Boeing 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.103

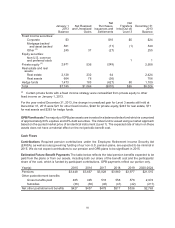

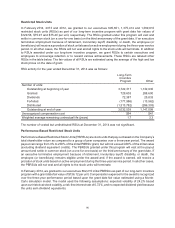

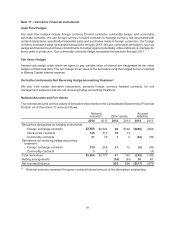

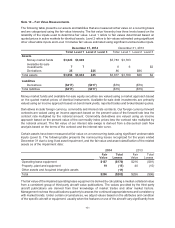

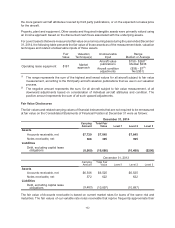

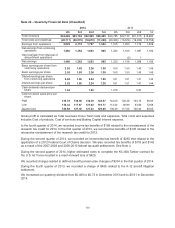

carrying amounts. The fair values of fixed rate notes receivable are estimated with discounted cash flow

analysis using interest rates currently offered on loans with similar terms to borrowers of similar credit

quality. The fair value of our debt that is traded in the secondary market is classified as Level 2 and is

based on current market yields. For our debt that is not traded in the secondary market, the fair value is

classified as Level 2 and is based on our indicative borrowing cost derived from dealer quotes or discounted

cash flows. The fair values of our debt classified as Level 3 are based on discounted cash flow models

using the implied yield from similar securities. With regard to other financial instruments with off-balance

sheet risk, it is not practicable to estimate the fair value of our indemnifications and financing commitments

because the amount and timing of those arrangements are uncertain. Items not included in the above

disclosures include cash, restricted cash, time deposits and other deposits, commercial paper, money

market funds, Accounts payable and long-term payables. The carrying values of those items, as reflected

in the Consolidated Statements of Financial Position, approximate their fair value at December 31, 2014

and 2013. The fair value of assets and liabilities whose carrying value approximates fair value is determined

using Level 2 inputs, with the exception of cash (Level 1).

Note 20 – Legal Proceedings

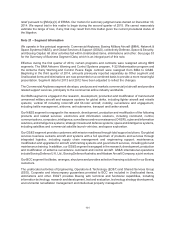

Various legal proceedings, claims and investigations related to products, contracts, employment and other

matters are pending against us. Potentially material contingencies are discussed below.

We are subject to various U.S. government investigations, from which civil, criminal or administrative

proceedings could result or have resulted in the past. Such proceedings involve or could involve claims

by the government for fines, penalties, compensatory and treble damages, restitution and/or forfeitures.

Under government regulations, a company, or one or more of its operating divisions or subdivisions, can

also be suspended or debarred from government contracts, or lose its export privileges, based on the

results of investigations. We believe, based upon current information, that the outcome of any such

government disputes and investigations will not have a material effect on our financial position, results of

operations, or cash flows, except as set forth below. Where it is reasonably possible that we will incur

losses in excess of recorded amounts in connection with any of the matters set forth below, we will disclose

either the amount or range of reasonably possible losses in excess of such amounts or, where no such

amount or range can be reasonably estimated, the reasons why no such estimate can be made.

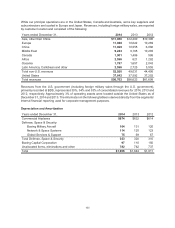

Employment, Labor and Benefits Litigation

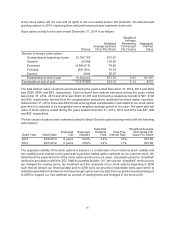

In connection with the 2005 sale of the former Wichita facility to Spirit AeroSystems, Inc. (Spirit), on February

16, 2007, an action entitled Harkness et al. v. The Boeing Company et al. was filed in the U.S. District

Court for the District of Kansas, alleging collective bargaining agreement breaches and ERISA violations

in connection with alleged failures to provide benefits to certain former employees of the Wichita facility.

During the second quarter of 2014, the plaintiffs and Boeing agreed to settle the matter, subject to a fairness

hearing, which has not been scheduled. The settlement would apply to approximately 2,000 employees

who were subsequently employed by Spirit. Spirit is obligated to indemnify Boeing for settlement of this

matter, and we intend to pursue full indemnification from Spirit. During the fourth quarter of 2014, Boeing

filed a complaint against Spirit in Delaware Superior Court seeking to enforce our rights to indemnification

and to recover from Spirit amounts incurred by Boeing for pension and retiree medical obligations. We

cannot reasonably estimate the range of loss, if any, that may result from this matter pending the outcome

of the fairness hearing.

On October 13, 2006, we were named as a defendant in a lawsuit filed in the U.S. District Court for the

Southern District of Illinois. Plaintiffs, seeking to represent a class of similarly situated participants and

beneficiaries in The Boeing Company Voluntary Investment Plan (the VIP), alleged that fees and expenses

incurred by the VIP were and are unreasonable and excessive, not incurred solely for the benefit of the

VIP and its participants, and were undisclosed to participants. The plaintiffs further alleged that defendants

breached their fiduciary duties in violation of §502(a)(2) of ERISA, and sought injunctive and equitable