US Cellular 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 US Cellular annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

United States Cellular Corporation

Notes to Consolidated Financial Statements (Continued)

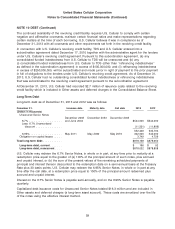

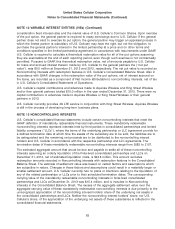

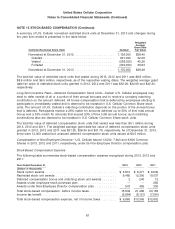

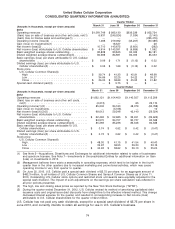

NOTE 15 STOCK-BASED COMPENSATION (Continued)

The following table provides a summary of the stock-based compensation expense included in the

Consolidated Statement of Operations for the years ended:

December 31, 2013 2012 2011

(Dollars in thousands)

Selling, general and administrative expense ...................... $12,933 $18,437 $17,538

System operations ........................................ 2,911 3,029 2,645

Total stock-based compensation expense ........................ $15,844 $21,466 $20,183

At December 31, 2013, unrecognized compensation cost for all U.S. Cellular stock-based compensation

awards was $24.5 million and is expected to be recognized over a weighted average period of 2.3 years.

U.S. Cellular’s tax benefits realized from the exercise of stock options and other awards totaled

$6.1 million in 2013.

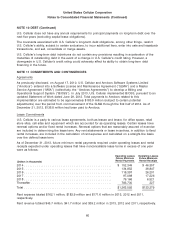

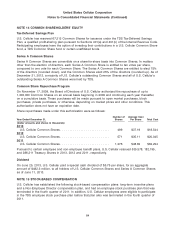

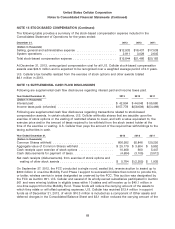

NOTE 16 SUPPLEMENTAL CASH FLOW DISCLOSURES

Following are supplemental cash flow disclosures regarding interest paid and income taxes paid.

Year Ended December 31, 2013 2012 2011

(Dollars in thousands)

Interest paid ........................................... $ 42,904 $ 44,048 $ 55,580

Income taxes paid (refunded) .............................. $157,778 $(58,609) $(54,469)

Following are supplemental cash flow disclosures regarding transactions related to stock-based

compensation awards. In certain situations, U.S. Cellular withholds shares that are issuable upon the

exercise of stock options or the vesting of restricted shares to cover, and with a value equivalent to, the

exercise price and/or the amount of taxes required to be withheld from the stock award holder at the

time of the exercise or vesting. U.S. Cellular then pays the amount of the required tax withholdings to the

taxing authorities in cash.

Year Ended December 31, 2013 2012 2011

(Dollars in thousands)

Common Shares withheld ................................. 606,582 92,846 120,250

Aggregate value of Common Shares withheld ................... $ 25,179 $ 3,604 $ 5,952

Cash receipts upon exercise of stock options ................... 10,468 900 5,447

Cash disbursements for payment of taxes ...................... (4,684) (3,105) (3,512)

Net cash receipts (disbursements) from exercise of stock options and

vesting of other stock awards ............................. $ 5,784 $ (2,205) $ 1,935

On September 27, 2012, the FCC conducted a single round, sealed bid, reverse auction to award up to

$300 million in one-time Mobility Fund Phase I support to successful bidders that commit to provide 3G,

or better, wireless service in areas designated as unserved by the FCC. This auction was designated by

the FCC as Auction 901. U.S. Cellular and several of its wholly-owned subsidiaries participated in Auction

901 and were winning bidders in eligible areas within 10 states and will receive up to $40.1 million in

one-time support from the Mobility Fund. These funds will reduce the carrying amount of the assets to

which they relate or will offset operating expenses. U.S. Cellular has received $13.4 million in support

funds as of December 31, 2013, of which $10.3 million is included as a component of Other assets and

deferred charges in the Consolidated Balance Sheet and $3.1 million reduced the carrying amount of the

68