Allstate 2012 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

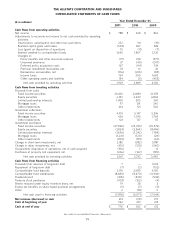

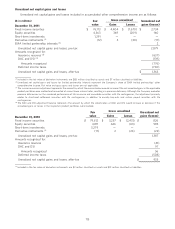

The computation of basic and diluted earnings per share for the years ended December 31 is presented in the

following table.

($ in millions, except per share data) 2011 2010 2009

Numerator:

Net income $ 788 $ 928 $ 854

Denominator:

Weighted average common shares outstanding 520.7 540.3 539.6

Effect of dilutive potential common shares:

Stock options 1.8 2.0 1.3

Restricted stock units (non-participating) 0.6 0.2 —

Weighted average common and dilutive

potential common shares outstanding 523.1 542.5 540.9

Earnings per share – Basic $ 1.51 $ 1.72 $ 1.58

Earnings per share – Diluted $ 1.51 $ 1.71 $ 1.58

The effect of dilutive potential common shares does not include the effect of options with an anti-dilutive effect on

earnings per share because their exercise prices exceed the average market price of Allstate common shares during the

period or for which the unrecognized compensation cost would have an anti-dilutive effect. Options to purchase

27.2 million, 26.7 million and 25.9 million Allstate common shares, with exercise prices ranging from $22.71 to $62.84,

$27.36 to $64.53 and $23.13 to $65.38, were outstanding in 2011, 2010 and 2009, respectively, but were not included in

the computation of diluted earnings per share in those years.

Adopted accounting standards

Consolidation Analysis Considering Investments Held through Separate Accounts

In April 2010, the Financial Accounting Standards Board (‘‘FASB’’) issued guidance clarifying that an insurer is not

required to combine interests in investments held in a qualifying separate account with its interests in the same

investments held in the general account when performing a consolidation evaluation. The adoption of this guidance as

of January 1, 2011 had no impact on the Company’s results of operations or financial position.

Disclosure of Supplementary Pro Forma Information for Business Combinations

In December 2010, the FASB issued disclosure guidance for entities that enter into material business combinations.

The guidance specifies that if an entity presents comparative financial statements, it should disclose pro forma revenue

and earnings of the combined entity as though the business combination that occurred during the current year had

occurred as of the beginning of the comparable prior annual reporting period. The guidance expands the supplemental

pro forma disclosures to include a description of the nature and amount of material, nonrecurring pro forma

adjustments directly attributable to the business combination. The Company will apply the guidance to any material

business combinations entered into on or after January 1, 2011.

Criteria for Classification as a Troubled Debt Restructuring (‘‘TDR’’)

In April 2011, the FASB issued clarifying guidance related to determining whether a loan modification or

restructuring should be classified as a TDR. The additional guidance provided pertains to the two criteria used to

determine whether a TDR exists, whether the creditor has granted a concession and whether the debtor is experiencing

financial difficulties. The guidance related to the identification of a TDR is to be applied retrospectively to the beginning

of the annual period of adoption. The measurement of impairment on a TDR identified under this guidance is effective

prospectively. Additional disclosures about TDRs of financing receivables are also required. The adoption of this

guidance as of July 1, 2011 did not have a material effect on the Company’s results of operations or financial position.

Pending accounting standards

Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts

In October 2010, the FASB issued guidance modifying the definition of the types of costs incurred by insurance

entities that can be capitalized in the acquisition of new and renewal insurance contracts. The guidance specifies that

the costs must be directly related to the successful acquisition of insurance contracts. The guidance also specifies that

advertising costs should be included as deferred acquisition costs only when the direct-response advertising accounting

109