Boeing 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

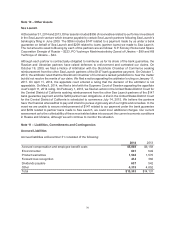

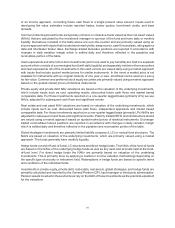

The capital lease obligation and IRB asset are recorded net in the Consolidated Statements of Financial

Position. As of December 31, 2014 and 2013, the assets and liabilities associated with the City of Wichita

IRBs were $638 and $690.

Note 13 – Debt

On October 31, 2014, we issued $300 of fixed rate senior notes due October 30, 2021 with an annual

interest rate of 2.35%, $300 of fixed rate senior notes due October 30, 2024 with an annual interest rate

of 2.85%, and $250 of floating rate senior notes due October 30, 2017. Each series of fixed rate senior

notes may be redeemed at our option at any time for a redemption price equal to the full principal amount

plus any accrued and unpaid interest and a make-whole premium. The floating rate senior notes bear

interest at an annual rate equal to three-month LIBOR plus 12.5 basis points, and are not redeemable

prior to maturity. The notes are unsecured senior obligations and rank equally in right of payment with our

existing and future unsecured and unsubordinated indebtedness. The net proceeds of the issuance, after

deducting underwriting discounts, commissions and offering expenses, totaled $838, of which $544 were

used to fund BCC.

Interest incurred, including amounts capitalized, was $504, $548 and $625 for the years ended December

31, 2014, 2013 and 2012, respectively. Interest expense recorded by BCC is reflected as Boeing Capital

interest expense on our Consolidated Statements of Operations. Total Company interest payments were

$511, $551 and $614 for the years ended December 31, 2014, 2013 and 2012, respectively.

We have $5,005 currently available under credit line agreements, of which $2,473 is a 364-day revolving

credit facility expiring in November 2015 and $2,472 expires in November 2019 and $60 in November

2017. The 364-day credit facility has a one-year term out option which allows us to extend the maturity of

any borrowings one year beyond the aforementioned expiration date. We continue to be in full compliance

with all covenants contained in our debt or credit facility agreements.

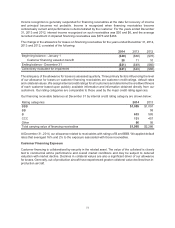

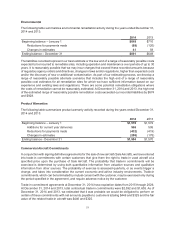

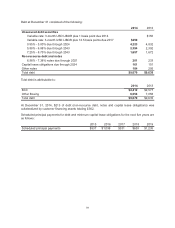

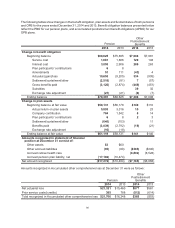

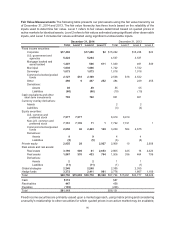

Short-term debt and current portion of long-term debt at December 31 consisted of the following:

2014 2013

Unsecured debt securities $755 $1,370

Non-recourse debt and notes 38 32

Capital lease obligations 64 68

Other notes 72 93

Total $929 $1,563