Boeing 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

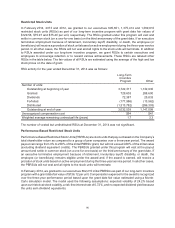

Restricted Stock Units

In February 2014, 2013 and 2012, we granted to our executives 695,651, 1,375,414 and 1,369,810

restricted stock units (RSUs) as part of our long-term incentive program with grant date fair values of

$129.58, $75.97 and $75.40 per unit, respectively. The RSUs granted under this program will vest and

settle in common stock (on a one-for-one basis) on the third anniversary of the grant date. If an executive

terminates employment because of retirement, involuntary layoff, disability, or death, the employee (or

beneficiary) will receive a proration of stock units based on active employment during the three-year service

period. In all other cases, the RSUs will not vest and all rights to the stock units will terminate. In addition

to RSUs awarded under our long-term incentive program, we grant RSUs to certain executives and

employees to encourage retention or to reward various achievements. These RSUs are labeled other

RSUs in the table below. The fair values of all RSUs are estimated using the average of the high and low

stock prices on the date of grant.

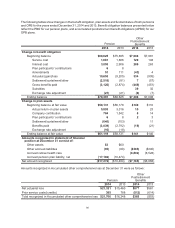

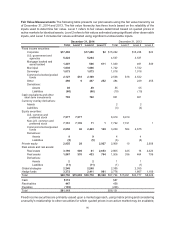

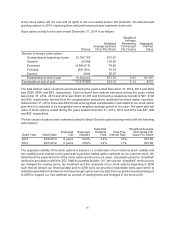

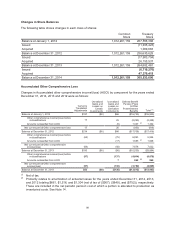

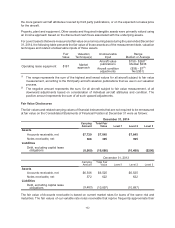

RSU activity for the year ended December 31, 2014 was as follows:

Long-Term

Incentive

Program Other

Number of units:

Outstanding at beginning of year 3,722,317 1,132,930

Granted 729,603 288,600

Dividends 72,387 25,833

Forfeited (177,986) (13,962)

Distributed (1,313,782) (286,303)

Outstanding at end of year 3,032,539 1,147,098

Unrecognized compensation cost $94 $41

Weighted average remaining contractual life (years) 1.7 2.3

The number of vested but undistributed RSUs at December 31, 2014 was not significant.

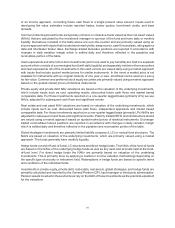

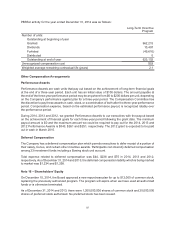

Performance-Based Restricted Stock Units

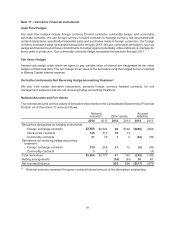

Performance-Based Restricted Stock Units (PBRSUs) are stock units that pay out based on the Company’s

total shareholder return as compared to a group of peer companies over a three-year period. The award

payout can range from 0% to 200% of the initial PBRSU grant, but will not exceed 400% of the initial value

(excluding dividend equivalent credits). The PBRSUs granted under this program will vest at the payout

amount and settle in common stock (on a one-for-one basis) on the third anniversary of the grant date. If

an executive terminates employment because of retirement, involuntary layoff, disability, or death, the

employee (or beneficiary) remains eligible under the award and, if the award is earned, will receive a

proration of stock units based on active employment during the three-year service period. In all other cases,

the PBRSUs will not vest and all rights to the stock units will terminate.

In February 2014, we granted to our executives 662,215 initial PBRSUs as part of our long-term incentive

program with a grant date fair value of $136.12 per unit. Compensation expense for the award is recognized

over the three-year performance period based upon the grant date fair value estimated using a Monte-

Carlo simulation model. The model used the following assumptions: expected volatility of 24.2% based

upon our historical stock volatility, a risk-free interest rate of 0.72%, and no expected dividend yield because

the units earn dividend equivalents.