Boeing 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

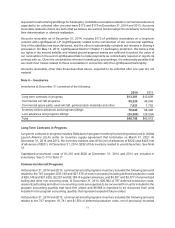

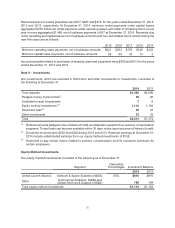

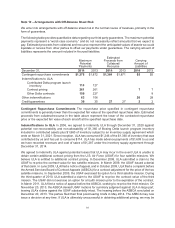

Note 12 – Arrangements with Off-Balance Sheet Risk

We enter into arrangements with off-balance sheet risk in the normal course of business, primarily in the

form of guarantees.

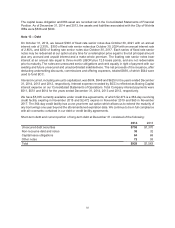

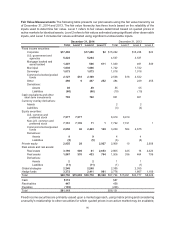

The following table provides quantitative data regarding our third party guarantees. The maximum potential

payments represent a “worst-case scenario,” and do not necessarily reflect amounts that we expect to

pay. Estimated proceeds from collateral and recourse represent the anticipated values of assets we could

liquidate or receive from other parties to offset our payments under guarantees. The carrying amount of

liabilities represents the amount included in Accrued liabilities.

Maximum

Potential

Payments

Estimated

Proceeds from

Collateral/

Recourse

Carrying

Amount of

Liabilities

December 31, 2014 2013 2014 2013 2014 2013

Contingent repurchase commitments $1,375 $1,872 $1,364 $1,871 $5 $5

Indemnifications to ULA:

Contributed Delta program launch

inventory 114 127

Contract pricing 261 261 77

Other Delta contracts 150 227 8

Other indemnifications 63 106 20 28

Credit guarantees 30 35 27 27 22

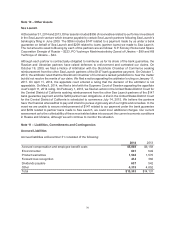

Contingent Repurchase Commitments The repurchase price specified in contingent repurchase

commitments is generally lower than the expected fair value at the specified repurchase date. Estimated

proceeds from collateral/recourse in the table above represent the lower of the contracted repurchase

price or the expected fair value of each aircraft at the specified repurchase date.

Indemnifications to ULA In 2006, we agreed to indemnify ULA through December 31, 2020 against

potential non-recoverability and non-allowability of $1,360 of Boeing Delta launch program inventory

included in contributed assets plus $1,860 of inventory subject to an inventory supply agreement which

ends on March 31, 2021. Since inception, ULA has consumed $1,246 of the $1,360 of inventory that was

contributed by us and has yet to consume $114. ULA has made advance payments of $1,609 to us and

we have recorded revenues and cost of sales of $1,287 under the inventory supply agreement through

December 31, 2014.

We agreed to indemnify ULA against potential losses that ULA may incur in the event ULA is unable to

obtain certain additional contract pricing from the U.S. Air Force (USAF) for four satellite missions. We

believe ULA is entitled to additional contract pricing. In December 2008, ULA submitted a claim to the

USAF to re-price the contract value for two satellite missions. In March 2009, the USAF issued a denial

of that claim. In June 2009, ULA filed a notice of appeal, and in October 2009, ULA filed a complaint before

the Armed Services Board of Contract Appeals (ASBCA) for a contract adjustment for the price of the two

satellite missions. In September 2009, the USAF exercised its option for a third satellite mission. During

the third quarter of 2010, ULA submitted a claim to the USAF to re-price the contract value of the third

mission. The USAF did not exercise an option for a fourth mission prior to the expiration of the contract.

In March 2011, ULA filed a notice of appeal before the ASBCA, seeking to re-price the third mission. On

November 20, 2013, the ASBCA denied USAF motions for summary judgment against ULA in large part,

leaving ULA’s claims against the USAF substantially intact. The hearing before the ASBCA concluded on

December 20, 2013. The parties filed their final post-hearing briefs in May 2014. The ASBCA may now

issue a decision at any time. If ULA is ultimately unsuccessful in obtaining additional pricing, we may be