Boeing 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

operational issues brought forth by the customer or regulators, updating manuals and engineering data,

and the issuance of service bulletins that impact the entire model’s fleet. Field service support involves

our personnel located at customer facilities providing and coordinating fleet support activities and requests.

The costs for fleet support are expensed as incurred as Cost of services.

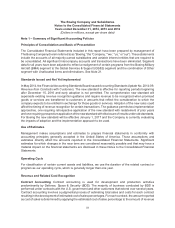

Research and Development

Research and development includes costs incurred for experimentation, design, and testing, as well as

bid and proposal efforts related to government products and services which are expensed as incurred

unless the costs are related to certain contractual arrangements with customers. Costs that are incurred

pursuant to such contractual arrangements are recorded over the period that revenue is recognized,

consistent with our contract accounting policy. We have certain research and development arrangements

that meet the requirement for best efforts research and development accounting. Accordingly, the amounts

funded by the customer are recognized as an offset to our research and development expense rather than

as contract revenues. Research and development expense included bid and proposal costs of $289, $285

and $326 in 2014, 2013 and 2012, respectively.

We have established cost sharing arrangements with some suppliers for the 787 program. Our cost sharing

arrangements state that the supplier contributions are for reimbursements of costs we incur for

experimentation, basic design, and testing activities during the 787 development. In each arrangement,

we retain substantial rights to the 787 part or component covered by the arrangement. The amounts

received from these cost sharing arrangements are recorded as a reduction to research and development

expenses since we have no obligation to refund any amounts received per the arrangements regardless

of the outcome of the development efforts. Specifically, under the terms of each agreement, payments

received from suppliers for their share of the costs are typically based on milestones and are recognized

as earned when we achieve the milestone events and no ongoing obligation on our part exists. In the

event we receive a milestone payment prior to the completion of the milestone, the amount is classified

in Accrued liabilities until earned.

Share-Based Compensation

We provide various forms of share-based compensation to our employees. For awards settled in shares,

we measure compensation expense based on the grant-date fair value net of estimated forfeitures. For

awards settled in cash, or that may be settled in cash, we measure compensation expense based on the

fair value at each reporting date net of estimated forfeitures. The expense is recognized over the requisite

service period, which is generally the vesting period of the award.

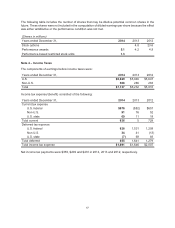

Income Taxes

Provisions for federal, state, and non-U.S. income taxes are calculated on reported Earnings before income

taxes based on current tax law and also include, in the current period, the cumulative effect of any changes

in tax rates from those used previously in determining deferred tax assets and liabilities. Such provisions

differ from the amounts currently receivable or payable because certain items of income and expense are

recognized in different time periods for financial reporting purposes than for income tax purposes.

Significant judgment is required in determining income tax provisions and evaluating tax positions.

The accounting for uncertainty in income taxes requires a more-likely-than-not threshold for financial

statement recognition and measurement of tax positions taken or expected to be taken in a tax return. We

record a liability for the difference between the benefit recognized and measured for financial statement

purposes and the tax position taken or expected to be taken on our tax return. To the extent that our

assessment of such tax positions changes, the change in estimate is recorded in the period in which the