US Cellular 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.United States Cellular Corporation

Management’s Discussion and Analysis of Financial Condition and Results of Operations

United States Cellular Corporation (‘‘U.S. Cellular’’) owns, operates and invests in wireless markets

throughout the United States. U.S. Cellular is an 84%-owned subsidiary of Telephone and Data

Systems, Inc. (‘‘TDS’’).

The following discussion and analysis should be read in conjunction with U.S. Cellular’s audited

consolidated financial statements and the description of U.S. Cellular’s business included in Item 1 of the

U.S. Cellular Annual Report on Form 10-K (‘‘Form 10-K’’) for the year ended December 31, 2013. The

discussion and analysis contained herein refers to consolidated data and results of operations, unless

otherwise noted.

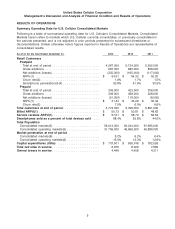

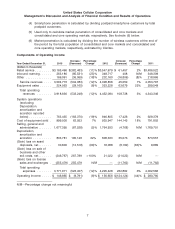

OVERVIEW

The following is a summary of certain selected information contained in the comprehensive

Management’s Discussion and Analysis of Financial Condition and Results of Operations that follows.

The overview does not contain all of the information that may be important. You should carefully read the

entire Management’s Discussion and Analysis of Financial Condition and Results of Operations and not

rely solely on the overview.

In its consolidated operating markets, U.S. Cellular serves approximately 4.8 million customers in 23

states. As of December 31, 2013, U.S. Cellular’s average penetration rate in its consolidated operating

markets was 15.0%. U.S. Cellular operates on a customer satisfaction strategy, striving to meet or exceed

customer needs by providing a comprehensive range of wireless products and services, excellent

customer support, and a high-quality network. U.S. Cellular’s business development strategy is to obtain

interests in and access to wireless licenses in its current operating markets and in areas that are

adjacent to or in close proximity to its other wireless licenses, thereby building contiguous operating

market areas with strong spectrum positions. U.S. Cellular believes that the acquisition of additional

licenses within its current operating markets will enhance its network capacity to meet its customers’

increased demand for data services. U.S. Cellular anticipates that grouping its operations into market

areas will continue to provide it with certain economies in its capital and operating costs.

Financial and operating highlights in 2013 included the following:

• On April 3, 2013, U.S. Cellular entered into an agreement relating to St. Lawrence Seaway RSA

Cellular Partnership (‘‘NY1’’) and New York RSA 2 Cellular Partnership (‘‘NY2’’ and, together with NY1,

the ‘‘Partnerships’’) with Cellco Partnership d/b/a Verizon Wireless, which required U.S. Cellular to

deconsolidate the Partnerships and thereafter account for them as equity method investments (the

‘‘NY1 & NY2 Deconsolidation’’). In connection with the deconsolidation, U.S. Cellular recognized a

non-cash pre-tax gain of $18.5 million which was recorded in Gain on investments in the Consolidated

Statement of Operations. See Note 7—Investments in Unconsolidated Entities in the Notes to

Consolidated Financial Statements for additional information regarding this transaction.

• On May 16, 2013, U.S. Cellular completed the sale of customers and certain PCS license spectrum in

U.S. Cellular’s Chicago, central Illinois, St. Louis and certain Indiana/Michigan/Ohio markets

(‘‘Divestiture Markets’’), to Sprint Corp., fka Sprint Nextel Corporation, for $480 million in cash (the

‘‘Divestiture Transaction’’). In connection with the sale, U.S. Cellular recognized a pre-tax gain of

$266.4 million which was recorded in (Gain) loss on sale of business and other exit costs, net in the

Consolidated Statement of Operations. See Note 5—Acquisitions, Divestitures and Exchanges in the

Notes to Consolidated Financial Statements for additional information regarding this transaction.

• On June 25, 2013, U.S. Cellular paid a special cash dividend of $5.75 per share, for an aggregate

amount of $482.3 million, to all holders of U.S. Cellular Common Shares and Series A Common

Shares as of June 11, 2013.

• On October 4, 2013, U.S. Cellular sold the majority of its Mississippi Valley non-operating market

license (‘‘unbuilt license’’) for $308.0 million. A pre-tax gain of $250.6 million was recorded in (Gain)

loss on license sales and exchanges in the Consolidated Statement of Operations.

1