Boeing 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

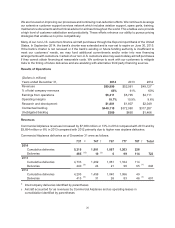

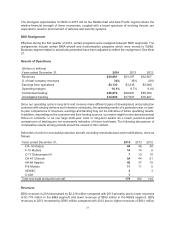

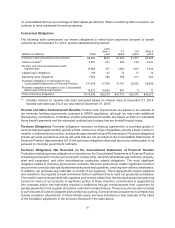

Revenues

GS&S revenues in 2014 decreased by $33 million compared with 2013 primarily due to lower volume of

$277 million in Integrated Logistics (IL) and Training Systems & Government Services (TSGS) programs.

These decreases were partially offset by higher Maintenance, Modification and Upgrades (MM&U)

revenues of $245 million primarily related to deliveries of three AEW&C Peace Eagle to Turkey in 2014.

GS&S revenues in 2013 increased by $92 million compared with 2012 primarily due to higher revenues

on MM&U and TSGS programs, partially offset by decreases in several IL programs.

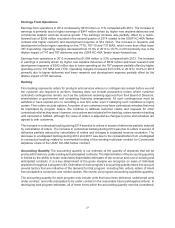

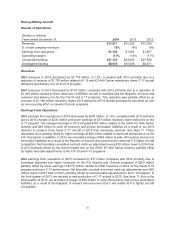

Earnings From Operations

GS&S earnings from operations in 2014 increased by $119 million, or 12%, compared with 2013 primarily

due to an increase of $145 million related to improved performance in several MM&U programs, most

notably the AEW&C Peace Eagle contract. Net favorable cumulative contract catch-up adjustments were

$123 million higher in 2014 than in 2013 primarily due to unfavorable adjustments on the AEW&C Peace

Eagle contract in 2013.

GS&S earnings from operations in 2013 decreased by $7 million compared with 2012 primarily due to

lower performance of $59 million in MM&U on the AEW&C Peace Eagle contract partially offset by $44

million of higher revenues and improved performance on several TSGS programs. Net favorable cumulative

contract catch-up adjustments in 2013 were $90 million lower than in 2012 primarily due to higher

unfavorable adjustments on the AEW&C Peace Eagle contract.

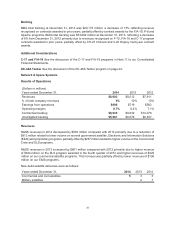

Backlog

GS&S total backlog has remained consistent at $17,818 million, $17,718 million and $17,891 million at

December 31, 2014, 2013 and 2012, respectively.

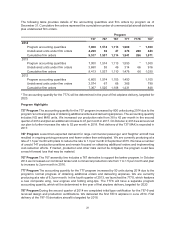

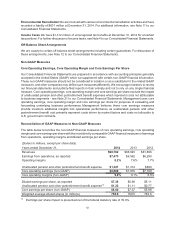

Boeing Capital

Business Environment and Trends

BCC’s gross customer financing and investment portfolio at December 31, 2014 totaled $3,506 million. A

substantial portion of BCC’s portfolio is concentrated among certain U.S. commercial airline customers.

BCC’s portfolio is also concentrated by varying degrees across Boeing aircraft product types, most notably

out-of-production Boeing aircraft such as 717 aircraft.

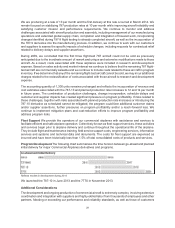

BCC provided customer financing of $489 million and $220 million during 2014 and 2013. While we may

be required to fund a number of new aircraft deliveries in 2015, we expect alternative financing will be

available at reasonable prices from broad and globally diverse sources.

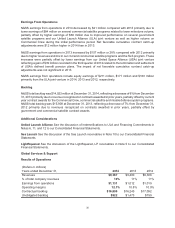

Aircraft values and lease rates are impacted by the number and type of aircraft that are currently out of

service. Approximately 2,300 western-built commercial jet aircraft (9.8% of current world fleet) were parked

at the end of 2014, including both in-production and out-of-production aircraft types. Of these parked

aircraft, approximately 15% are not expected to return to service. At the end of 2013 and 2012, 9.2% and

10.0% of the western-built commercial jet aircraft were parked. Aircraft valuations could decline if significant

numbers of additional aircraft, particularly types with relatively few operators, are placed out of service.