Boeing 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

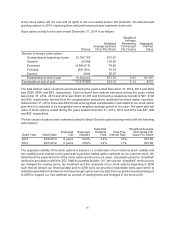

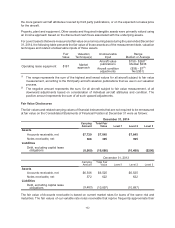

the more generic aircraft attributes covered by third party publications, or on the expected net sales price

for the aircraft.

Property, plant and equipment, Other assets and Acquired intangible assets were primarily valued using

an income approach based on the discounted cash flows associated with the underlying assets.

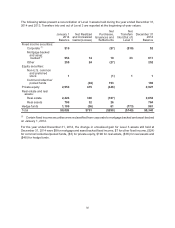

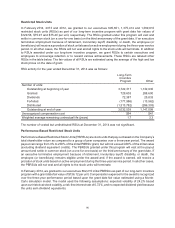

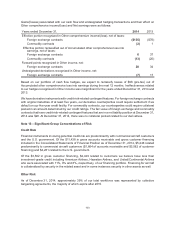

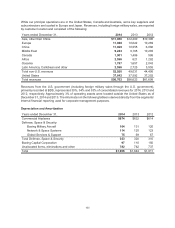

For Level 3 assets that were measured at fair value on a nonrecurring basis during the year ended December

31, 2014, the following table presents the fair value of those assets as of the measurement date, valuation

techniques and related unobservable inputs of those assets.

Fair

Value

Valuation

Technique(s)

Unobservable

Input

Range

Median or Average

Operating lease equipment $187 Market

approach

Aircraft value

publications

$158 - $268(1)

Median $238

Aircraft condition

adjustments

($58) - $7(2)

Net ($51)

(1) The range represents the sum of the highest and lowest values for all aircraft subject to fair value

measurement, according to the third party aircraft valuation publications that we use in our valuation

process.

(2) The negative amount represents the sum, for all aircraft subject to fair value measurement, of all

downward adjustments based on consideration of individual aircraft attributes and condition. The

positive amount represents the sum of all such upward adjustments.

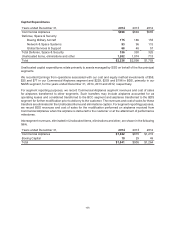

Fair Value Disclosures

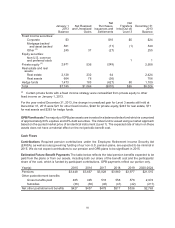

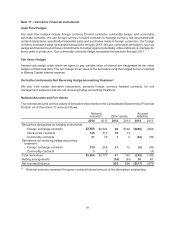

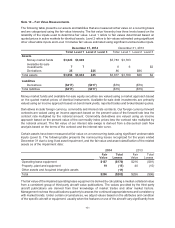

The fair values and related carrying values of financial instruments that are not required to be remeasured

at fair value on the Consolidated Statements of Financial Position at December 31 were as follows:

December 31, 2014

Carrying

Amount

Total Fair

Value Level 1 Level 2 Level 3

Assets

Accounts receivable, net $7,729 $7,845 $7,845

Notes receivable, net 366 395 395

Liabilities

Debt, excluding capital lease

obligations (8,909) (10,686) (10,480) ($206)

December 31, 2013

Carrying

Amount

Total Fair

Value Level 1 Level 2 Level 3

Assets

Accounts receivable, net $6,546 $6,525 $6,525

Notes receivable, net 572 622 622

Liabilities

Debt, excluding capital lease

obligations (9,483) (10,897) (10,897)

The fair value of Accounts receivable is based on current market rates for loans of the same risk and

maturities. The fair values of our variable rate notes receivable that reprice frequently approximate their