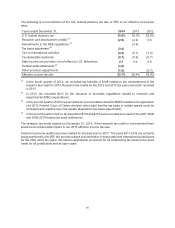

Boeing 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

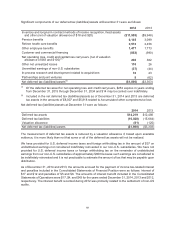

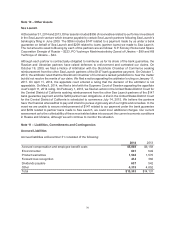

requests for restructuring and filings for bankruptcy. Unbillable receivables related to commercial customers

expected to be collected after one year were $172 and $179 at December 31, 2014 and 2013. Accounts

receivable related to claims are items that we believe are earned, but are subject to uncertainty concerning

their determination or ultimate realization.

Accounts receivable as of December 31, 2014, includes $112 of unbillable receivables on a long-term

contract with LightSquared, LP (LightSquared) related to the construction of two commercial satellites.

One of the satellites has been delivered, and the other is substantially complete but remains in Boeing’s

possession. On May 14, 2012, LightSquared filed for Chapter 11 bankruptcy protection. We believe that

our rights in the second satellite and related ground-segment assets are sufficient to protect the value of

our receivables in the event LightSquared fails to make payments as contractually required or rejects its

contract with us. Given the uncertainties inherent in bankruptcy proceedings, it is reasonably possible that

we could incur losses related to these receivables in connection with the LightSquared bankruptcy.

Accounts receivable, other than those described above, expected to be collected after one year are not

material.

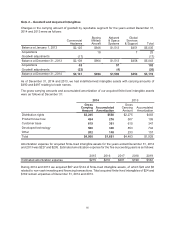

Note 6 – Inventories

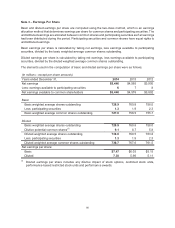

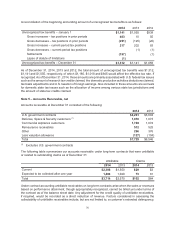

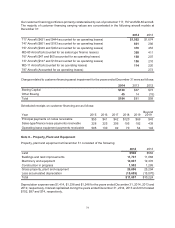

Inventories at December 31 consisted of the following:

2014 2013

Long-term contracts in progress $13,381 $12,608

Commercial aircraft programs 55,220 48,065

Commercial spare parts, used aircraft, general stock materials and other 7,421 7,793

Inventory before advances and progress billings 76,022 68,466

Less advances and progress billings (29,266) (25,554)

Total $46,756 $42,912

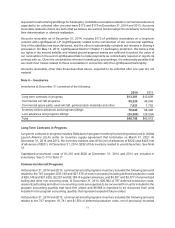

Long-Term Contracts in Progress

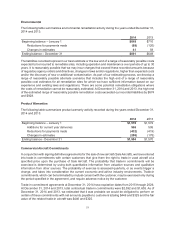

Long-term contracts in progress includes Delta launch program inventory that is being sold at cost to United

Launch Alliance (ULA) under an inventory supply agreement that terminates on March 31, 2021. At

December 31, 2014 and 2013, the inventory balance was $154 (net of advances of $322) and $425 (net

of advances of $331). At December 31, 2014, $292 of this inventory related to unsold launches. See Note

12.

Capitalized precontract costs of $1,281 and $520 at December 31, 2014 and 2013 are included in

inventories. See C-17 in Note 11.

Commercial Aircraft Programs

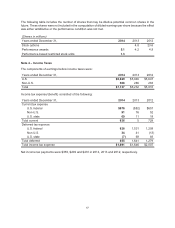

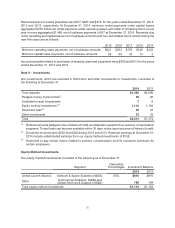

At December 31, 2014 and 2013, commercial aircraft programs inventory included the following amounts

related to the 787 program: $33,163 and $27,576 of work in process (including deferred production costs

of $26,149 and $21,620), $2,257 and $2,189 of supplier advances, and $3,801 and $3,377 of unamortized

tooling and other non-recurring costs. At December 31, 2014, $20,982 of 787 deferred production costs,

unamortized tooling and other non-recurring costs are expected to be recovered from units included in the

program accounting quantity that have firm orders and $8,968 is expected to be recovered from units

included in the program accounting quantity that represent expected future orders.

At December 31, 2014 and 2013, commercial aircraft programs inventory included the following amounts

related to the 747 program: $1,741 and $1,554 of deferred production costs, net of previously recorded