Boeing 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Boeing annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Boeing Company

2014 Annual Report

Leading Ahead

Table of contents

-

Page 1

Leading Ahead The Boeing Company 2014 Annual Report -

Page 2

... space and security systems. The top U.S. exporter, Boeing supports airlines and U.S. and allied government customers in more than 150 countries. Our products and tailored services include commercial and military aircraft, satellites, weapons, electronic and defense systems, launch systems, advanced... -

Page 3

...and North Charleston, South Carolina- setting new records for deliveries. Delivered 179 military aircraft, along with 10,998 weapons systems and five satellites, despite extremely challenging defense, space and security markets. Booked a record 1,432 net new commercial airplane orders, expanding our... -

Page 4

... business, we do so with renewed confidence in our capabilities, winning strategies for our markets and time-tested resolve to continue leading our industry through innovation inspired by our customers' needs, and fueled by the talents, technologies and teamwork of our employees and global partners... -

Page 5

... to return increased value to shareholders as we invest and grow. Boeing Commercial Airplanes had revenues of $60 billion on an industry record 723 deliveries, which expanded our global market share lead for the third consecutive year. Net new orders of 1,432 airplanes- nearly twice our 2014 output... -

Page 6

.... Wide-body Sm. Wide-body Single-Aisle Services Increased production rates, superior new airplanes and continued innovation will keep Boeing competitive across addressable markets, valued at $3.5 trillion over the next 10 years. Services Products In global markets for defense, space and security... -

Page 7

...military aircraft and satellites in 2014 than in 2010. 121 184 52% Fueled by innovation, Boeing's product development pipeline is robust. In Commercial Airplanes: Start of ï¬nal assembly of the new, fuel-efï¬cient 737 MAX (shown here) is planned for 2015, with ï¬rst delivery in 2017. The 787-10... -

Page 8

... our manufacturing and engineering footprint by expanding our airline customer support center in Southern California, insourcing from suppliers to Boeing South Carolina propulsion system design and production work for the 737 MAX, and placing more defense support work in Oklahoma City and St. Louis... -

Page 9

...services growing above 30 percent of revenue and international business around that same level. Our 2015 Defense, Space & Security priorities are to extend and grow our core business by bringing enhanced capability and affordability to our customers; boost the performance of our development programs... -

Page 10

..., Boeing Defense, Space & Security Raymond L. Conner Vice Chairman President and Chief Executive Officer, Boeing Commercial Airplanes Gregory D. Smith Chief Financial Officer Executive Vice President, Business Development and Strategy Dennis A. Muilenburg Vice Chairman President and Chief Operating... -

Page 11

... filer Smaller reporting company No Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes As of June 30, 2014, there were 721,356,642 common shares outstanding held by nonaffiliates of the registrant, and the aggregate market value of... -

Page 12

...Item 8. Financial Statements and Supplementary Data ...Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure ...Item 9A. Controls and Procedures ...Item 9B. Other Information ...PART III Item 10. Directors, Executive Officers and Corporate Governance...Item 11... -

Page 13

...• • Commercial Airplanes; Our Defense, Space & Security (BDS) business comprises three segments Boeing Military Aircraft (BMA), Network & Space Systems (N&SS) and Global Services & Support (GS&S); and Boeing Capital (BCC). The unallocated activities of Engineering, Operations & Technology (EO... -

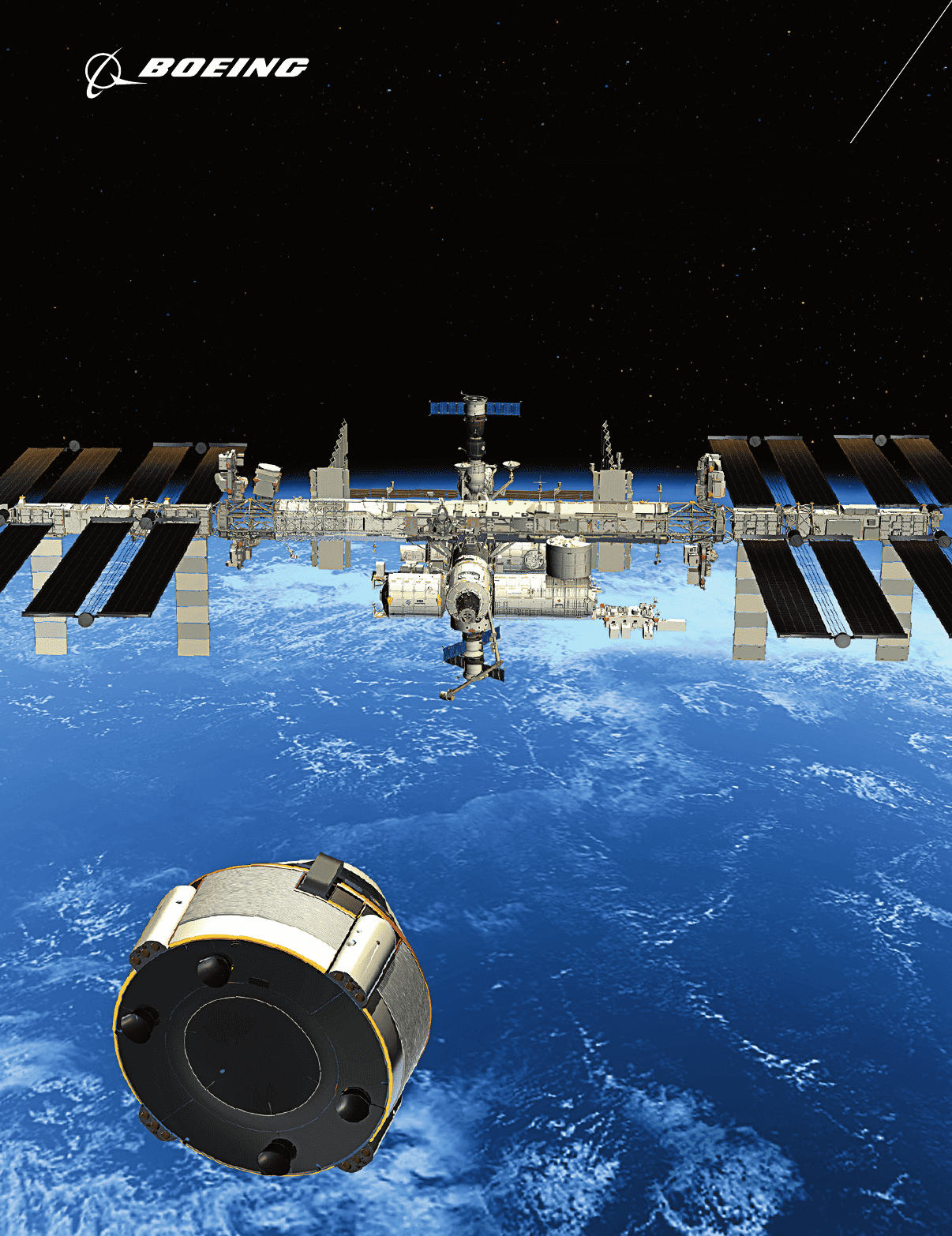

Page 14

... Commercial Crew and International Space Station. This segment also includes our joint venture operations related to United Launch Alliance. Global Services & Support Segment This segment provides customers with mission readiness through total support solutions. Our global services business sustains... -

Page 15

... and related test activities for defense systems, new and derivative jet aircraft including both commercial and military, advanced space and other company-sponsored product development. These are expensed as incurred including amounts allocable as reimbursable overhead costs on U.S. government... -

Page 16

... as BAE Systems and Airbus Group, continue to build a strategic presence in the U.S. market by strengthening their North American operations and partnering with U.S. defense companies. In addition, certain competitors have occasionally formed teams with other competitors to address specific customer... -

Page 17

... 11 to our Consolidated Financial Statements. International. Our international sales are subject to U.S. and non-U.S. governmental regulations and procurement policies and practices, including regulations relating to import-export control, investment, exchange controls and repatriation of earnings... -

Page 18

... Boeing. Forward-Looking Statements This report, as well as our Annual Report to Shareholders, quarterly reports, and other filings we make with the SEC, press releases and other written and oral communications, contains "forward-looking statements" within the meaning of the Private Securities... -

Page 19

... long-term traffic growth are sustained economic growth and political stability both in developed and emerging markets. Demand for our commercial aircraft is further influenced by airline profitability, availability of aircraft financing, world trade policies, government-to-government relations... -

Page 20

... to aircraft performance and/or increased warranty or fleet support costs. Further, if we cannot efficiently and cost-effectively incorporate design changes into already-completed 787 production aircraft, we may face further profitability pressures on this program. If our commercial airplanes fail... -

Page 21

... Management Agency, routinely audit government contractors. These agencies review our performance under contracts, cost structure and compliance with applicable laws, regulations, and standards, as well as the adequacy of and our compliance with our internal control systems and policies. Any costs... -

Page 22

... due to circumstances beyond the supplier's control, such as geo-political developments, or as a result of performance problems or financial difficulties, could have a material adverse effect on our ability to meet commitments to our customers or increase our operating costs. For example, we are... -

Page 23

... the total program. Several factors determine accounting quantity, including firm orders, letters of intent from prospective customers and market studies. Changes to customer or model mix, production costs and rates, learning curve, changes to price escalation indices, costs of derivative aircraft... -

Page 24

.... In 2014, non-U.S. customers accounted for approximately 58% of our revenues. We expect that non-U.S. sales will continue to account for a significant portion of our revenues for the foreseeable future. As a result, we are subject to risks of doing business internationally, including changes in... -

Page 25

... bear substantial costs. For example, liabilities arising from the use of certain of our products, such as aircraft technologies, missile systems, border security systems, anti-terrorism technologies, and/or air traffic management systems may not be insurable on commercially reasonable terms. While... -

Page 26

... use of our data, information systems or networks could impact our sales, increase our expenses and/or have an adverse effect on the reputation of Boeing and of our products and services. Some of our and our suppliers' workforces are represented by labor unions, which may lead to work stoppages... -

Page 27

... access to our or our customers' information and systems could negatively impact our business. We face certain security threats, including threats to the confidentiality, availability and integrity of our data and systems. We maintain an extensive network of technical security controls, policy... -

Page 28

... engineering, administration and other productive uses, of which approximately 96% was located in the United States. The following table provides a summary of the floor space by business as of December 31, 2014: (Square feet in thousands) Commercial Airplanes Defense, Space & Security Other(2) Total... -

Page 29

...table provides information about purchases of our common stock we made during the quarter ended December 31, 2014: (Dollars in millions, except per share data) (a) (b) (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (d) Approximate Dollar Value of Shares That May... -

Page 30

...investments Total debt Customer financing assets Shareholders' equity(3) Common shares outstanding (in millions)(4) Contractual Backlog: Commercial Airplanes Defense, Space & Security:(1) Boeing Military Aircraft Network & Space Systems Global Services & Support Total Defense, Space & Security Total... -

Page 31

... Consolidated Results of Operations and Financial Condition Overview We are a global market leader in design, development, manufacture, sale, service and support of commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems and services. We are one... -

Page 32

... to higher revenues in the Network & Space Systems (N&SS) and Global Services & Support (GS&S) segments, partially offset by lower revenues in the Boeing Military Aircraft (BMA) segment. The change in unallocated items, eliminations and other in 2014, 2013 and 2012 primarily reflects the timing of... -

Page 33

... and other postretirement benefits totaled $2,483 million, $3,769 million and $3,383 million in 2014, 2013 and 2012, respectively. The decrease in 2014 net periodic benefit cost related to pension is primarily due to lower amortization of actuarial losses due to higher discount rates which more than... -

Page 34

... tax benefits being recorded in the fourth quarter of 2013. For additional discussion related to Income Taxes, see Note 4 to our Consolidated Financial Statements. Total Costs and Expenses ("Cost of Sales") Cost of sales, for both products and services, consists primarily of raw materials... -

Page 35

... 787 program partially offset by increased spending on the 737 MAX and 777X. Backlog Our backlog at December 31 was as follows: (Dollars in millions) Contractual Backlog: Commercial Airplanes Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total... -

Page 36

...Should suppliers or customers experience disruption, our production and/or deliveries could be materially impacted. Segment Results of Operations and Financial Condition Commercial Airplanes Business Environment and Trends Airline Industry Environment Global economic activity and global trade, which... -

Page 37

... international competitors who are intent on increasing their market share. They offer competitive products and have access to most of the same customers and suppliers. With government support, Airbus has historically invested heavily to create a family of products to compete with ours. Regional jet... -

Page 38

... in millions) Years ended December 31, Revenues % of total company revenues Earnings from operations Operating margins Research and development Contractual backlog Unobligated backlog Revenues Commercial Airplanes revenues increased by $7,009 million or 13% in 2014 compared with 2013 and by $3,854... -

Page 39

... by higher new airplane deliveries and commercial aviation services revenue growth. This earnings increase was partially offset by a reachforward loss of $238 million recorded in the second quarter of 2014 related to the USAF KC-46A Tanker contract and higher research and development expense of $74... -

Page 40

... may be material. 767 Program The 767 assembly line includes a 767 derivative to support the tanker program. In October 2014 we increased our combined tanker and commercial production rate from 1 to 1.5 per month and plan to increase to 2 per month in 2016. 777 Program The accounting quantity for... -

Page 41

...address challenges associated with aircraft production and assembly, including management of our manufacturing operations and extended global supply chain, completion and integration of traveled work, incorporating changes identified during 787-8 flight testing to already completed aircraft, as well... -

Page 42

..., customer and model mix, production costs and rates, changes to price escalation factors due to changes in the inflation rate or other economic indicators, performance or reliability issues involving completed aircraft, capital expenditures and other costs associated with increasing or adding new... -

Page 43

...Operating margins Contractual backlog Unobligated backlog 2014 $30,881 34% $3,133 10.1% $46,974 $14,939 2013 $33,197 38% $3,235 9.7% $49,681 $17,607 2012 $32,607 40% $3,068 9.4% $55,068 $16,407 Since our operating cycle is long-term and involves many different types of development and production... -

Page 44

... Our BDS business includes a variety of development programs which have complex design and technical challenges. Many of these programs have cost-type contracting arrangements. In these cases, the associated financial risks are primarily in reduced fees, lower profit rates or program cancellation if... -

Page 45

... Years ended December 31, Revenues % of total company revenues Earnings from operations Operating margins Contractual backlog Unobligated backlog Revenues BMA revenues in 2014 decreased by $1,774 million, or 12%, compared with 2013 primarily due to a reduction of revenue of $1,730 million related to... -

Page 46

... lower volume on several government satellite, Electronic and Information Solutions (E&IS) and proprietary programs, partially offset by $257 million related to higher volume on the Commercial Crew and SLS programs. N&SS revenues in 2013 increased by $601 million compared with 2012 primarily due to... -

Page 47

... Consolidated Financial Statements. Global Services & Support Results of Operations (Dollars in millions) Years ended December 31, Revenues % of total company revenues Earnings from operations Operating margins Contractual backlog Unobligated backlog 2014 $9,367 10% $1,131 12.1% $16,896 $922 2013... -

Page 48

... in-production and out-of-production aircraft types. Of these parked aircraft, approximately 15% are not expected to return to service. At the end of 2013 and 2012, 9.2% and 10.0% of the western-built commercial jet aircraft were parked. Aircraft valuations could decline if significant numbers of... -

Page 49

... revenues. Financial Position The following table presents selected financial data for BCC as of December 31: (Dollars in millions) Customer financing and investment portfolio, net Other assets, primarily cash and short-term investments Total assets Other liabilities, primarily deferred income taxes... -

Page 50

... in commercial airplane program inventory, primarily 787 inventory. Advances and progress billings increased by $6.9 billion in 2014, $3.9 billion in 2013 and $1.9 billion in 2012, primarily due to payments from commercial airplane customers. Discretionary contributions to our pension plans totaled... -

Page 51

... strategic business opportunities should they arise within the next year. However, there can be no assurance of the cost or availability of future borrowings, if any, under our commercial paper program, in the debt markets or our credit facilities. At December 31, 2014 and 2013, our pension plans... -

Page 52

... is supported by firm contracts and/or has historically resulted in settlement through reimbursement from customers for penalty payments to the supplier should the customer not take delivery. These amounts are also included in our forecasts of costs for program and contract accounting. Some... -

Page 53

... timing of future cash flows related to uncertain tax positions. Our income tax matters are excluded from the table above. See Note 4 to our Consolidated Financial Statements. Commercial Commitments The following table summarizes our commercial commitments outstanding as of December 31, 2014. Total... -

Page 54

... pension and other postretirement benefit expenses which represent costs not attributable to business segments - see Note 21 to our Consolidated Financial Statements. Management uses core operating earnings, core operating margin and core earnings per share for purposes of evaluating and forecasting... -

Page 55

... Policies Contract Accounting Contract accounting is used to determine revenue, cost of sales, and profit predominantly by our BDS business. Contract accounting involves a judgmental process of estimating the total sales and costs for each contract, which results in the development of estimated cost... -

Page 56

... amount of sales recognized for airplanes delivered and accepted by the customer. Factors that must be estimated include program accounting quantity, sales price, labor and employee benefit costs, material costs, procured part costs, major component costs, overhead costs, program tooling and other... -

Page 57

... in 2016 to a companyfunded defined contribution retirement savings plan. Accounting rules require an annual measurement of our projected obligation and plan assets. These measurements are based upon several assumptions, including the discount rate and the expected long-term rate of asset return... -

Page 58

...) Pension plans Projected benefit obligation Net periodic pension cost Pension expense is also sensitive to changes in the expected long-term rate of asset return. A decrease or increase of 25 basis points in the expected long-term rate of asset return would have increased or decreased 2014 net... -

Page 59

... Statements of Equity ...Summary of Business Segment Data ...Note 1 - Summary of Significant Accounting Policies ...Note 2 - Goodwill and Acquired Intangibles ...Note 3 - Earnings Per Share ...Note 4 - Income Taxes ...Note 5 - Accounts Receivable ...Note 6 - Inventories ...Note 7 - Customer... -

Page 60

...per share data) Years ended December 31, Sales of products Sales of services Total revenues Cost of products Cost of services Boeing Capital interest expense Total costs and expenses Income from operating investments, net General and administrative expense Research and development expense, net (Loss... -

Page 61

... (cost)/benefit related to our equity method investments, net of tax $15, ($13), and ($74) Amortization of prior service cost included in net periodic pension cost, net of tax of ($12), ($6), and ($10) Prior service cost arising during the period, net of tax of $3, $41, and $9 Total defined benefit... -

Page 62

... Total assets Liabilities and equity Accounts payable Accrued liabilities Advances and billings in excess of related costs Deferred income taxes and income taxes payable Short-term debt and current portion of long-term debt Total current liabilities Accrued retiree health care Accrued pension plan... -

Page 63

..., net of advances and progress billings Accounts payable Accrued liabilities Advances and billings in excess of related costs Income taxes receivable, payable and deferred Other long-term liabilities Pension and other postretirement plans Customer financing, net Other Net cash provided by operating... -

Page 64

... related dividend equivalents Excess tax pools Treasury shares issued for stock options exercised, net Treasury shares issued for other share-based plans, net Common shares repurchased Cash dividends declared ($3.10 per share) Changes in noncontrolling interests Balance at December 31, 2014 Total... -

Page 65

... Company and Subsidiaries Notes to the Consolidated Financial Statements Summary of Business Segment Data (Dollars in millions) Years ended December 31, Revenues: Commercial Airplanes Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Defense... -

Page 66

... ended December 31, 2014, 2013 and 2012 (Dollars in millions, except per share data) Note 1 - Summary of Significant Accounting Policies Principles of Consolidation and Basis of Presentation The Consolidated Financial Statements included in this report have been prepared by management of The Boeing... -

Page 67

... revenues, cost of sales and the related effect on operating income are recognized using a cumulative catch-up adjustment which recognizes in the current period the cumulative effect of the changes on current and prior periods based on a contract's percent complete. In 2014, 2013 and 2012 net... -

Page 68

... during 2014, 2013 and 2012, respectively. Revenues and costs are presented net in Cost of sales in the Consolidated Statements of Operations. Fleet Support We provide assistance and services to facilitate efficient and safe aircraft operation to the operators of all our commercial airplane models... -

Page 69

...and development expense rather than as contract revenues. Research and development expense included bid and proposal costs of $289, $285 and $326 in 2014, 2013 and 2012, respectively. We have established cost sharing arrangements with some suppliers for the 787 program. Our cost sharing arrangements... -

Page 70

... majority of union employees currently participating in defined benefit pension plans will transition in 2016 to a company-funded defined contribution retirement savings plan. We also provide postretirement benefit plans other than pensions, consisting principally of health care coverage to eligible... -

Page 71

... Inventoried costs on commercial aircraft programs and long-term contracts include direct engineering, production and tooling and other non-recurring costs, and applicable overhead, which includes fringe benefits, production related indirect and plant management salaries and plant services, not... -

Page 72

... incur, excluding start-up costs which are expensed as incurred. Capitalized precontract costs are included in Inventories, net of advances and progress billings, in the accompanying Consolidated Statements of Financial Position. Should future orders not materialize or we determine the costs are no... -

Page 73

... Other income/(expense), net. Derivatives All derivative instruments are recognized in the financial statements and measured at fair value regardless of the purpose or intent of holding them. We use derivative instruments to principally manage a variety of market risks. For derivatives designated as... -

Page 74

... for Sale Aircraft but prior to the purchase of the used trade-in aircraft. Estimates based on current aircraft values would be included in Accrued liabilities. The fair value of trade-in aircraft is determined using aircraft-specific data such as model, age and condition, market conditions for... -

Page 75

... certain other assets in which the customer has an equity interest and use the proceeds to cover the shortfall. Each quarter we review customer credit ratings, published historical credit default rates for different rating categories, and multiple third-party aircraft value publications as a basis... -

Page 76

... remedies are not specified. Estimated payments are recorded as a reduction of revenue at delivery of the related aircraft. We have agreements that require certain suppliers to compensate us for amounts paid to customers for failure of supplied equipment to meet specified performance targets. Claims... -

Page 77

... Intangibles Changes in the carrying amount of goodwill by reportable segment for the years ended December 31, 2014 and 2013 were as follows: Commercial Airplanes $2,125 (17) $2,108 45 (22) $2,131 Boeing Military Aircraft $946 18 $964 Network & Space Systems $1,513 Global Services & Support $451... -

Page 78

... common shares outstanding. The elements used in the computation of basic and diluted earnings per share were as follows: (In millions - except per share amounts) Years ended December 31, Net earnings Less: earnings available to participating securities Net earnings available to common shareholders... -

Page 79

... condition was not met. (Shares in millions) Years ended December 31, Stock options Performance awards Performance-based restricted stock units Note 4 - Income Taxes The components of earnings before income taxes were: Years ended December 31, U.S. Non-U.S. Total Income tax expense/(benefit... -

Page 80

... income tax rate (1) 2014 35.0% (2.9) (3.6) (0.2) (0.7) 0.7 (3.6) (1.0) 23.7% 2013 35.0% (4.9) (3.4) (0.1) (0.6) 0.4 2012 35.0% 0.8 (1.2) (0.7) 0.8 (0.7) 34.0% 26.4% In the fourth quarter of 2014, we recorded tax benefits of $188 related to the reinstatement of the research tax credit for 2014... -

Page 81

...were as follows: 2014 Inventory and long-term contract methods of income recognition, fixed assets and other (net of valuation allowance of $18 and $20) Pension benefits Retiree health care benefits Other employee benefits Customer and commercial financing Net operating loss, credit and capital loss... -

Page 82

... state tax credits claimed. Note 5 - Accounts Receivable, net Accounts receivable at December 31 consisted of the following: U.S. government contracts Defense, Space & Security customers (1) Commercial Airplanes customers Reinsurance receivables Other Less valuation allowance Total (1) 2014 $4,281... -

Page 83

..., 2014 and 2013, commercial aircraft programs inventory included the following amounts related to the 787 program: $33,163 and $27,576 of work in process (including deferred production costs of $26,149 and $21,620), $2,257 and $2,189 of supplier advances, and $3,801 and $3,377 of unamortized tooling... -

Page 84

... in sales-type/finance leases at December 31 were as follows: Minimum lease payments receivable Estimated residual value of leased assets Unearned income Total 2014 $1,475 521 (461) $1,535 2013 $1,731 543 (575) $1,699 Operating lease equipment primarily includes large commercial jet aircraft and... -

Page 85

... values. We assign internal credit ratings for all customers and determine the creditworthiness of each customer based upon publicly available information and information obtained directly from our customers. Our rating categories are comparable to those used by the major credit rating agencies... -

Page 86

...-11 Aircraft (Accounted for as operating leases) 787 Aircraft (Accounted for as operating leases) Charges related to customer financing asset impairment for the years ended December 31 were as follows: 2014 $139 45 $184 2013 $67 14 $81 2012 $73 (15) $58 Boeing Capital Other Boeing Total Scheduled... -

Page 87

...consisted of the following as of December 31: Segment United Launch Alliance Network & Space Systems (N&SS) Commercial Airplanes, N&SS and Other Global Services & Support (GS&S) Total equity method investments Ownership Percentages 50% Investment Balance 2014 2013 $916 $970 198 $1,114 194 $1,164 75 -

Page 88

...Assets Sea Launch At December 31, 2014 and 2013, Other assets included $356 of receivables related to our former investment in the Sea Launch venture which became payable by certain Sea Launch partners following Sea Launch's bankruptcy filing in June 2009. The $356 includes $147 related to a payment... -

Page 89

...605. As of December 31, 2014 and 2013, we estimated that it was probable we would be obligated to perform on certain of these commitments with net amounts payable to customers totaling $446 and $325 and the fair value of the related trade-in aircraft was $446 and $325. 77 2014 $1,570 566 (432) (200... -

Page 90

... Financing commitments related to aircraft on order, including options and those proposed in sales campaigns, totaled $16,723 and $17,987 as of December 31, 2014 and 2013. The estimated earliest potential funding dates for these commitments as of December 31, 2014 are as follows: 2015 2016 2017 2018... -

Page 91

... against the cash surrender value of the policies, we present the net asset in Other assets on the Consolidated Statements of Financial Position as of December 31, 2014 and 2013. United States Government Defense Environment Overview U.S. government appropriation levels remain subject to significant... -

Page 92

... operations in Russia and Ukraine. To date, we have not experienced any significant disruptions to production or deliveries. Should suppliers or customers experience disruption, our production and/or deliveries could be materially impacted. 747 and 787 Commercial Airplane Programs The development... -

Page 93

... advance payments of $1,609 to us and we have recorded revenues and cost of sales of $1,287 under the inventory supply agreement through December 31, 2014. We agreed to indemnify ULA against potential losses that ULA may incur in the event ULA is unable to obtain certain additional contract pricing... -

Page 94

... in pre-tax losses associated with the three missions. Potential payments for Other Delta contracts include $85 related to deferred support costs. In June 2011, the Defense Contract Management Agency (DCMA) notified ULA that it had determined that $271 of deferred support costs are not recoverable... -

Page 95

... Statements of Operations. Total Company interest payments were $511, $551 and $614 for the years ended December 31, 2014, 2013 and 2012, respectively. We have $5,005 currently available under credit line agreements, of which $2,473 is a 364-day revolving credit facility expiring in November 2015... -

Page 96

..., 2014, $213 of debt (non-recourse debt, notes and capital lease obligations) was collateralized by customer financing assets totaling $362. Scheduled principal payments for debt and minimum capital lease obligations for the next five years are as follows: Scheduled principal payments 2015 $937 2016... -

Page 97

... retirement savings plan. We fund our major pension plans through trusts. Pension assets are placed in trust solely for the benefit of the plans' participants, and are structured to maintain liquidity that is sufficient to pay benefit obligations as well as to keep pace over the long-term... -

Page 98

... balance Change in plan assets Beginning balance at fair value Actual return on plan assets Company contribution Plan participants' contributions Settlement/curtailment/other Benefits paid Exchange rate adjustment Ending balance at fair value Amounts recognized in statement of financial position at... -

Page 99

... plans, are used to calculate the benefit obligation at December 31 of each year and the net periodic benefit cost for the subsequent year. December 31, Discount rate: Pension Other postretirement benefits Expected return on plan assets Rate of compensation increase 2014 3.90% 3.50% 7.00% 3.80% 2013... -

Page 100

... our pension assets is to earn a rate of return over time to satisfy the benefit obligations of the pension plans and to maintain sufficient liquidity to pay benefits and address other cash requirements of the pension fund. Specific investment objectives for our long-term investment strategy include... -

Page 101

... identified across different asset classes or markets, primarily using long-short positions in derivatives and physical securities. Hedge fund strategy types include, but are not limited to, event driven, relative value, long-short and multi-strategy. Investment managers are retained for... -

Page 102

...on quoted prices in active markets for identical assets. Level 2 refers to fair values estimated using significant other observable inputs, and Level 3 includes fair values estimated using significant unobservable inputs. Total Fixed income securities: Corporate U.S. government and agencies Mortgage... -

Page 103

...on specific terms and conditions of the individual funds. Investments in private equity, private debt, real estate, real assets, global strategies, and hedge funds are primarily calculated and reported by the General Partner (GP), fund manager or third party administrator. Pension assets invested in... -

Page 104

... the year ended December 31, 2014 and 2013. Transfers into and out of Level 3 are reported at the beginning-of-year values. January 1 2014 Balance Fixed income securities: Corporate (1) Mortgage backed and asset backed(1) Other Equity securities: Non-U.S. common and preferred stock Common/collective... -

Page 105

...(Level 1). The expected rate of return on these assets does not have a material effect on the net periodic benefit cost. Cash Flows Contributions Required pension contributions under the Employee Retirement Income Security Act (ERISA), as well as rules governing funding of our non-U.S. pension plans... -

Page 106

... of the pension plans provide that, in the event there is a change in control of the Company which is not approved by the Board of Directors and the plans are terminated within five years thereafter, the assets in the plan first will be used to provide the level of retirement benefits required by... -

Page 107

... December 31, 2014, there was $34 of total unrecognized compensation cost related to our stock option plan which is expected to be recognized over a weighted average period of one year. The grant date fair value of stock options vested during the years ended December 31, 2014, 2013 and 2012 was $87... -

Page 108

...date of grant. RSU activity for the year ended December 31, 2014 was as follows: Long-Term Incentive Program Number of units: Outstanding at beginning of year Granted Dividends Forfeited Distributed Outstanding at end of year Unrecognized compensation cost Weighted average remaining contractual life... -

Page 109

... deferred compensation among 23 investment funds including a Boeing stock unit account. Total expense related to deferred compensation was $44, $238 and $75 in 2014, 2013 and 2012, respectively. As of December 31, 2014 and 2013, the deferred compensation liability which is being marked to market... -

Page 110

...Primarily relates to amortization of actuarial losses for the years ended December 31, 2014, 2013, and 2012 totaling $661, $1,516, and $1,304 (net of tax of ($367), ($849), and ($752)), respectively. These are included in the net periodic pension cost of which a portion is allocated to production as... -

Page 111

... which we agree to pay variable rates of interest are designated as fair value hedges of fixed-rate debt. The net change in fair value of the derivatives and the hedged items is reported in Boeing Capital interest expense. Derivative Instruments Not Receiving Hedge Accounting Treatment We also hold... -

Page 112

... credit risk are predominantly with commercial aircraft customers and the U.S. government. Of the $11,438 in gross accounts receivable and gross customer financing included in the Consolidated Statements of Financial Position as of December 31, 2014, $5,246 related predominantly to commercial... -

Page 113

... 31, 2013 Total Level 1 Level 2 Level 3 $3,783 $3,783 8 6 86 $3,877 $3,789 $2 $86 $86 $2 $25 $25 ($217) ($217) ($217) ($217) ($79) ($79) ($79) ($79) Money market funds and available-for-sale equity securities are valued using a market approach based on the quoted market prices of identical... -

Page 114

... and related carrying values of financial instruments that are not required to be remeasured at fair value on the Consolidated Statements of Financial Position at December 31 were as follows: December 31, 2014 Carrying Amount Total Fair Value Level 1 Level 2 Level 3 Assets Accounts receivable, net... -

Page 115

...time deposits and other deposits, commercial paper, money market funds, Accounts payable and long-term payables. The carrying values of those items, as reflected in the Consolidated Statements of Financial Position, approximate their fair value at December 31, 2014 and 2013. The fair value of assets... -

Page 116

... intelligence systems; strategic missile and defense systems; space and intelligence systems, including satellites and commercial satellite launch vehicles; and space exploration. Our GS&S segment provides customers with mission readiness through total support solutions. Our global services business... -

Page 117

... directly from the segments' internal financial reporting used for corporate management purposes. Depreciation and Amortization Years ended December 31, Commercial Airplanes Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Defense, Space... -

Page 118

...ended December 31, Commercial Airplanes Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Defense, Space & Security Unallocated items, eliminations and other Total 2014 $698 175 93 68 336 1,202 $2,236 2013 $694 186 96 48 330 1,074 $2,098 2012... -

Page 119

... 31, Commercial Airplanes Defense, Space & Security: Boeing Military Aircraft Network & Space Systems Global Services & Support Total Defense, Space & Security Boeing Capital Unallocated items, eliminations and other Total 2014 $55,149 7,232 5,895 4,586 17,713 3,525 22,811 $99,198 2013 $49,520... -

Page 120

... Total costs and expenses. Total costs and expenses includes Cost of products, Cost of services and Boeing Capital interest expense. In the fourth quarter of 2014, we recorded income tax benefits of $188 related to the reinstatement of the research tax credit for 2014. In the first quarter of 2013... -

Page 121

...REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of The Boeing Company Chicago, Illinois We have audited the accompanying consolidated statements of financial position of The Boeing Company and subsidiaries (the "Company") as of December 31, 2014 and 2013, and the related... -

Page 122

...the Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2014 of the Company and our report dated February 12, 2015 expressed an unqualified opinion on those financial statements. /s/ Deloitte & Touche LLP Chicago... -

Page 123

... Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms and is accumulated and communicated to our management, including the Chief Executive Officer and Chief Financial Officer, as appropriate to allow... -

Page 124

... Community Relations for Military Aircraft and Missile Systems unit. President, Boeing International since November 2007 and Senior Vice President, Business Development and Strategy since October 2009. Mr. Hill joined Boeing in 1996 when the Company acquired Rockwell's aerospace and defense business... -

Page 125

... Operations since joining Boeing in June 2008. Mr. Keating served as Senior Vice President, Global Government Relations at Honeywell International Inc. from October 2002 to May 2008. Prior thereto, Mr. Keating was Chairman of the Board and Managing Partner of Timmons and Company (a Washington... -

Page 126

... held a number of positions at Boeing including CFO, Shared Services Group; Controller, Shared Services Group; Senior Director, Internal Audit; and leadership roles in supply chain, factory operations and program management. Chief Technology Officer and Senior Vice President, Engineering, Operations... -

Page 127

...to officers and other employees, directors and consultants. Each of these compensation plans was approved by our shareholders. The following table sets forth information regarding outstanding options and shares available for future issuance under these plans as of December 31, 2014: Number of shares... -

Page 128

... 16, 2013). (ii) (10) Material Contracts. Bank Credit Agreements (i) 364-Day Credit Agreement, dated as of November 10, 2011, among The Boeing Company, the Lenders party thereto, Citigroup Global Markets Inc. and J.P. Morgan Securities LLC as joint lead arrangers and joint book managers, JPMorgan... -

Page 129

...-Q for the quarter ended September 30, 2014). (vi) Management Contracts and Compensatory Plans (vii) (viii) Deferred Compensation Plan for Directors of The Boeing Company, as amended and restated effective January 1, 2008 (Exhibit 10.2 to the Company's Current Report on Form 8-K dated October 28... -

Page 130

... Company's Current Report on Form 8-K dated December 17, 2012). Form of Notice of Terms of Restricted Stock Units dated February 25, 2013 (Exhibit (10)(xiv)(g) to the Company's Form 10-K for the year ended December 31, 2013). Form of Notice of Terms of Restricted Stock Units dated February 24, 2014... -

Page 131

...99) Additional Exhibits. (i) (101) Commercial Program Method of Accounting (Exhibit (99)(i) to the 1997 Form 10K). Interactive Data Files. (101.INS) (101.SCH...Regulation S-K, copies of certain instruments defining the rights of holders of long-term debt of the Company are not filed herewith. Pursuant... -

Page 132

... of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on February 12, 2015. THE BOEING COMPANY (Registrant) By: /s/ Robert E. Verbeck Robert E. Verbeck - Vice President of Finance and Corporate... -

Page 133

...Executive Vice President and Chief Financial Officer (Principal Financial Officer) /s/ Lawrence W. Kellner Lawrence W. Kellner - Director /s/ Robert E. Verbeck Robert E. Verbeck - Vice President of Finance and Corporate Controller (Principal Accounting Officer) /s/ Edward M. Liddy Edward M. Liddy... -

Page 134

... GAAP financial measures of earnings from operations, operating margins and diluted earnings per share. See page 42 of Form 10-K. U.S. dollars in millions except per share data 2014 2013 2012 2011 2010 Revenues Earnings from operations, as reported Operating margins Unallocated pension and... -

Page 135

... Executive Officer Renton, Washington, USA The Boeing 737 is the world's best-selling family of commercial jetliners. Today's Next-Generation 737-700, -800 and -900ER models incorporate the latest advanced technology and design features that improve fuel efficiency and reduce operating costs while... -

Page 136

.... Our design knowledge, manufacturing experience, engineering expertise and ï¬,eet data enrich every service we provide. Boeing and its subsidiaries partner with airlines and leasing companies to deliver solutions that improve efï¬ciency in daily operations and maximize business performance. 124... -

Page 137

... aircraft, and by the end of 2014, had delivered more than 90 enhanced wing sets. In 2009, Boeing was awarded a four-year Boeing is designing advanced concepts to reduce the cost of on-demand space access. Currently, a Phantom Works team is working with the Defense Advanced Research Projects Agency... -

Page 138

Selected Programs, Products and Services Boeing Defense, Space & Security continued The C-17 Globemaster III, the world's most advanced and versatile airlifter, is designed for long-range transport of equipment, supplies and military troops. The C-17 is used extensively to support combat operations,... -

Page 139

... of a long-range ballistic missile target. GMD has achieved nine successful intercept tests to date. Boeing continues to lead GMD development, integration, testing, operations and sustainment activities, building on the company's extensive program experience. Harpoon sites, exposed aircraft, port... -

Page 140

Selected Programs, Products and Services Boeing Defense, Space & Security continued Boeing is building four 702HP satellites to provide new Ka-band global and high-capacity satellite services to Inmarsat. The new satellites will join Inmarsat's ï¬,eet of geostationary satellites that provide a wide ... -

Page 141

... customers. The 502 satellites share Boeing is converting retired F-16s into full-scale aerial targets that will replace the existing QF-4 ï¬,eet. The QF-16s will be used to test newly developed weapons and train pilots for the SSEE systems are tactical cryptologic and information warfare systems... -

Page 142

... launches commercial missions on behalf of Boeing Launch Services. ULA launched 14 successful missions in 2014. unmanned vehicles such as ScanEagle and Integrator. Boeing and Insitu's technology and related support systems provide important tools that deliver critical data or support strike capacity... -

Page 143

...and expand financiers' involvement in the outstanding opportunities associated with aircraft and aerospace investment. The team's experience in structured financing, leasing, complex restructuring and trading brings opportunity and value to its financial partners. As of Dec. 31, 2014, Boeing Capital... -

Page 144

...shareholder information) 312-544-2660 (8 a.m. to 4:30 p.m. Central Time) Investor Relations Contact The Boeing Company Mail Code 5003-2001 100 North Riverside Plaza Chicago, IL 60606-1596 To Request an Annual Report, Proxy Statement, Form 10-K or Form 10-Q, Contact: Mail Services The Boeing Company... -

Page 145

... Inc. Boeing director since 2010 Committees: Compensation; Governance, Organization and Nominating; Special Programs Mike S. Zaï¬rovski Executive Advisor, The Blackstone Group; President, The Zaf Group; Former President and Chief Executive Officer, Nortel Networks Corporation Boeing director since... -

Page 146

..., Business Development and Strategy John J. Tracy Chief Technology Officer Senior Vice President, Engineering, Operations & Technology Robert E. Verbeck* Vice President, Finance and Corporate Controller *Appointed Officer 134 Photo opposite: Boeing's first KC-46 Tanker test aircraft, a 767... -

Page 147

...our products and services are helping solve the world's toughest problems. Visit us at boeing. com/environment to view our current Environment Report and information on how the people of Boeing are developing ways to protect the planet and create a better tomorrow. The Boeing Company Annual Report... -

Page 148

The Boeing Company 100 North Riverside Plaza Chicago, IL 60606-1596 USA