Boeing 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.91

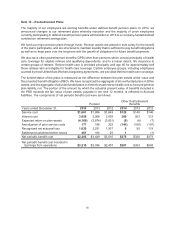

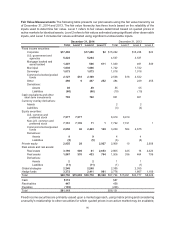

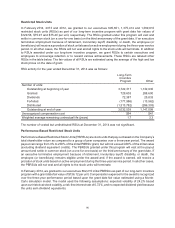

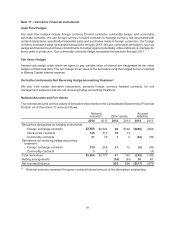

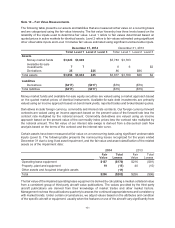

or an income approach, converting future cash flows to a single present value amount. Inputs used in

developing fair value estimates include reported trades, broker quotes, benchmark yields, and base

spreads.

Common/collective/pooled funds are typically common or collective trusts valued at their net asset values

(NAVs) that are calculated by the investment manager or sponsor of the fund and have daily or monthly

liquidity. Derivatives included in the table above are over-the-counter and are primarily valued using an

income approach with inputs that include benchmark yields, swap curves, cash flow analysis, rating agency

data and interdealer broker rates. Exchange-traded derivative positions are reported in accordance with

changes in daily variation margin which is settled daily and therefore reflected in the payables and

receivables portion of the table.

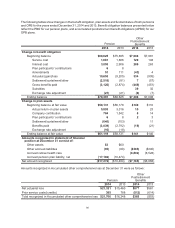

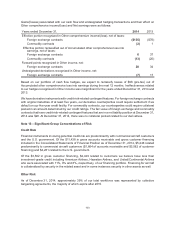

Cash equivalents and other short-term investments (which are used to pay benefits) are held in a separate

account which consists of a commingled fund (with daily liquidity) and separately held short-term securities

and cash equivalents. All of the investments in this cash vehicle are valued daily using a market approach

with inputs that include quoted market prices for similar instruments. In the event a market price is not

available for instruments with an original maturity of one year or less, amortized cost is used as a proxy

for fair value. Common and preferred stock equity securities are primarily valued using a market approach

based on the quoted market prices of identical instruments.

Private equity and private debt NAV valuations are based on the valuation of the underlying investments,

which include inputs such as cost, operating results, discounted future cash flows and market based

comparable data. For those investments reported on a one-quarter lagged basis (primarily LPs) we use

NAVs, adjusted for subsequent cash flows and significant events.

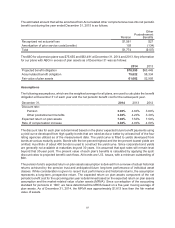

Real estate and real asset NAV valuations are based on valuation of the underlying investments, which

include inputs such as cost, discounted future cash flows, independent appraisals and market based

comparable data. For those investments reported on a one-quarter lagged basis (primarily LPs) NAVs are

adjusted for subsequent cash flows and significant events. Publicly traded REITs and infrastructure stocks

are valued using a market approach based on quoted market prices of identical instruments. Exchange-

traded commodities futures positions are reported in accordance with changes in daily variation margin

which is settled daily and therefore reflected in the payables and receivables portion of the table.

Global strategies investments are primarily limited liability company (LLC) or mutual fund structures. The

NAVs are based on valuation of the underlying investments, which are primarily valued using a market

approach. The funds generally have monthly liquidity.

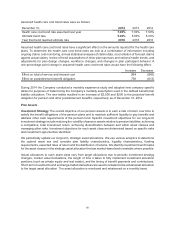

Hedge funds consist of fund-of-fund LLC structures and direct hedge funds. The NAVs of the fund-of-funds

are based on the NAVs of the underlying hedge funds as well as any cash and accruals held at the fund-

of-fund level. For direct hedge funds the NAVs are primarily based on valuation of the underlying

investments. This is primarily done by applying a market or income valuation methodology depending on

the specific type of security or instrument held. Redemptions in hedge funds are based on specific terms

and conditions of the individual funds.

Investments in private equity, private debt, real estate, real assets, global strategies, and hedge funds are

primarily calculated and reported by the General Partner (GP), fund manager or third party administrator.

Pension assets invested in these structures rely on the NAV of these investments as the practical expedient

for the valuations.