Boeing 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

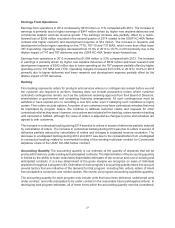

Air cargo traffic grew at close to long-term average rates in 2014, with continued improvement projected

in 2015. In addition, capacity metrics such as load factors and freighter aircraft utilization are showing

signs of improvement. The relative weakness of the air cargo market in recent years has impacted near-

term demand for new freighter aircraft and freighter conversions. We continue to closely monitor the impact

of this trend on our business.

Airline financial performance also plays a role in the demand for new capacity. Airlines continue to focus

on increasing revenue through alliances, partnerships, new marketing initiatives, and effective leveraging

of ancillary services and related revenues. Airlines are also relentlessly focusing on reducing costs by

renewing fleets to leverage more efficient airplanes. Net profits for the global airline industry are estimated

to total $20 billion in 2014 compared to $11 billion in 2013. Together with strong demand growth, we expect

lower oil prices will improve airline profitability in 2015.

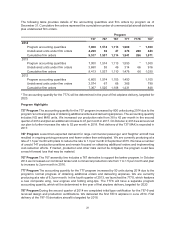

The long-term outlook for the industry remains positive due to the fundamental drivers of air travel growth:

economic growth and the increasing propensity to travel due to increased trade, globalization, and improved

airline services driven by liberalization of air traffic rights between countries. Our 20-year forecast is for a

long-term average growth rate of 5% per year for passenger and cargo traffic, based on a projected average

annual worldwide real economic growth rate of 3%. Based on long-term global economic growth projections,

and factoring in increased utilization of the worldwide airplane fleet and requirements to replace older

airplanes, we project a $5.2 trillion market for approximately 37,000 new airplanes over the next 20 years.

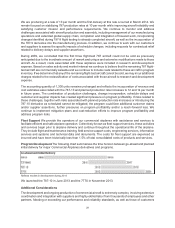

The industry remains vulnerable to near-term exogenous developments including fuel price spikes, credit

market shocks, terrorism, natural disasters, conflicts, epidemics and increased global environmental

regulations.

Industry Competitiveness The commercial jet airplane market and the airline industry remain extremely

competitive. Market liberalization in Europe and Asia is enabling low-cost airlines to continue gaining

market share. These airlines are increasing the pressure on airfares. This results in continued cost

pressures for all airlines and price pressure on our products. Major productivity gains are essential to

ensure a favorable market position at acceptable profit margins.

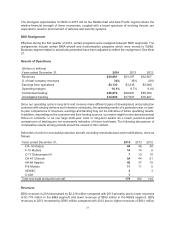

Continued access to global markets remains vital to our ability to fully realize our sales potential and long-

term investment returns. Approximately 11% of Commercial Airplanes’ contractual backlog, in dollar terms,

is with U.S. airlines, including cargo carriers.

We face aggressive international competitors who are intent on increasing their market share. They offer

competitive products and have access to most of the same customers and suppliers. With government

support, Airbus has historically invested heavily to create a family of products to compete with ours. Regional

jet makers Embraer and Bombardier, coming from the less than 100-seat commercial jet market, continue

to develop larger and more capable airplanes. Additionally, other competitors from Russia, China and

Japan are developing commercial jet aircraft in the market above 90 seats. Many of these competitors

have historically enjoyed access to government-provided financial support, including “launch aid,” which

greatly reduces the commercial risks associated with airplane development activities and

enables airplanes to be brought to market more quickly than otherwise possible. This market environment

has resulted in intense pressures on pricing and other competitive factors, and we expect these pressures

to continue or intensify in the coming years.

Worldwide, airplane sales are generally conducted in U.S. dollars. Fluctuating exchange rates affect the

profit potential of our major competitors, all of whom have significant costs in other currencies. Changes

in value of the U.S. dollar relative to their local currencies impact competitors’ revenues and profits.

Competitors routinely respond to a relatively weaker U.S. dollar by aggressively reducing costs and

increasing productivity, thereby improving their longer-term competitive posture. Competitors can use the

improved efficiency to fund product development, gain market share through pricing and/or improve

earnings.