Boeing 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

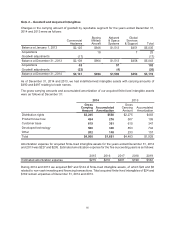

recognized. When the current estimates of total sales and costs for a contract indicate a loss, a provision

for the entire loss on the contract is recognized.

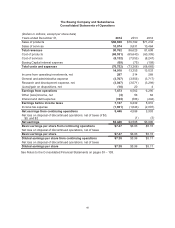

Changes in estimated revenues, cost of sales and the related effect on operating income are recognized

using a cumulative catch-up adjustment which recognizes in the current period the cumulative effect of

the changes on current and prior periods based on a contract’s percent complete. In 2014, 2013 and 2012

net favorable cumulative catch-up adjustments, including reach-forward losses, across all contracts

increased Earnings from operations by $100, $242 and $379, respectively and diluted EPS by $0.10, $0.23

and $0.33, respectively. Significant adjustments during the three years ended December 31, 2014 included

a reach-forward loss of $425 on the USAF KC-46A Tanker contract recorded during 2014.

We combine contracts for accounting purposes when they are negotiated as a package with an overall

profit margin objective. These essentially represent an agreement to do a single project for a single

customer, involve interrelated construction activities with substantial common costs, and are performed

concurrently or sequentially. When a group of contracts is combined, revenue and profit are earned

uniformly over the performance of the combined contracts. Similarly, we may segment a single contract

or group of contracts when a clear economic decision has been made during contract negotiations that

would produce different rates of profitability for each element or phase of the contract.

Sales related to fixed-price contracts are recognized as deliveries are made, except for certain fixed-price

contracts that require substantial performance over an extended period before deliveries begin, for which

sales are recorded based on the attainment of performance milestones. Sales related to contracts in which

we are reimbursed for costs incurred plus an agreed upon profit are recorded as costs are incurred. The

Federal Acquisition Regulations provide guidance on the types of cost that will be reimbursed in establishing

contract price. Contracts may contain provisions to earn incentive and award fees if specified targets are

achieved. Incentive and award fees that can be reasonably estimated and are probable are recorded over

the performance period of the contract. Incentive and award fees that cannot be reasonably estimated are

recorded when awarded.

Program Accounting Our Commercial Airplanes segment predominantly uses program accounting to

account for cost of sales related to its programs. Program accounting is applicable to products manufactured

for delivery under production-type contracts where profitability is realized over multiple contracts and years.

Under program accounting, inventoriable production costs, program tooling and other non-recurring costs,

and warranty costs are accumulated and charged to cost of sales by program instead of by individual units

or contracts. A program consists of the estimated number of units (accounting quantity) of a product to be

produced in a continuing, long-term production effort for delivery under existing and anticipated contracts.

The determination of the accounting quantity is limited by the ability to make reasonably dependable

estimates of the revenue and cost of existing and anticipated contracts. To establish the relationship of

sales to cost of sales, program accounting requires estimates of (a) the number of units to be produced

and sold in a program, (b) the period over which the units can reasonably be expected to be produced,

and (c) the units’ expected sales prices, production costs, program tooling and other non-recurring costs,

and routine warranty costs for the total program.

We recognize sales for commercial airplane deliveries as each unit is completed and accepted by the

customer. Sales recognized represent the price negotiated with the customer, adjusted by an escalation

formula as specified in the customer agreement. The amount reported as cost of sales is determined by

applying the estimated cost of sales percentage for the total remaining program to the amount of sales

recognized for airplanes delivered and accepted by the customer. Changes in estimated revenues, cost

of sales and the related effects on program margins are recognized prospectively except in cases where

the program is determined to have a reach-forward loss in which case the loss is recognized in the current

period. See Note 11.