Boeing 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

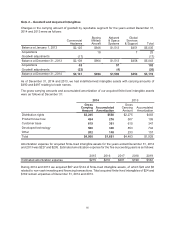

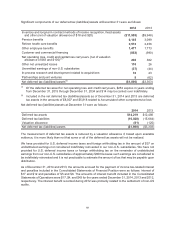

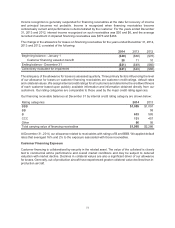

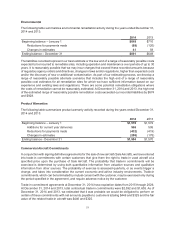

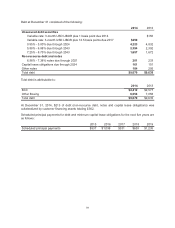

Our customer financing portfolio is primarily collateralized by out-of-production 717, 757 and MD-80 aircraft.

The majority of customer financing carrying values are concentrated in the following aircraft models at

December 31:

2014 2013

717 Aircraft ($421 and $444 accounted for as operating leases) $1,562 $1,674

747 Aircraft ($601 and $183 accounted for as operating leases) 601 286

757 Aircraft ($349 and $402 accounted for as operating leases) 370 453

MD-80 Aircraft (Accounted for as sales-type finance leases) 358 411

767 Aircraft ($47 and $60 accounted for as operating leases) 158 207

737 Aircraft ($127 and $138 accounted for as operating leases) 156 210

MD-11 Aircraft (Accounted for as operating leases) 114 220

787 Aircraft (Accounted for as operating leases) 273

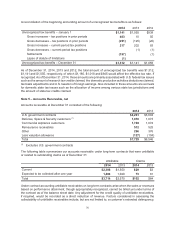

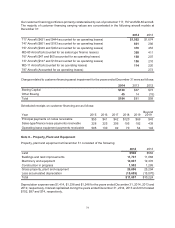

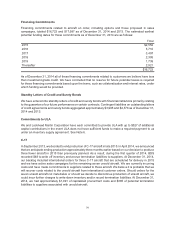

Charges related to customer financing asset impairment for the years ended December 31 were as follows:

2014 2013 2012

Boeing Capital $139 $67 $73

Other Boeing 45 14 (15)

Total $184 $81 $58

Scheduled receipts on customer financing are as follows:

Year 2015 2016 2017 2018 2019

Beyond

2019

Principal payments on notes receivable $55 $41 $42 $120 $69 $43

Sales-type/finance lease payments receivable 228 225 206 195 182 439

Operating lease equipment payments receivable 505 130 92 70 54 143

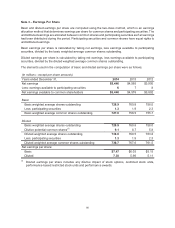

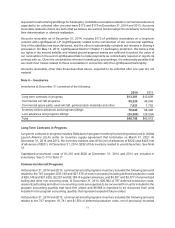

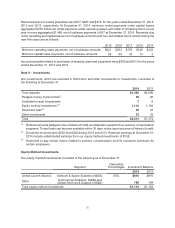

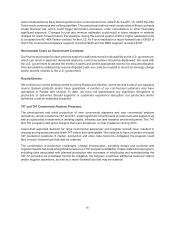

Note 8 – Property, Plant and Equipment

Property, plant and equipment at December 31 consisted of the following:

2014 2013

Land $560 $562

Buildings and land improvements 11,767 11,068

Machinery and equipment 12,867 12,376

Construction in progress 1,502 1,288

Gross property, plant and equipment 26,696 25,294

Less accumulated depreciation (15,689) (15,070)

Total $11,007 $10,224

Depreciation expense was $1,414, $1,338 and $1,248 for the years ended December 31, 2014, 2013 and

2012, respectively. Interest capitalized during the years ended December 31, 2014, 2013 and 2012 totaled

$102, $87 and $74, respectively.