company assesses its properties, plant... -

Page 29

... obligations for OPEB plans, which provide for certain health care and life insurance benefits for qualifying retired employees and which are not funded, are the discount rate and the assumed health care cost-trend rates. Information related to the Company's processes to develop these assumptions is... -

Page 30

... Intraday price. The company's common stock is listed on the New York Stock Exchange (trading symbol: CVX). As of February 9, 2015, stockholders of record numbered approximately 152,000. There are no restrictions on the company's ability to pay dividends. 28 Chevron Corporation 2014 Annual Report -

Page 31

... directors who are not officers or employees of the company. The Audit Committee meets regularly with members of management, the internal auditors and the independent registered public accounting firm to review accounting, internal control, auditing and financial reporting matters. Both the internal... -

Page 32

Report of Independent Registered Public Accounting Firm To the Stockholders and the Board of Directors of Chevron Corporation: In our opinion, the accompanying consolidated balance sheet and the related consolidated statements of income, comprehensive income, equity and of cash flows present fairly,... -

Page 33

... Statement of Income Millions of dollars, except per-share amounts Year ended December 31 2014 Revenues and Other Income Sales and other operating revenues* Income from equity affiliates Other income Total Revenues and Other Income Costs and Other Deductions Purchased crude oil and products... -

Page 34

... Income taxes on defined benefit plans Total Other Comprehensive (Loss) Gain, Net of Tax Comprehensive Income Comprehensive income attributable to noncontrolling interests Comprehensive Income Attributable to Chevron Corporation See accompanying Notes to the Consolidated Financial Statements. 2013... -

Page 35

...31, 2014 and 2013) Capital in excess of par value Retained earnings Accumulated other comprehensive loss Deferred compensation and benefit plan trust Treasury stock, at cost (2014 - 563,027,772 shares; 2013 - 529,073,512 shares) Total Chevron Corporation Stockholders' Equity Noncontrolling interests... -

Page 36

... in long-term receivables Decrease (increase) in other deferred charges Cash contributions to employee pension plans Other Net Cash Provided by Operating Activities Investing Activities Capital expenditures Proceeds and deposits related to asset sales Net sales of time deposits Net (purchases) sales... -

Page 37

...dollars 2014 Shares Preferred Stock Common Stock Capital in Excess of Par Balance at January 1 Treasury stock transactions Balance at December 31 Retained Earnings Balance at January 1 Net income attributable to Chevron Corporation Cash dividends on common stock Stock dividends Tax (charge) benefit... -

Page 38

... are reported in current income. The company may enter into interest rate swaps from time to time as part of its overall strategy to manage the interest rate risk on its debt. Interest rate swaps related to a portion of the company's fixed-rate debt, if any, may be accounted for as fair value hedges... -

Page 39

.... For crude oil, natural gas and mineralproducing properties, a liability for an ARO is made in accordance with accounting standards for asset retirement and environmental obligations. Refer to Note 24, on page 67, for a discussion of the company's AROs. Chevron Corporation 2014 Annual Report 37 -

Page 40

... in employee benefit costs for the year ending December 31, 2014. Related income taxes for the same period, totaling $245, are reflected in Income Tax Expense on the Consolidated Statement of Income. All other reclassified amounts were insignificant. 38 Chevron Corporation 2014 Annual Report -

Page 41

... on the face of the Consolidated Statement of Income. The term "earnings" is defined as "Net Income Attributable to Chevron Corporation." Activity for the equity attributable to noncontrolling interests for 2014, 2013 and 2012 is as follows: 2014 Balance at January 1 Net income Distributions... -

Page 42

...,000 shares of the company's common stock that were reserved for awards under the Chevron Corporation Non-Employee Directors' Equity Compensation and Deferral Plan. Note 6 Lease Commitments Certain noncancelable leases are classified as capital leases, and the leased assets are included as part of... -

Page 43

...regulated pipeline operations of Chevron. CUSA also holds the company's investment in the Chevron Phillips Chemical Company LLC joint venture, which is accounted for using the equity method. The summarized financial information for CUSA and its consolidated subsidiaries is as follows: 2014 Sales and... -

Page 44

... LLP Chevron has a 50 percent equity ownership interest in Tengizchevroil LLP (TCO). Refer to Note 13, beginning on page 48, for a discussion of TCO operations. Summarized financial information for 100 percent of TCO is presented in the table below: 2014 Sales and other operating revenues Costs... -

Page 45

... 31, 2014, and December 31, 2013, respectively. At December 31, 2014, these investments are classified as Level 1 and include restricted funds related to upstream abandonment activities, funds held in escrow for tax-deferred exchanges and asset acquisitions, and tax payments, which are reported in... -

Page 46

... of its cash equivalents, time deposits, marketable securities, derivative financial instruments and trade receivables. The company's short-term investments are placed with a wide array of financial institutions with high credit ratings. Company investment policies limit the company's exposure both... -

Page 47

... of salary and other compensation awards that are invested in Chevron stock units by certain officers and employees of the company. Diluted EPS includes the effects of these items as well as the dilutive effects of outstanding stock options awarded under the company's stock option programs (refer to... -

Page 48

... Operating segment sales and other operating revenues, including internal transfers, for the years 2014, 2013 and 2012, are presented in the table that follows. Products are transferred between operating segments at internal product values that approximate market prices. Revenues for the upstream... -

Page 49

... revenues from the manufacture and sale of fuel and lubricant additives and the transportation and trading of refined products and crude oil. "All Other" activities include revenues from power and energy services, insurance operations, real estate activities and technology companies. 2014 Upstream... -

Page 50

... certain equity affiliates, Chevron pays its share of some income taxes directly. For such affiliates, the equity in earnings does not include these taxes, which are reported on the Consolidated Statement of Income as "Income tax expense." Investments and Advances At December 31 2014 2013 Upstream... -

Page 51

... fair value of Chevron's share of CAL common stock was approximately $3,755. Other Information "Sales and other operating revenues" on the Consolidated Statement of Income includes $10,404, $14,635 and $17,356 with affiliated companies for 2014, 2013 and 2012, respectively. "Purchased crude oil and... -

Page 52

...from the oil exploration and production operations and seeks unspecified damages to fund environmental remediation and restoration of the alleged environmental harm, plus a health monitoring program. Until 1992, Texaco Petroleum Company (Texpet), a subsidiary of Texaco Inc., was a minority member of... -

Page 53

Notes to the Consolidated Financial Statements Millions of dollars, except per-share amounts On February 14, 2011, the provincial court in Lago Agrio rendered an adverse judgment in the case. The court rejected Chevron's defenses to the extent the court addressed them in its opinion. The judgment ... -

Page 54

... the Lago Agrio plaintiffs and several of their lawyers, consultants and supporters, alleging violations of the Racketeer Influenced and Corrupt Organizations Act and other state laws. Through the civil lawsuit, Chevron is seeking relief that includes a 52 Chevron Corporation 2014 Annual Report -

Page 55

.... For international operations, before-tax income was $24,906, $31,233 and $37,876 in 2014, 2013 and 2012, respectively. U.S. federal income tax expense was reduced by $68, $175 and $165 in 2014, 2013 and 2012, respectively, for business tax credits. Chevron Corporation 2014 Annual Report 53 -

Page 56

... 0.1 43.2 % The company's effective tax rate decreased from 39.9 percent in 2013 to 38.1 percent in 2014. The decrease primarily resulted from the impact of changes in jurisdictional mix and equity earnings, and the tax effects related to the 2014 sale of interests in Chad and Cameroon, partially... -

Page 57

... liabilities for interim or annual periods. The following table indicates the changes to the company's unrecognized tax benefits for the years ended December 31, 2014, 2013 and 2012. The term "unrecognized tax benefits" in the accounting standards for income taxes refers to the differences between... -

Page 58

... - $1,450; 2017 - $3,750; 2018 - $2,000; 2019 - $2,650; and after 2019 - $6,110. In November 2014, $4,000 of Chevron Corporation bonds were issued. See Note 9, beginning on page 42, for information concerning the fair value of the company's long-term debt. 56 Chevron Corporation 2014 Annual Report -

Page 59

... met or if the company obtains information that raises substantial doubt about the economic or operational viability of the project, the exploratory well would be assumed to be impaired, and its costs, net of any salvage value, would be charged to expense. Chevron Corporation 2014 Annual Report 57 -

Page 60

... units and restricted stock units was $71 ($46 after tax), $223 ($145 after tax) and $177 ($115 after tax) for 2014, 2013 and 2012, respectively. No significant stock-based compensation cost was capitalized at December 31, 2014, or December 31, 2013. 58 Chevron Corporation 2014 Annual Report -

Page 61

... addition, outstanding stock appreciation rights and other awards that were granted under various LTIP and former Unocal programs totaled approximately 3.3 million equivalent shares as of December 31, 2014. A liability of $78 was recorded for these awards. Chevron Corporation 2014 Annual Report 59 -

Page 62

... and dental benefits, as well as life insurance for some active and qualifying retired employees. The plans are unfunded, and the company and retirees share the costs. Medical coverage for Medicare-eligible retirees in the company's main U.S. medical plan is secondary to Medicare (including Part... -

Page 63

Notes to the Consolidated Financial Statements Millions of dollars, except per-share amounts Amounts recognized on a before-tax basis in "Accumulated other comprehensive loss" for the company's pension and OPEB plans were $7,417 and $5,464 at the end of 2014 and 2013, respectively. These amounts ... -

Page 64

.... For 2014, the company used an expected long-term rate of return of 7.5 percent for U.S. pension plan assets, which account for 72 percent of the company's pension plan assets. In both 2013 and 2012, the company used a long-term rate of return of 7.5 for this plan. The market-related value of... -

Page 65

.... The "Other" asset class includes net payables for securities purchased but not yet settled (Level 1); dividends and interest- and tax-related receivables (Level 2); insurance contracts and investments in private-equity limited partnerships (Level 3). Chevron Corporation 2014 Annual Report 63 -

Page 66

... returns. To assess the plans' investment performance, long-term asset allocation policy benchmarks have been established. For the primary U.S. pension plan, the company's Benefit Plan Investment Committee has established the following approved asset allocation ranges: Equities 40-70 percent, Fixed... -

Page 67

... retirement plans. At December 31, 2014 and 2013, trust assets of $38 and $40, respectively, were invested primarily in interest-earning accounts. Employee Incentive Plans The Chevron Incentive Plan is an annual cash bonus plan for eligible employees that links awards to corporate, business... -

Page 68

...further work. On May 23, 2011, the company filed an application with the City Planning Department for a conditional use permit for a revised project to complete construction of the hydrogen plant, certain sulfur removal facilities and related infrastructure. 66 Chevron Corporation 2014 Annual Report -

Page 69

..., of which $800 was related to upstream and $200 to a mining asset. Earnings in 2013 included after-tax charges of approximately $400 for impairments and other asset writeoffs, of which $300 was related to upstream and $100 to other assets and investments. Chevron Corporation 2014 Annual Report 67 -

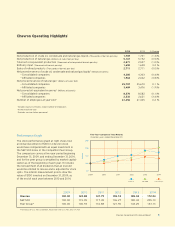

Page 70

... the 2011 acquisition of Atlas Energy, Inc. The company tested this goodwill for impairment during 2014 and concluded no impairment was necessary. Five Year Financial Summary Unaudited Millions of dollars, except per-share amounts 2014 2013 2012 2011 2010 Statement of Income Data Revenues and Other... -

Page 71

... Consolidated Financial Statements Millions of dollars, except per-share amounts Five-Year Operating Summary Unaudited Worldwide-Includes Equity in Affiliates Thousands of barrels per day, except natural gas data, which is millions cubic feet per day United States Net production of crude oil and... -

Page 72

...in exploration, property acquisitions and development; capitalized costs; and results of operations. Tables V through VII present information on the company's estimated net proved reserve quantities, standardized measure of estimated discounted future net cash flows related to proved Table I - Costs... -

Page 73

... include Chevron's equity interests in Tengizchevroil (TCO) in the Republic of Kazakhstan and in other affiliates, principally in Venezuela and Angola. Refer to Note 13, beginning on page 48, for a discussion of the company's major equity affiliates. Table II - Capitalized Costs Related to Oil and... -

Page 74

...tax rates, reflecting allowable deductions and tax credits. Interest income and expense are excluded from the results reported in Table III and from the net income amounts on page 46. Consolidated Companies Millions of dollars Year Ended December 31, 2014 Revenues from net production Sales Transfers... -

Page 75

... have been deducted from net production in calculating the unit average sales price and production cost. This has no effect on the results of producing operations. Natural gas converted to oil-equivalent gas (OEG) barrels at a rate of 6 MCF = 1 OEG barrel. Chevron Corporation 2014 Annual Report 73 -

Page 76

... to be recovered through existing wells with existing equipment and operating methods. Due to the inherent uncertainties and the limited nature of reservoir data, estimates of reserves are subject to change as additional information becomes available. 74 Chevron Corporation 2014 Annual Report -

Page 77

...engineers. As part of the internal control process related to reserves estimation, the company maintains a Reserves Advisory Committee (RAC) that is chaired by the Manager of Corporate Reserves, a corporate department that reports directly to the Vice Chairman responsible for the company's worldwide... -

Page 78

...existing projects in the United States, Europe, Asia, and Africa. In 2014, improved recovery increased reserves by 34 million barrels, primarily due to secondary recovery projects in the United States, mostly related to steamflood expansions in California. 76 Chevron Corporation 2014 Annual Report -

Page 79

..., 2013 and 2012, respectively. Included are year-end reserve quantities related to production-sharing contracts (PSC). PSC-related reserve quantities are 19 percent, 20 percent and 20 percent for consolidated companies for 2014, 2013 and 2012, respectively. Chevron Corporation 2014 Annual Report... -

Page 80

... of 614 BCF in the United States were primarily in the Appalachian region and the Delaware Basin. Sales In 2012, the sale of a portion of the company's equity interest in the Wheatstone Project was responsible for the 439 BCF reduction in Australia. 78 Chevron Corporation 2014 Annual Report -

Page 81

... of future development and production costs. The calculations are made as of December 31 each year and do not represent management's estimate of the company's future cash flows or value of its oil and gas reserves. In the following table, the caption "Standardized Measure Net Cash Flows" refers to... -

Page 82

... changes in prices, development and production costs Accretion of discount Net change in income tax Net change for 2012 Present Value at December 31, 2012 Sales and transfers of oil and gas produced net of production costs Development costs incurred Purchases of reserves Sales of reserves Extensions... -

Page 83

...Texaco), to combine Socal's exploration and production interests in the Middle East and Indonesia and provide an outlet for crude oil through The Texas Company's marketing network in Africa and Asia. 2011 Acquired Atlas Energy, Inc., an independent U.S. developer and producer of shale gas resources... -

Page 84

...Harvard Business School and is retired Chairman of the Board and Chief Executive Officer of Amgen Inc., a global biotechnology medicines company. Previously he was President and Chief Operating Officer of Amgen. He is a Director of Northrop Grumman Corporation. (1) Inge G. Thulin, 61 Director since... -

Page 85

... and trading operations. Previously Managing Director, Asia South Business Unit. Joined the company in 1989. Joseph C. Geagea, 55 Senior Vice President, Technology, Projects and Services, since 2014. Responsible for energy technology; delivery of major capital projects; procurement; information... -

Page 86

... All of these terms are used for convenience only and are not intended as a precise description of any of the separate companies, each of which manages its own affairs. Corporate Headquarters 6001 Bollinger Canyon Road San Ramon, CA 94583-2324 925 842 1000 84 Chevron Corporation 2014 Annual Report -

Page 87

... Canyon Road BR1X3432 San Ramon, CA 94583-5177 For additional information about the company and the energy industry, visit Chevron's website, Chevron.com . It includes articles, news releases, speeches, quarterly earnings information, the Proxy Statement and the complete text of this Annual Report... -

Page 88

Chevron Corporation 6001 Bollinger Canyon Road San Ramon, CA 94583-2324 USA www.chevron.com 10% Recycled 100% Recyclable © 2015 Chevron Corporation. All rights reserved. 912-0973