Boeing 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

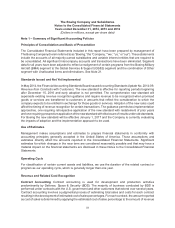

Goodwill and Indefinite-Lived Intangible Impairments

We test goodwill for impairment by performing a qualitative assessment or using a two-step impairment

process. If we choose to perform a qualitative assessment, we evaluate economic, industry and company-

specific factors as an initial step in assessing the fair value of operations. If we determine it is more likely

than not that the carrying value of the net assets is more than the fair value of the related operations, the

two-step impairment process is then performed; otherwise, no further testing is required. For operations

where the two-step impairment process is used, we first compare the book value of net assets to the fair

value of the related operations. If the fair value is determined to be less than book value, a second step

is performed to compute the amount of the impairment. In this process, a fair value for goodwill is estimated,

based in part on the fair value of the operations, and is compared to its carrying value. The shortfall of the

fair value below carrying value represents the amount of goodwill impairment.

We estimate the fair values of the related operations using discounted cash flows. Forecasts of future cash

flows are based on our best estimate of future sales and operating costs, based primarily on existing firm

orders, expected future orders, contracts with suppliers, labor agreements and general market conditions.

Changes in these forecasts could significantly change the amount of impairment recorded, if any.

The cash flow forecasts are adjusted by an appropriate discount rate derived from our market capitalization

plus a suitable control premium at the date of evaluation. Therefore, changes in the stock price may also

affect the amount of impairment recorded, if any.

We completed our assessment of goodwill as of April 1, 2014 and determined that there is no impairment

of goodwill. As of December 31, 2014, we estimated that the fair value of each reporting unit significantly

exceeded its corresponding carrying value. Changes in our forecasts, or decreases in the value of our

common stock could cause book values of certain operations to exceed their fair values which may result

in goodwill impairment charges in future periods.

As of December 31, 2014 and 2013, we had $490 million and $497 million of indefinite-lived intangible

assets related to the Jeppesen and Aviall brand and trade names acquired in business combinations. We

test these intangibles for impairment by comparing their carrying value to current projections of discounted

cash flows attributable to the brand and trade names. Any excess carrying value over the amount of

discounted cash flows represents the amount of the impairment. A 10% decrease in the discounted cash

flows would not impact the carrying value of these indefinite-lived intangible assets.

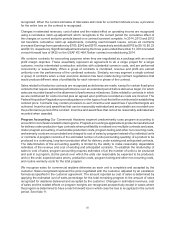

Pension Plans

The majority of our employees are earning benefits under defined benefit pension plans through 2016. In

2014, we announced changes to our retirement plans whereby nonunion and the majority of union

employees currently participating in defined benefit pension plans will transition in 2016 to a company-

funded defined contribution retirement savings plan. Accounting rules require an annual measurement of

our projected obligation and plan assets. These measurements are based upon several assumptions,

including the discount rate and the expected long-term rate of asset return. Future changes in assumptions

or differences between actual and expected outcomes can significantly affect our future annual expense,

projected benefit obligation and Shareholders’ equity.