Allstate 2012 Annual Report Download - page 257

Download and view the complete annual report

Please find page 257 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

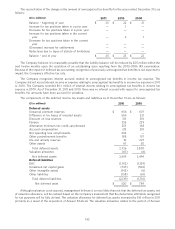

Cash flows

There was no required cash contribution necessary to satisfy the minimum funding requirement under the IRC for

the tax qualified pension plans as of December 31, 2011. The Company currently plans to contribute $417 million to its

pension plans in 2012.

The Company contributed $41 million and $35 million to the postretirement benefit plans in 2011 and 2010,

respectively. Contributions by participants were $20 million and $22 million in 2011 and 2010, respectively.

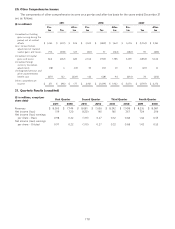

Estimated future benefit payments

Estimated future benefit payments expected to be paid in the next 10 years, based on the assumptions used to

measure the Company’s benefit obligation as of December 31, 2011, are presented in the table below. Effective January 1,

2010, the Company no longer participates in the Retiree Drug Subsidy program due to the change in the Company’s

retiree medical plan for Medicare-eligible retirees.

Postretirement benefits

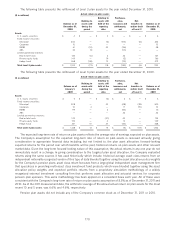

($ in millions)

Gross

Pension benefit

benefits payments

2012 $ 310 $ 42

2013 319 43

2014 350 45

2015 362 47

2016 396 49

2017-2021 2,467 272

Total benefit payments $ 4,204 $ 498

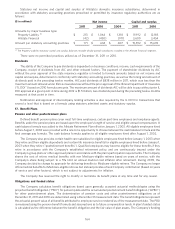

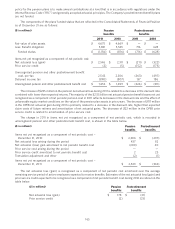

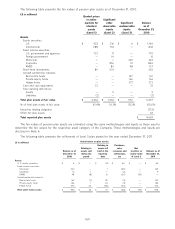

Allstate 401(k) Savings Plan

Employees of the Company, with the exception of those employed by the Company’s international, Sterling Collision

Centers (‘‘Sterling’’), Esurance and Answer Financial subsidiaries, are eligible to become members of the Allstate 401(k)

Savings Plan (‘‘Allstate Plan’’). The Company’s contributions are based on the Company’s matching obligation and

certain performance measures. The Company is responsible for funding its anticipated contribution to the Allstate Plan,

and may, at the discretion of management, use the ESOP to pre-fund certain portions. In connection with the Allstate

Plan, the Company has a note from the ESOP with a principal balance of $22 million as of December 31, 2011. The ESOP

note has a fixed interest rate of 7.9% and matures in 2019. The Company records dividends on the ESOP shares in

retained income and all the shares held by the ESOP are included in basic and diluted weighted average common shares

outstanding.

The Company’s contribution to the Allstate Plan was $48 million, $36 million, and $78 million in 2011, 2010 and

2009, respectively. These amounts were reduced by the ESOP benefit computed for the years ended December 31 as

follows:

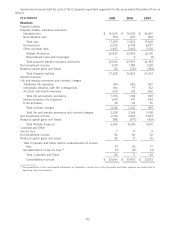

($ in millions) 2011 2010 2009

Interest expense recognized by ESOP $ 2 $ 2 $ 2

Less: dividends accrued on ESOP shares (2) (2) (2)

Cost of shares allocated 2 2 2

Compensation expense 2 2 2

Reduction of defined contribution due to ESOP 9 11 22

ESOP benefit $ (7) $ (9) $ (20)

The Company made no contributions to the ESOP in 2011, 2010 and 2009. As of December 31, 2011, total

committed to be released, allocated and unallocated ESOP shares were 0.2 million, 34 million and 5 million,

respectively.

Allstate has defined contribution plans for eligible employees of its Canadian, Sterling, Esurance and Answer

Financial subsidiaries. Expense for these plans was $7 million, $5 million and $6 million in 2011, 2010 and 2009,

respectively.

171