Boeing 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

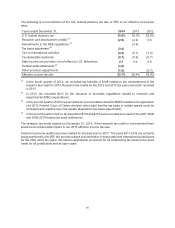

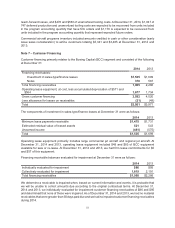

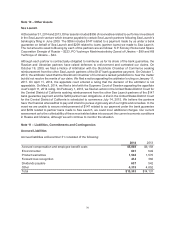

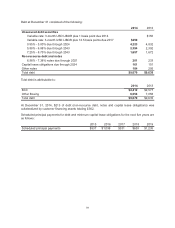

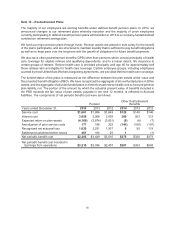

Financing Commitments

Financing commitments related to aircraft on order, including options and those proposed in sales

campaigns, totaled $16,723 and $17,987 as of December 31, 2014 and 2013. The estimated earliest

potential funding dates for these commitments as of December 31, 2014 are as follows:

Total

2015 $2,552

2016 3,710

2017 3,497

2018 2,305

2019 1,738

Thereafter 2,921

$16,723

As of December 31, 2014 all of these financing commitments related to customers we believe have less

than investment-grade credit. We have concluded that no reserve for future potential losses is required

for these financing commitments based upon the terms, such as collateralization and interest rates, under

which funding would be provided.

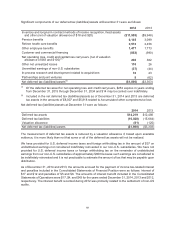

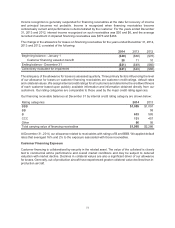

Standby Letters of Credit and Surety Bonds

We have entered into standby letters of credit and surety bonds with financial institutions primarily relating

to the guarantee of our future performance on certain contracts. Contingent liabilities on outstanding letters

of credit agreements and surety bonds aggregated approximately $3,985 and $4,376 as of December 31,

2014 and 2013.

Commitments to ULA

We and Lockheed Martin Corporation have each committed to provide ULA with up to $527 of additional

capital contributions in the event ULA does not have sufficient funds to make a required payment to us

under an inventory supply agreement. See Note 6.

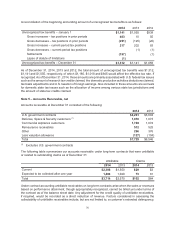

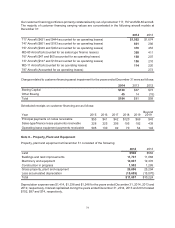

C-17

In September 2013, we decided to end production of C-17 aircraft in late 2015. In April 2014, we announced

that we anticipate ending production approximately three months earlier based on our decision to produce

three fewer aircraft in 2015 than previously planned. As a result, during the first quarter of 2014, BDS

recorded $48 to write off inventory and accrue termination liabilities to suppliers. At December 31, 2014,

our backlog included international orders for three C-17 aircraft that are scheduled for delivery in 2015

and we have active sales campaigns for the remaining seven unsold aircraft. We are currently incurring

costs and have made commitments to suppliers related to these aircraft. We believe it is probable that we

will recover costs related to the unsold aircraft from international customer orders. Should orders for the

seven unsold aircraft not materialize or should we decide to discontinue production of unsold aircraft, we

could incur further charges to write-down inventory and/or record termination liabilities. At December 31,

2014, we had approximately $1,091 of capitalized precontract costs and $385 of potential termination

liabilities to suppliers associated with unsold aircraft.