Allstate 2012 Annual Report Download - page 244

Download and view the complete annual report

Please find page 244 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company continues to monitor its lawsuits, regulatory inquiries, and other legal proceedings for further

developments that would make the loss contingency both probable and estimable, and accordingly accruable, or that

could affect the amount of accruals that have been previously established. There may continue to be exposure to loss in

excess of any amount accrued. Disclosure of the nature and amount of an accrual is made when there have been

sufficient legal and factual developments such that the Company’s ability to resolve the matter would not be impaired

by the disclosure of the amount of accrual.

When the Company assesses it is reasonably possible or probable that a loss has been incurred, it discloses the

matter. When it is possible to estimate the reasonably possible loss or range of loss above the amount accrued, if any,

for the matters disclosed, that estimate is aggregated and disclosed. Disclosure is not required when an estimate of the

reasonably possible loss or range of loss cannot be made.

For certain of the matters described below in the ‘‘Claims related proceedings’’ and ‘‘Other proceedings’’

subsections, the Company is able to estimate the reasonably possible loss or range of loss above the amount accrued, if

any. In determining whether it is possible to estimate the reasonably possible loss or range of loss, the Company reviews

and evaluates the disclosed matters, in conjunction with counsel, in light of potentially relevant factual and legal

developments.

These developments may include information learned through the discovery process, rulings on dispositive

motions, settlement discussions, information obtained from other sources, experience from managing these and other

matters, and other rulings by courts, arbitrators or others. When the Company possesses sufficient appropriate

information to develop an estimate of the reasonably possible loss or range of loss above the amount accrued, if any,

that estimate is aggregated and disclosed below. There may be other disclosed matters for which a loss is probable or

reasonably possible but such an estimate is not possible. Disclosure of the estimate of the reasonably possible loss or

range of loss above the amount accrued, if any, for any individual matter would only be considered when there have

been sufficient legal and factual developments such that the Company’s ability to resolve the matter would not be

impaired by the disclosure of the individual estimate.

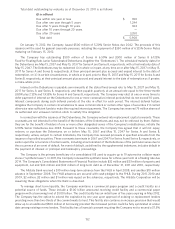

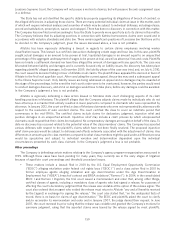

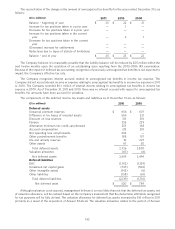

As of December 31, 2011, the Company estimates that the aggregate range of reasonably possible loss in excess of

the amount accrued, if any, for the disclosed matters where such an estimate is possible is zero to $855 million, pre-tax.

This disclosure is not an indication of expected loss, if any. Under accounting guidance, an event is ‘‘reasonably

possible’’ if ‘‘the chance of the future event or events occurring is more than remote but less than likely’’ and an event is

‘‘remote’’ if ‘‘the chance of the future event or events occurring is slight.’’ This estimate is based upon currently available

information and is subject to significant judgment and a variety of assumptions, and known and unknown uncertainties.

The matters underlying the estimate will change from time to time, and actual results may vary significantly from the

current estimate. The estimate does not include matters or losses for which an estimate is not possible. Therefore, this

estimate represents an estimate of possible loss only for certain matters meeting these criteria. It does not represent the

Company’s maximum possible loss exposure. Information is provided below regarding the nature of all of the disclosed

matters and, where specified, the amount, if any, of plaintiff claims associated with these loss contingencies.

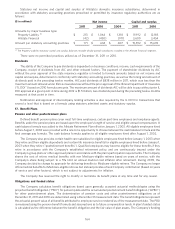

Due to the complexity and scope of the matters disclosed in the ‘‘Claims related proceedings’’ and ‘‘Other

proceedings’’ subsections below and the many uncertainties that exist, the ultimate outcome of these matters cannot

be predicted. In the event of an unfavorable outcome in one or more of these matters, the ultimate liability may be in

excess of amounts currently accrued, if any, and may be material to the Company’s operating results or cash flows for a

particular quarterly or annual period. However, based on information currently known to it, management believes that

the ultimate outcome of all matters described below, as they are resolved over time, is not likely to have a material effect

on the financial position of the Company.

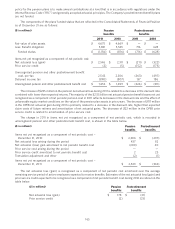

Claims related proceedings

Allstate is vigorously defending a putative class action lawsuit filed in the aftermath of Hurricane Katrina and

currently pending in the United States District Court for the Eastern District of Louisiana (‘‘District Court’’). This matter

was filed by the Louisiana Attorney General against Allstate and every other homeowner insurer doing business in the

State of Louisiana, on behalf of the State of Louisiana, as assignee, and on behalf of a class of Road Home fund

recipients. In this matter the State alleged that the insurers failed to pay all damages owed under their policies. The

claims currently pending in this matter are for breach of contract and for declaratory relief on the alleged underpayment

of claims by the insurers. All other claims, including extra-contractual claims, have been dismissed. The Company had

moved to dismiss the complaint on the grounds that the State had no standing to bring the lawsuit as an assignee of

insureds because of anti-assignment language in the underlying insurance policies. Now, however, due to a ruling by the

158