Allstate 2012 Annual Report Download - page 246

Download and view the complete annual report

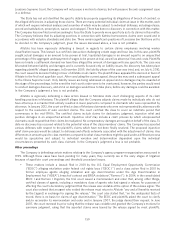

Please find page 246 of the 2012 Allstate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Plaintiffs filed a notice of appeal with the U.S. Court of Appeals for the Third Circuit (‘‘Third Circuit’’). In July

2009, the Third Circuit vacated the trial court’s entry of summary judgment in the Company’s favor and

remanded the cases to the trial court for additional discovery, including additional discovery related to the

validity of the release and waiver. In its opinion, the Third Circuit held that if the release and waiver is held to be

valid, then all of the claims in Romero I and EEOC I are barred. Thus, if the waiver and release is upheld, then

only the claims in Romero I asserted by the small group of employee agents who did not sign the release and

waiver would remain for adjudication. In January 2010, following the remand, the cases were assigned to a new

judge for further proceedings in the trial court. Plaintiffs filed their Second Amended Complaint on July 28,

2010. Plaintiffs seek broad but unspecified ‘‘make whole relief,’’ including back pay, compensatory and punitive

damages, liquidated damages, lost investment capital, attorneys’ fees and costs, and equitable relief, including

reinstatement to employee agent status with all attendant benefits for up to approximately 6,500 former

employee agents. Despite the length of time that these matters have been pending, to date only limited

discovery has occurred related to the damages claimed by individual plaintiffs, and no damages discovery has

occurred related to the claims of the putative class. Nor have plaintiffs provided any calculations of the putative

class’s alleged back pay or the alleged liquidated, compensatory or punitive damages, instead asserting that

such calculations will be provided at a later stage during expert discovery. Damage claims are subject to

reduction by amounts and benefits received by plaintiffs and putative class members subsequent to their

employment termination. Little to no discovery has occurred with respect to amounts earned or received by

plaintiffs and putative class members in mitigation of their alleged losses. Alleged damage amounts and lost

benefits of the approximately 6,500 putative class members also are subject to individual variation and

determination dependent upon retirement dates, participation in employee benefit programs, and years of

service. Discovery limited to the validity of the waiver and release is in process. At present, no class is certified.

Summary judgment proceedings on the validity of the waiver and release are expected to occur in the first half

of 2012.

• A putative nationwide class action has also been filed by former employee agents alleging various violations of

ERISA, including a worker classification issue (‘‘Romero II’’). These plaintiffs are challenging certain

amendments to the Agents Pension Plan and are seeking to have exclusive agent independent contractors

treated as employees for benefit purposes. Romero II was dismissed with prejudice by the trial court, was the

subject of further proceedings on appeal, and was reversed and remanded to the trial court in 2005. In June

2007, the court granted the Company’s motion to dismiss the case. Plaintiffs filed a notice of appeal with the

Third Circuit. In July 2009, the Third Circuit vacated the district court’s dismissal of the case and remanded the

case to the trial court for additional discovery, and directed that the case be reassigned to another trial court

judge. In its opinion, the Third Circuit held that if the release and waiver is held to be valid, then one of plaintiffs’

three claims asserted in Romero II is barred. The Third Circuit directed the district court to consider on remand

whether the other two claims asserted in Romero II are barred by the release and waiver. In January 2010,

following the remand, the case was assigned to a new judge (the same judge for the Romero I and EEOC I

cases) for further proceedings in the trial court. On April 23, 2010, plaintiffs filed their First Amended

Complaint. Plaintiffs seek broad but unspecified ‘‘make whole’’ or other equitable relief, including losses of

income and benefits as a result of their decision to retire from the Company between November 1, 1999 and

December 31, 2000. They also seek repeal of the challenged amendments to the Agents Pension Plan with all

attendant benefits revised and recalculated for thousands of former employee agents, and attorney’s fees and

costs. Despite the length of time that this matter has been pending, to date only limited discovery has occurred

related to the damages claimed by individual plaintiffs, and no damages discovery has occurred related to the

claims of the putative class. Nor have plaintiffs provided any calculations of the putative class’s alleged losses,

instead asserting that such calculations will be provided at a later stage during expert discovery. Damage

claims are subject to reduction by amounts and benefits received by plaintiffs and putative class members

subsequent to their employment termination. Little to no discovery has occurred with respect to amounts

earned or received by plaintiffs and putative class members in mitigation of their alleged losses. Alleged

damage amounts and lost benefits of the putative class members also are subject to individual variation and

determination dependent upon retirement dates, participation in employee benefit programs, and years of

service. As in Romero I and EEOC I, discovery at this time is limited to issues relating to the validity of the

waiver and release. Class certification has not been decided. Summary judgment proceedings on the validity of

the waiver and release are expected to occur in the first half of 2012.

In these agency program reorganization matters, the threshold issue of the validity and scope of the waiver and

release is yet to be decided and, if decided in favor of the Company, would preclude any damages being awarded in

Romero I and EEOC I and may also preclude damages from being awarded in Romero II. In the Company’s judgment a

160