Boeing 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

BCC enters into certain transactions with Boeing, reflected in Unallocated items, eliminations and other,

in the form of intercompany guarantees and other subsidies that mitigate the effects of certain credit quality

or asset impairment issues on the BCC segment.

On October 31, 2014, Boeing issued $850 million of fixed and floating rate notes and entered into a

concurrent intercompany loan on the same terms with BCC for $550 million, comprised of $300 million of

fixed rate notes and $250 million of floating rate notes. Interest expense associated with these intercompany

notes is included in Boeing Capital interest expense. See Note 13.

Restructurings and Restructuring Requests

From time to time, certain customers have requested a restructuring of their transactions with BCC. During

2014, BCC did not reach agreement on any restructuring requests that would have a material effect on

our earnings, cash flows and/or financial position.

Liquidity and Capital Resources

Cash Flow Summary

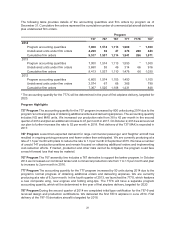

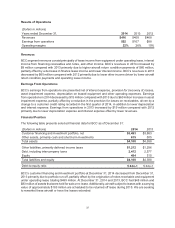

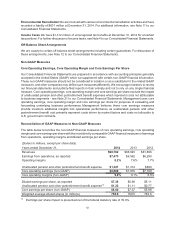

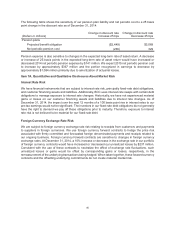

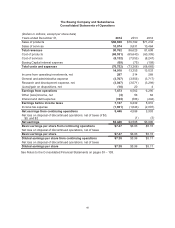

(Dollars in millions)

Years ended December 31, 2014 2013 2012

Net earnings $5,446 $4,585 $3,900

Non-cash items 2,515 2,516 2,728

Changes in working capital 897 1,078 880

Net cash provided by operating activities 8,858 8,179 7,508

Net cash provided/(used) by investing activities 2,467 (5,154) (3,757)

Net cash used by financing activities (8,593) (4,249) (3,477)

Effect of exchange rate changes on cash and cash equivalents (87) (29) 18

Net increase/(decrease) in cash and cash equivalents 2,645 (1,253) 292

Cash and cash equivalents at beginning of year 9,088 10,341 10,049

Cash and cash equivalents at end of period $11,733 $9,088 $10,341

Operating Activities Net cash provided by operating activities was $8.9 billion during 2014, compared

with $8.2 billion during 2013 and $7.5 billion in 2012. The increase of $0.7 billion in 2014 was primarily

due to higher customer advances which more than offset higher gross inventory. The increase of $0.7

billion in 2013 was primarily due to increased customer receipts reflecting higher delivery and order volumes

in 2013. Our investment in gross inventories increased by $7.6 billion in 2014, $5.7 billion in 2013 and

$6.2 billion in 2012, driven by continued investment in commercial airplane program inventory, primarily

787 inventory. Advances and progress billings increased by $6.9 billion in 2014, $3.9 billion in 2013 and

$1.9 billion in 2012, primarily due to payments from commercial airplane customers. Discretionary

contributions to our pension plans totaled $0.8 billion in 2014 compared with $1.5 billion in 2013 and $1.6

billion in 2012.

Investing Activities Cash provided by investing activities was $2.5 billion during 2014 compared with

$5.2 billion used during 2013 and $3.8 billion used during 2012, largely due to changes in investments in

time deposits. Net proceeds from investments were $4.8 billion in 2014 compared with net contributions

to investments of $2.9 billion in 2013 and $2 billion in 2012. In 2014, capital expenditures totaled $2.2

billion, up from $2.1 billion in 2013 and $1.7 billion in 2012. We expect capital expenditures to be higher

in 2015 than 2014 due to continued investment to support growth.