Boeing 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

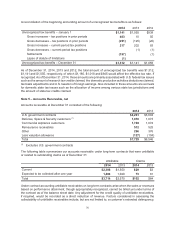

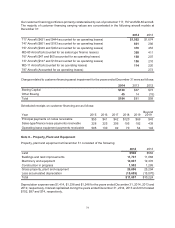

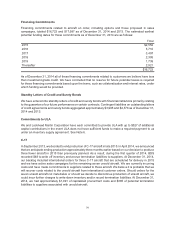

reach-forward losses, and $476 and $563 of unamortized tooling costs. At December 31, 2014, $1,047 of

747 deferred production and unamortized tooling costs are expected to be recovered from units included

in the program accounting quantity that have firm orders and $1,170 is expected to be recovered from

units included in the program accounting quantity that represent expected future orders.

Commercial aircraft programs inventory included amounts credited in cash or other consideration (early

issue sales consideration) to airline customers totaling $3,341 and $3,465 at December 31, 2014 and

2013.

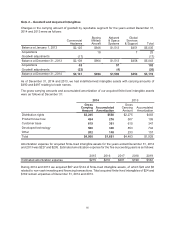

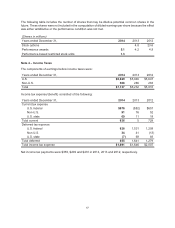

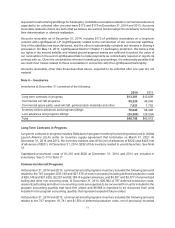

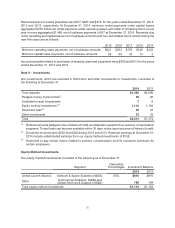

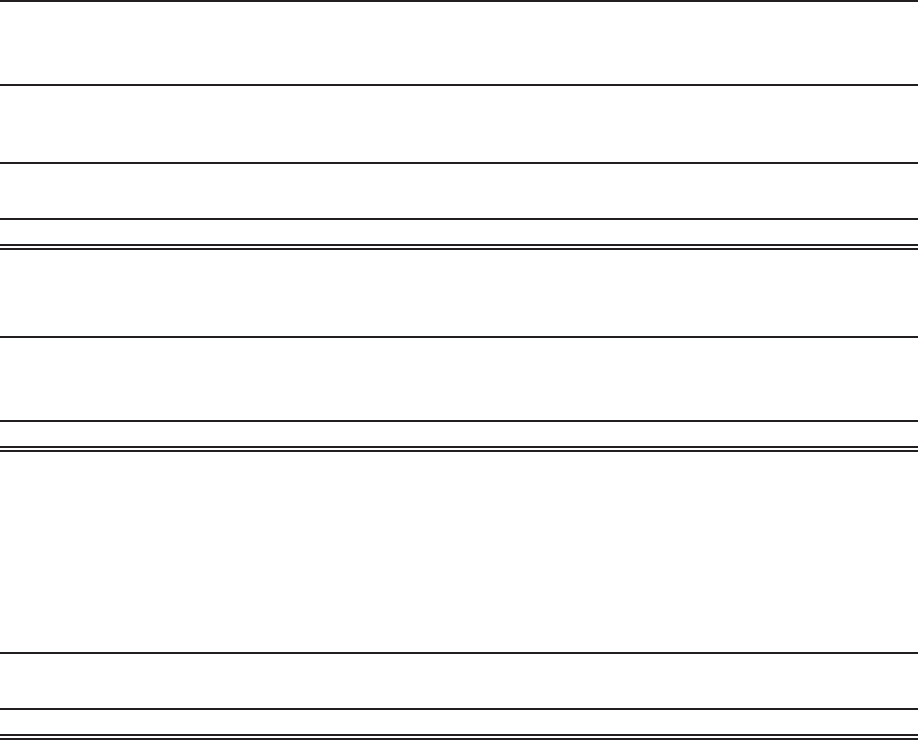

Note 7 – Customer Financing

Customer financing primarily relates to the Boeing Capital (BCC) segment and consisted of the following

at December 31:

2014 2013

Financing receivables:

Investment in sales-type/finance leases $1,535 $1,699

Notes 370 587

Total financing receivables 1,905 2,286

Operating lease equipment, at cost, less accumulated depreciation of $571 and

$564 1,677 1,734

Gross customer financing 3,582 4,020

Less allowance for losses on receivables (21) (49)

Total $3,561 $3,971

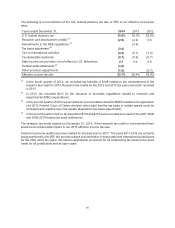

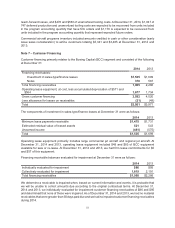

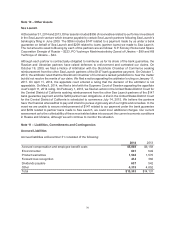

The components of investment in sales-type/finance leases at December 31 were as follows:

2014 2013

Minimum lease payments receivable $1,475 $1,731

Estimated residual value of leased assets 521 543

Unearned income (461) (575)

Total $1,535 $1,699

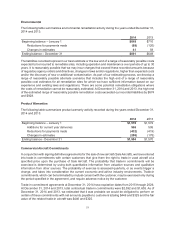

Operating lease equipment primarily includes large commercial jet aircraft and regional jet aircraft. At

December 31, 2014 and 2013, operating lease equipment included $48 and $83 of BCC equipment

available for sale or re-lease. At December 31, 2014 and 2013, we had firm lease commitments for $0

and $57 of this equipment.

Financing receivable balances evaluated for impairment at December 31 were as follows:

2014 2013

Individually evaluated for impairment $86 $95

Collectively evaluated for impairment 1,819 2,191

Total financing receivables $1,905 $2,286

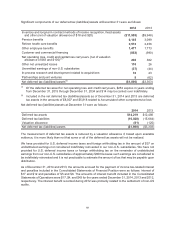

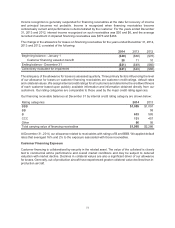

We determine a receivable is impaired when, based on current information and events, it is probable that

we will be unable to collect amounts due according to the original contractual terms. At December 31,

2014 and 2013, we individually evaluated for impairment customer financing receivables of $86 and $95

and determined that none of these were impaired. As of December 31, 2014 and 2013, we had no material

receivables that were greater than 30 days past due and we had no impaired customer financing receivables

during 2014.