Allstate 2012 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

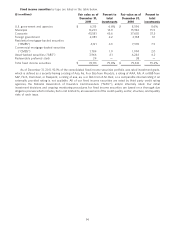

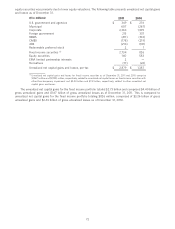

Gross unrealized gains and losses as of December 31, 2011 on fixed income securities by type and sector are

provided in the table below.

($ in millions) Amortized Fair value

cost as a as a

Gross unrealized

Par Amortized Fair percent of percent of

value (1) cost Gains Losses value par value (2) par value (2)

Corporate:

Banking $ 3,649 $ 3,621 $ 96 $ (185) $ 3,532 99.2% 96.8%

Financial services 3,695 3,643 169 (54) 3,758 98.6 101.7

Capital goods 4,878 4,915 372 (32) 5,255 100.8 107.7

Utilities 7,204 7,201 711 (32) 7,880 100.0 109.4

Consumer goods

(cyclical and

non-cyclical) 8,250 8,361 521 (21) 8,861 101.3 107.4

Transportation 1,851 1,858 164 (15) 2,007 100.4 108.4

Communications 2,638 2,647 151 (14) 2,784 100.3 105.5

Basic industry 2,287 2,302 140 (8) 2,434 100.7 106.4

Energy 3,363 3,408 242 (4) 3,646 101.3 108.4

Technology 1,841 1,874 109 (3) 1,980 101.8 107.6

Other 1,491 1,387 68 (11) 1,444 93.0 96.8

Total corporate fixed

income portfolio 41,147 41,217 2,743 (379) 43,581 100.2 105.9

U.S. government and

agencies 6,310 5,966 349 — 6,315 94.5 100.1

Municipal 15,543 13,634 863 (256) 14,241 87.7 91.6

Foreign government 1,951 1,866 216 (1) 2,081 95.6 106.7

RMBS 5,292 4,532 110 (521) 4,121 85.6 77.9

CMBS 2,017 1,962 48 (226) 1,784 97.3 88.4

ABS 4,458 4,180 73 (287) 3,966 93.8 89.0

Redeemable preferred

stock 22 22 2 — 24 100.0 109.1

Total fixed income

securities $ 76,740 $ 73,379 $ 4,404 $ (1,670) $ 76,113 95.6 99.2

(1) Included in par value are zero-coupon securities that are generally purchased at a deep discount to the par value that is received at maturity. These

primarily included corporate, U.S. government and agencies, municipal and foreign government zero-coupon securities with par value of

$514 million, $948 million, $3.48 billion and $382 million, respectively.

(2) Excluding the impact of zero-coupon securities, the percentage of amortized cost to par value would be 100.5% for corporates, 101.4% for U.S.

government and agencies, 101.2% for municipals and 103.3% for foreign governments. Similarly, excluding the impact of zero-coupon securities, the

percentage of fair value to par value would be 106.2% for corporates, 104.7% for U.S. government and agencies, 106.1% for municipals and 111.3%

for foreign governments.

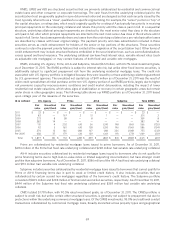

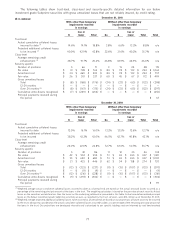

The banking, financial services, and capital goods sectors had the highest concentration of gross unrealized losses

in our corporate fixed income securities portfolio as of December 31, 2011. In general, credit spreads remain wider than

at initial purchase for most of the securities with gross unrealized losses in these categories.

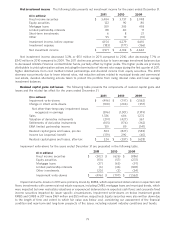

The unrealized net capital gain for the equity portfolio totaled $160 million and comprised $369 million of gross

unrealized gains and $209 million of gross unrealized losses as of December 31, 2011. This is compared to an unrealized

net capital gain for the equity portfolio totaling $583 million, comprised of $646 million of gross unrealized gains and

$63 million of gross unrealized losses as of December 31, 2010.

73