Allstate 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

favorable reserve reestimates and lower catastrophe losses. The increase is primarily driven by increases in Florida and

New York. In 2010, claim frequencies in the bodily injury and physical damage coverages have increased compared to

2009, but remain within historical norms. Bodily injury and physical damage coverages severity results in 2010

increased in line with historical CPI trends.

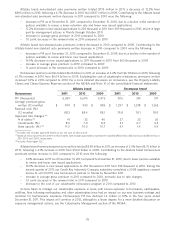

Homeowners loss ratio for the Allstate brand increased 15.9 points to 98.0 in 2011 from 82.1 in 2010 due to higher

catastrophe losses. Excluding the impact of catastrophe losses, the Allstate brand homeowners loss ratio improved 2.8

points in 2011 compared to 2010 due to average earned premiums increasing faster than loss costs. Homeowners loss

ratio for the Allstate brand increased 2.5 points to 82.1 in 2010 from 79.6 in 2009 due to a $75 million unfavorable prior

year reserve reestimate related to a litigation settlement and higher catastrophe losses including prior year reserve

reestimates for catastrophes, partially offset by average earned premiums increasing faster than loss costs.

Expense ratio for Allstate Protection increased 0.6 points in 2011 compared to 2010. Restructuring costs increased

0.1 points in 2011 compared to 2010, driven by technology and operations efficiency efforts and agent pension plan

settlement charges. Excluding restructuring, the expense ratio for Allstate Protection increased 0.5 points in 2011

compared to 2010, driven by additional marketing, including $78 million spent on the Grow to Win initiative, and other

growth initiative costs, and reduced guaranty fund accrual levels in 2010. We expect advertising costs to increase in

2012 as we focus on growing Esurance. The expense ratio for Allstate Protection increased 0.5 points in 2010 compared

to 2009. Restructuring costs decreased 0.3 points in 2010 compared to 2009, driven by prior year costs associated with

claim office consolidations, reorganization of Business Insurance and technology prioritization and efficiency efforts.

Excluding restructuring, the expense ratio for Allstate Protection increased 0.8 points in 2010 compared to 2009, driven

by additional marketing expenses and increases in net costs of employee benefits, partially offset by reduced guaranty

fund accrual levels and improved operational efficiencies.

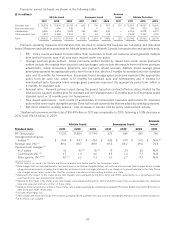

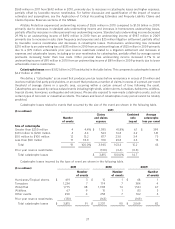

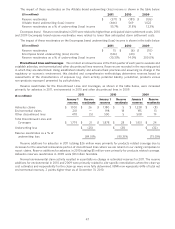

The impact of specific costs and expenses on the expense ratio are included in the following table.

Esurance

Allstate brand Encompass brand brand Allstate Protection

2011 2010 2009 2011 2010 2009 2011 2011 2010 2009

Amortization of DAC 13.9 14.0 14.2 18.0 18.3 18.5 2.0 13.9 14.2 14.5

Other costs and expenses 11.3 10.8 9.9 11.2 9.7 8.3 17.4 11.4 10.8 9.7

Business combination expenses and

amortization of purchased intangible

assets ——————20.9 0.2 — —

Restructuring and related charges 0.2 0.1 0.4 — 0.5 0.3 — 0.2 0.1 0.4

Total expense ratio 25.4 24.9 24.5 29.2 28.5 27.1 40.3 25.7 25.1 24.6

The expense ratio for the standard auto and homeowners businesses generally approximates the total Allstate

Protection expense ratio. The expense ratio for the non-standard auto business generally is lower than the total Allstate

Protection expense ratio due to lower agent commission rates and higher average premiums for non-standard auto as

compared to standard auto. The Encompass brand DAC amortization is higher on average than Allstate brand DAC

amortization due to higher commission rates. The Esurance brand expense ratio is higher than Allstate and Encompass

brands due to business combination expenses and amortization of purchased intangible assets. Purchased intangible

assets will be amortized on an accelerated basis with over 80% of the amortization taking place by 2016. Since Esurance

uses a direct distribution model, its primary acquisition-related costs are advertising as opposed to commissions for the

Allstate and Encompass brands. Advertising expense had a 10.9 point impact on the Esurance brand expense ratio in

2011. Advertising costs are not capitalized as DAC while commission costs are capitalized as DAC. As a result the

Esurance expense and combined ratios will be higher during periods of growth since the expenses will be recognized

prior to the premium earned.

DAC We establish a DAC asset for costs that vary with and are primarily related to acquiring business, principally

agents’ remuneration, premium taxes and inspection costs. For the Allstate Protection business, DAC is amortized to

39