Allstate 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

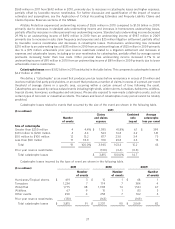

We have different plans around the country to improve the growth and profitability of our homeowners business. In

states where we offer homeowners and other property coverages that do not have severe weather issues and that have

acceptable returns, we are seeking to grow. In another group of states where we offer homeowners and other property

coverages, we plan to implement pricing and/or underwriting actions that will improve performance to achieve our

profitability targets. For two other groups of states, including those with severe weather issues and other risks such as

hurricane exposure, we may take more substantial actions including raising prices, offering policies with more limited

coverage, or brokering to other carriers. We are currently piloting our Allstate House and HomeSM product which

provides greater options of coverage for roof damage including depreciated value versus replacement value and uses a

number of factors to determine price, some of which relate to auto insurance risks. We expect to roll it out countrywide

for new business gradually over the next three years.

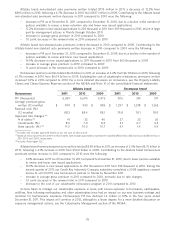

Allstate brand homeowners premiums written increased in 2010 compared to 2009. Contributing to the Allstate

brand homeowners premiums written increase in 2010 compared to 2009 were the following:

– 4.1% decrease in PIF as of December 31, 2010 compared to December 31, 2009, following a 3.9% decrease as

of December 31, 2009 compared to December 31, 2008, due to fewer policies available to renew and fewer

new issued applications

– 3.6% decrease in new issued applications to 536 thousand in 2010 from 556 thousand in 2009. Excluding

Florida, new issued applications on a countrywide basis decreased 12.4% to 487 thousand in 2010 from

556 thousand in 2009.

– increase in average gross premium in 2010 compared to 2009, primarily due to rate changes

– 0.3 point increase in the renewal ratio in 2010 compared to 2009

– decrease in the net cost of our catastrophe reinsurance program in 2010 compared to 2009

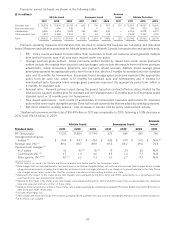

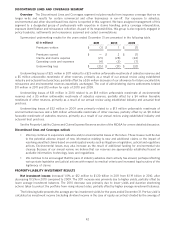

Underwriting results are shown in the following table.

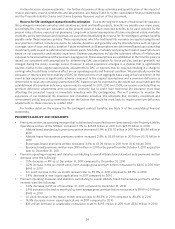

($ in millions) 2011 2010 2009

Premiums written $ 25,981 $ 25,906 $ 25,972

Premiums earned $ 25,942 $ 25,955 $ 26,195

Claims and claims expense (20,140) (18,923) (18,722)

Amortization of DAC (3,640) (3,678) (3,789)

Other costs and expenses (2,968) (2,795) (2,552)

Restructuring and related charges (43) (33) (105)

Underwriting (loss) income $ (849) $ 526 $ 1,027

Catastrophe losses $ 3,815 $ 2,207 $ 2,069

Underwriting income (loss) by line of business

Standard auto $ 568 $ 692 $ 987

Non-standard auto 101 74 76

Homeowners (1,330) (335) (125)

Other personal lines (188) 95 89

Underwriting (loss) income $ (849) $ 526 $ 1,027

Underwriting income (loss) by brand

Allstate brand $ (666) $ 569 $ 1,022

Encompass brand (146) (43) 5

Esurance brand (37) — —

Underwriting (loss) income $ (849) $ 526 $ 1,027

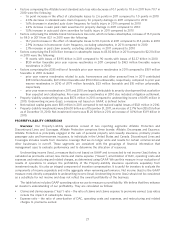

Allstate Protection experienced an underwriting loss of $849 million in 2011 compared to underwriting income of

$526 million in 2010, primarily due to an increase in homeowners underwriting loss, an underwriting loss for other

personal lines compared to an underwriting gain in the prior year, and a decrease in standard auto underwriting income.

Homeowners underwriting loss increased $995 million to $1.33 billion in 2011 from $335 million in 2010, primarily due

to increases in catastrophe losses and higher expenses partially offset by average earned premiums increasing faster

than loss costs. Other personal lines underwriting income decreased $283 million to an underwriting loss of

$188 million in 2011 from underwriting income of $95 million in 2010, primarily due to increases in catastrophe losses,

unfavorable reserve reestimates and higher expenses. Standard auto underwriting income decreased $124 million to

36