Boeing 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

92

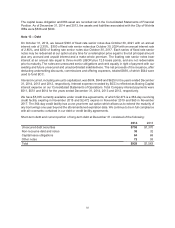

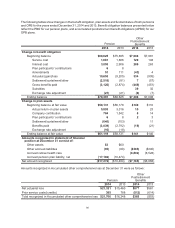

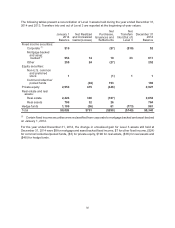

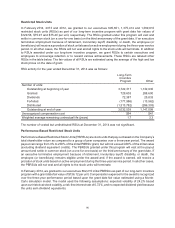

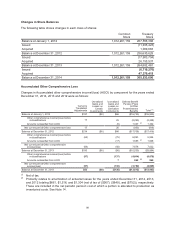

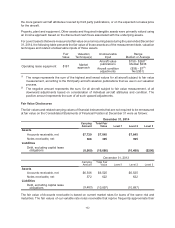

The following tables present a reconciliation of Level 3 assets held during the year ended December 31,

2014 and 2013. Transfers into and out of Level 3 are reported at the beginning-of-year values.

January 1

2014

Balance

Net Realized

and Unrealized

Gains/(Losses)

Net

Purchases,

Issuances and

Settlements

Net

Transfers

Into/(Out of)

Level 3

December 31

2014

Balance

Fixed income securities:

Corporate (1) $19 ($7) ($10) $2

Mortgage backed

and asset

backed(1) 554 14 10 33 611

Other 255 24 (27) 252

Equity securities:

Non-U.S. common

and preferred

stock 1(1) 1 1

Common/collective/

pooled funds (24) 193 169

Private equity 2,958 415 (446) 2,927

Real estate and real

assets:

Real estate 2,424 336 (107) 2,653

Real assets 706 32 26 764

Hedge funds 1,109 (36) 61 (173) 961

Total $8,026 $761 ($298) ($149) $8,340

(1) Certain fixed income securities were reclassified from corporate to mortgage backed and asset backed

on January 1, 2014.

For the year ended December 31, 2014, the change in unrealized gain for Level 3 assets still held at

December 31, 2014 were $8 for mortgage and asset backed fixed income, $7 for other fixed income, ($24)

for common/collective/pooled funds, ($3) for private equity, $198 for real estate, ($38) for real assets and

($48) for hedge funds.