Allstate 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

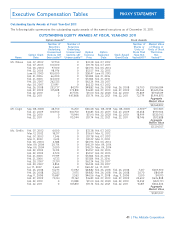

(3) The values in this change-in-control row represent amounts paid if both the change-in-control and qualifying termination occur on December 31,

2011. Equity awards granted prior to 2012 immediately vest upon a change-in-control; the amounts payable to each named executive would be as

follows:

Mr. Wilson 3,976,154 8,568,832 12,544,986

Mr. Civgin 1,065,935 2,124,357 3,190,292

Ms. Greffin 742,314 1,891,537 2,633,851

Mr. Gupta 0 546,089 546,089

Mr. Winter 0 1,468,189 1,468,189

Beginning with awards granted in 2012, equity awards will not accelerate in the event of a change-in-control unless also accompanied by a

qualifying termination of employment. A change-in-control also would accelerate the distribution of each named executive’s non-qualified deferred

compensation and SRIP benefits. Please see the Non-Qualified Deferred Compensation at Fiscal Year End 2011 table and footnote 2 to the Pension

Benefits table in the Retirement Benefits section for details regarding the applicable amounts for each named executive.

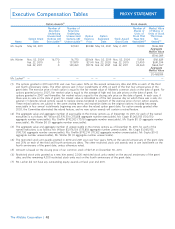

(4) Under the change-in-control plan, Mr. Winter’s severance benefit was reduced by $310,593 to avoid the imposition of excise taxes and maximize

the severance benefit available under the plan.

(5) The Welfare Benefits and Outplacement Services amount includes the cost to provide certain welfare benefits to the named executive and family

during the period the named executive is eligible for continuation coverage under applicable law. The amount shown reflects Allstate’s costs for

these benefits or programs assuming an 18-month continuation period. The value of outplacement services is $40,000 for Mr. Wilson and

$20,000 for each other named executive.

(6) The named executives who participate in the long-term disability plan are eligible to participate in Allstate’s supplemental long-term disability plan

for employees whose annual earnings exceed the level which produces the maximum monthly benefit provided by the long-term disability plan

(basic plan). The benefit is equal to 50% of the named executive’s qualified annual earnings divided by twelve and rounded to the nearest one

hundred dollars, reduced by $7,500, which is the maximum monthly benefit payment that can be received under the Basic Plan. The amount

reflected assumes the named executive remains totally disabled until age 65 and represents the present value of the monthly benefit payable until

age 65. Ms. Greffin does not participate in the long-term disability plan.

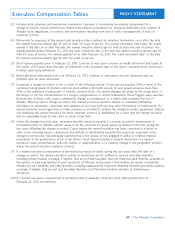

(7) Under the terms of Mr. Lacher’s separation agreement, for a one year period following his termination of employment, Mr. Lacher is restricted from

soliciting Allstate employees, customers, or suppliers and engaging in certain activities competitive with the property and casualty insurance

business of Allstate.

51

Restricted stock

Stock Options — units — Total —

Unvested and Unvested and Unvested and

Accelerated Accelerated Accelerated

Name ($) ($) ($)

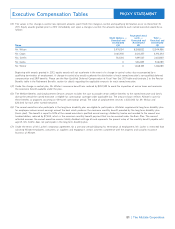

Executive Compensation Tables

| The Allstate Corporation

PROXY STATEMENT