Boeing 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

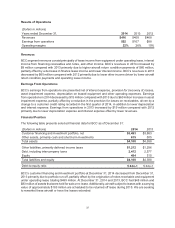

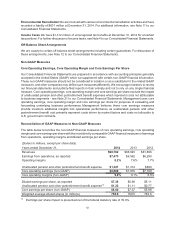

Results of Operations

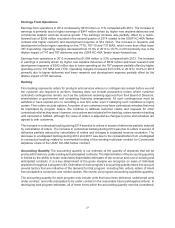

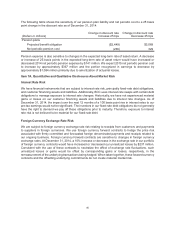

(Dollars in millions)

Years ended December 31, 2014 2013 2012

Revenues $416 $408 $468

Earnings from operations $92 $107 $88

Operating margins 22% 26% 19%

Revenues

BCC segment revenues consist principally of lease income from equipment under operating lease, interest

income from financing receivables and notes, and other income. BCC’s revenues in 2014 increased by

$8 million compared with 2013 primarily due to higher aircraft return condition payments of $60 million,

partially offset by a decrease in finance lease income and lower interest income. BCC’s revenues in 2013

decreased by $60 million compared with 2012 primarily due to lower other income driven by lower aircraft

return condition payments and operating lease income.

Earnings From Operations

BCC’s earnings from operations are presented net of interest expense, provision for (recovery of) losses,

asset impairment expense, depreciation on leased equipment and other operating expenses. Earnings

from operations in 2014 decreased by $15 million compared with 2013 due to $60 million increase in asset

impairment expense, partially offset by a reduction in the provision for losses on receivables, driven by a

change to a customer credit rating recorded in the first quarter of 2014, in addition to lower depreciation

and interest expense. Earnings from operations in 2013 increased by $19 million compared with 2012

primarily due to lower depreciation expense and interest expense offset by lower revenues.

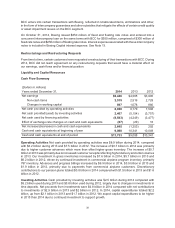

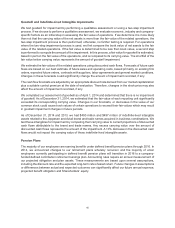

Financial Position

The following table presents selected financial data for BCC as of December 31:

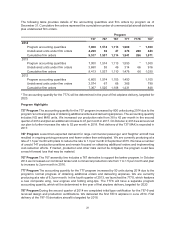

(Dollars in millions) 2014 2013

Customer financing and investment portfolio, net $3,493 $3,883

Other assets, primarily cash and short-term investments 615 505

Total assets $4,108 $4,388

Other liabilities, primarily deferred income taxes $1,212 $1,296

Debt, including intercompany loans 2,412 2,577

Equity 484 515

Total liabilities and equity $4,108 $4,388

Debt-to-equity ratio 5.0-to-1 5.0-to-1

BCC’s customer financing and investment portfolio at December 31, 2014 decreased from December 31,

2013 primarily due to portfolio run-off, partially offset by the origination of notes receivable and equipment

under operating lease totaling $489 million. At December 31, 2014 and 2013, BCC had $48 million and

$83 million of assets that were held for sale or re-lease. Additionally, aircraft subject to leases with a carrying

value of approximately $183 million are scheduled to be returned off lease during 2015. We are seeking

to remarket these aircraft or have the leases extended.