Boeing 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

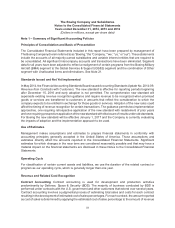

Aircraft Valuation

Used aircraft under trade-in commitments and aircraft under repurchase commitments In

conjunction with signing a definitive agreement for the sale of new aircraft (Sale Aircraft), we have entered

into trade-in commitments with certain customers that give them the right to trade in used aircraft at a

specified price upon the purchase of Sale Aircraft. Additionally, we have entered into contingent repurchase

commitments with certain customers wherein we agree to repurchase the Sale Aircraft at a specified price,

generally 10 to 15 years after delivery of the Sale Aircraft. Our repurchase of the Sale Aircraft is contingent

upon a future, mutually acceptable agreement for the sale of additional new aircraft. If we execute an

agreement for the sale of additional new aircraft, and if the customer exercises its right to sell the Sale

Aircraft to us, a contingent repurchase commitment would become a trade-in commitment. Our historical

experience is that contingent repurchase commitments infrequently become trade-in commitments.

Exposure related to trade-in commitments may take the form of:

(1) adjustments to revenue for the difference between the contractual trade-in price in the definitive

agreement and our best estimate of the fair value of the trade-in aircraft as of the date of such

agreement, which would be recognized upon delivery of the Sale Aircraft, and/or

(2) charges to cost of products for adverse changes in the fair value of trade-in aircraft that occur

subsequent to signing of a definitive agreement for Sale Aircraft but prior to the purchase of the

used trade-in aircraft. Estimates based on current aircraft values would be included in Accrued

liabilities.

The fair value of trade-in aircraft is determined using aircraft-specific data such as model, age and condition,

market conditions for specific aircraft and similar models, and multiple valuation sources. This process

uses our assessment of the market for each trade-in aircraft, which in most instances begins years before

the return of the aircraft. There are several possible markets in which we continually pursue opportunities

to place used aircraft. These markets include, but are not limited to, the resale market, which could

potentially include the cost of long-term storage; the leasing market, with the potential for refurbishment

costs to meet the leasing customer’s requirements; or the scrap market. Trade-in aircraft valuation varies

significantly depending on which market we determine is most likely for each aircraft. On a quarterly basis,

we update our valuation analysis based on the actual activities associated with placing each aircraft into

a market. This quarterly valuation process yields results that are typically lower than residual value

estimates by independent sources and tends to more accurately reflect results upon the actual placement

of the aircraft.

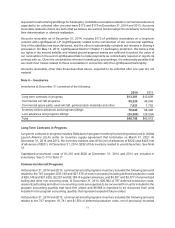

Used aircraft acquired by the Commercial Airplanes segment are included in Inventories at the lower of

cost or market as it is our intent to sell these assets. To mitigate costs and enhance marketability, aircraft

may be placed on operating lease. While on operating lease, the assets are included in Customer financing.

Customer financing Customer financing includes operating lease equipment, notes receivable, and sales-

type/finance leases. Sales-type/finance leases are treated as receivables, and allowances for losses are

established as necessary.

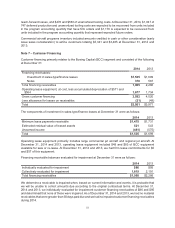

We assess the fair value of the assets we own, including equipment under operating leases, assets held

for sale or re-lease, and collateral underlying receivables, to determine if their fair values are less than the

related assets’ carrying values. Differences between carrying values and fair values of sales-type/finance

leases and notes and other receivables, as determined by collateral value, are considered in determining

the allowance for losses on receivables.

We use a median calculated from published collateral values from multiple third-party aircraft value

publications based on the type and age of the aircraft to determine the fair value of aircraft. Under certain

circumstances, we apply judgment based on the attributes of the specific aircraft or equipment, usually